FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

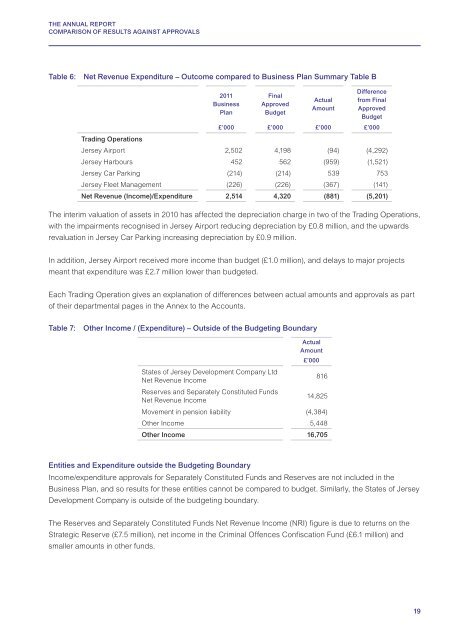

THE ANNUAL <strong>REPORT</strong>COMPARISON OF RESULTS AGAINST APPROVALSTable 6: Net Revenue Expenditure – Outcome compared to Business Plan Summary Table BTrading Operations<strong>2011</strong>BusinessPlanFinalApprovedBudgetActualAmountDifferencefrom FinalApprovedBudget£’000 £’000 £’000 £’000Jersey Airport 2,502 4,198 (94) (4,292)Jersey Harbours 452 562 (959) (1,521)Jersey Car Parking (214) (214) 539 753Jersey Fleet Management (226) (226) (367) (141)Net Revenue (Income)/Expenditure 2,514 4,320 (881) (5,201)The interim valuation of assets in 2010 has affected the depreciation charge in two of the Trading Operations,with the impairments recognised in Jersey Airport reducing depreciation by £0.8 million, and the upwardsrevaluation in Jersey Car Parking increasing depreciation by £0.9 million.In addition, Jersey Airport received more income than budget (£1.0 million), and delays to major projectsmeant that expenditure was £2.7 million lower than budgeted.Each Trading Operation gives an explanation of differences between actual amounts and approvals as partof their departmental pages in the Annex to the Accounts.Table 7: Other Income / (Expenditure) – Outside of the Budgeting Boundary<strong>States</strong> of Jersey Development Company LtdNet Revenue IncomeReserves and Separately Constituted FundsNet Revenue IncomeActualAmount£’00081614,825Movement in pension liability (4,384)Other Income 5,448Other Income 16,705Entities and Expenditure outside the Budgeting BoundaryIncome/expenditure approvals for Separately Constituted Funds and Reserves are not included in theBusiness Plan, and so results for these entities cannot be compared to budget. Similarly, the <strong>States</strong> of JerseyDevelopment Company is outside of the budgeting boundary.The Reserves and Separately Constituted Funds Net Revenue Income (NRI) figure is due to returns on theStrategic Reserve (£7.5 million), net income in the Criminal Offences Confiscation Fund (£6.1 million) andsmaller amounts in other funds.19