FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

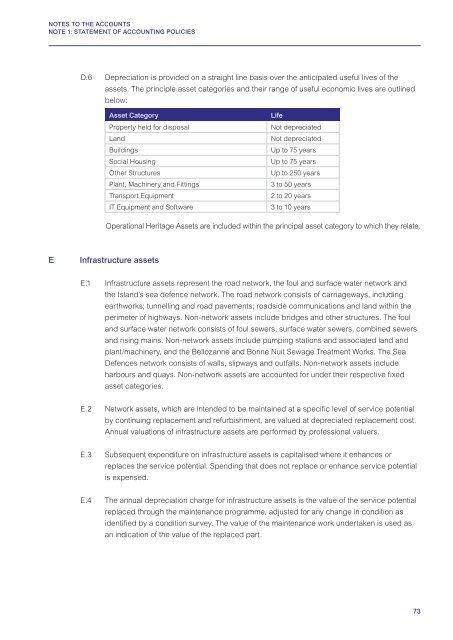

NOTES TO THE <strong>ACCOUNTS</strong>NOTE 1: STATEMENT OF ACCOUNTING POLICIESD.6 Depreciation is provided on a straight line basis over the anticipated useful lives of theassets. The principle asset categories and their range of useful economic lives are outlinedbelow:Asset CategoryProperty held for disposalLandBuildingsSocial HousingOther StructuresPlant, Machinery and FittingsTransport EquipmentIT Equipment and SoftwareLifeNot depreciatedNot depreciatedUp to 75 yearsUp to 75 yearsUp to 250 years3 to 50 years2 to 20 years3 to 10 yearsOperational Heritage Assets are included within the principal asset category to which they relate.EInfrastructure assetsE.1 Infrastructure assets represent the road network, the foul and surface water network andthe Island’s sea defence network. The road network consists of carriageways, includingearthworks; tunnelling and road pavements; roadside communications and land within theperimeter of highways. Non-network assets include bridges and other structures. The fouland surface water network consists of foul sewers, surface water sewers, combined sewersand rising mains. Non-network assets include pumping stations and associated land andplant/machinery, and the Bellozanne and Bonne Nuit Sewage Treatment Works. The SeaDefences network consists of walls, slipways and outfalls. Non-network assets includeharbours and quays. Non-network assets are accounted for under their respective fixedasset categories.E.2 Network assets, which are intended to be maintained at a specific level of service potentialby continuing replacement and refurbishment, are valued at depreciated replacement cost.Annual valuations of infrastructure assets are performed by professional valuers.E.3 Subsequent expenditure on infrastructure assets is capitalised where it enhances orreplaces the service potential. Spending that does not replace or enhance service potentialis expensed.E.4 The annual depreciation charge for infrastructure assets is the value of the service potentialreplaced through the maintenance programme, adjusted for any change in condition asidentified by a condition survey. The value of the maintenance work undertaken is used asan indication of the value of the replaced part.73