FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

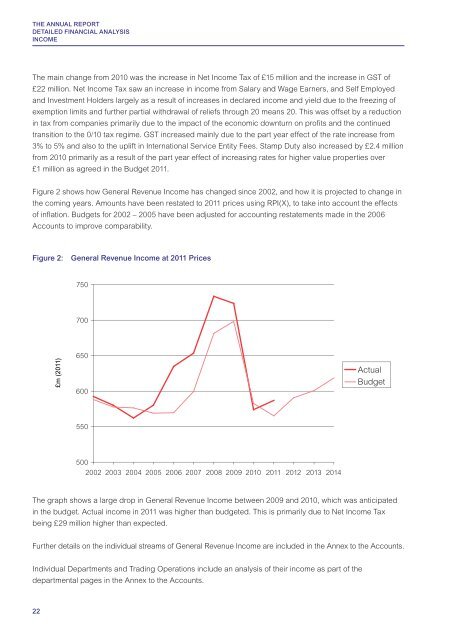

THE ANNUAL <strong>REPORT</strong>DETAILED <strong>FINANCIAL</strong> ANALYSISINCOMEThe main change from 2010 was the increase in Net Income Tax of £15 million and the increase in GST of£22 million. Net Income Tax saw an increase in income from Salary and Wage Earners, and Self Employedand Investment Holders largely as a result of increases in declared income and yield due to the freezing ofexemption limits and further partial withdrawal of reliefs through 20 means 20. This was offset by a reductionin tax from companies primarily due to the impact of the economic downturn on profits and the continuedtransition to the 0/10 tax regime. GST increased mainly due to the part year effect of the rate increase from3% to 5% and also to the uplift in International Service Entity Fees. Stamp Duty also increased by £2.4 millionfrom 2010 primarily as a result of the part year effect of increasing rates for higher value properties over£1 million as agreed in the Budget <strong>2011</strong>.Figure 2 shows how General Revenue Income has changed since 2002, and how it is projected to change inthe coming years. Amounts have been restated to <strong>2011</strong> prices using RPI(X), to take into account the effectsof inflation. Budgets for 2002 – 2005 have been adjusted for accounting restatements made in the 2006Accounts to improve comparability.Figure 2: General Revenue Income at <strong>2011</strong> Prices750700£m (<strong>2011</strong>)650600ActualBudget5505002002 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong> 2012 2013 2014The graph shows a large drop in General Revenue Income between 2009 and 2010, which was anticipatedin the budget. Actual income in <strong>2011</strong> was higher than budgeted. This is primarily due to Net Income Taxbeing £29 million higher than expected.Further details on the individual streams of General Revenue Income are included in the Annex to the Accounts.Individual Departments and Trading Operations include an analysis of their income as part of thedepartmental pages in the Annex to the Accounts.22