FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

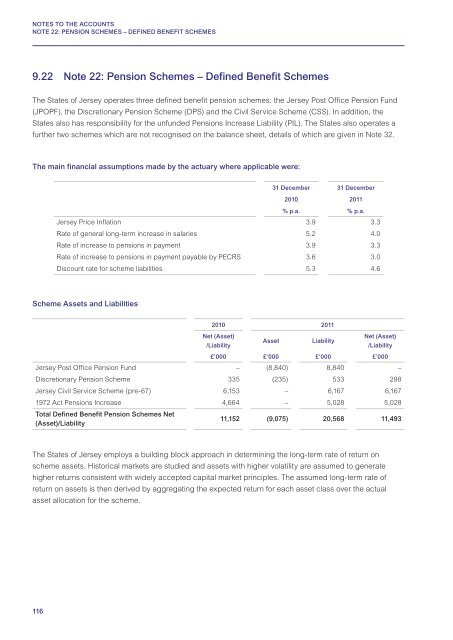

NOTES TO THE <strong>ACCOUNTS</strong>NOTE 22: PENSION SCHEMES – DEFINED BENEFIT SCHEMES9.22 Note 22: Pension Schemes – Defined Benefit SchemesThe <strong>States</strong> of Jersey operates three defined benefit pension schemes: the Jersey Post Office Pension Fund(JPOPF), the Discretionary Pension Scheme (DPS) and the Civil Service Scheme (CSS). In addition, the<strong>States</strong> also has responsibility for the unfunded Pensions Increase Liability (PIL). The <strong>States</strong> also operates afurther two schemes which are not recognised on the balance sheet, details of which are given in Note 32.The main financial assumptions made by the actuary where applicable were:31 December 31 December2010 <strong>2011</strong>% p.a. % p.a.Jersey Price Inflation 3.9 3.3Rate of general long-term increase in salaries 5.2 4.0Rate of increase to pensions in payment 3.9 3.3Rate of increase to pensions in payment payable by PECRS 3.6 3.0Discount rate for scheme liabilities 5.3 4.6Scheme Assets and Liabilities2010 <strong>2011</strong>Net (Asset)/LiabilityAssetLiabilityNet (Asset)/Liability£’000 £’000 £’000 £’000Jersey Post Office Pension Fund – (8,840) 8,840 –Discretionary Pension Scheme 335 (235) 533 298Jersey Civil Service Scheme (pre-67) 6,153 – 6,167 6,1671972 Act Pensions Increase 4,664 – 5,028 5,028Total Defined Benefit Pension Schemes Net(Asset)/Liability11,152 (9,075) 20,568 11,493The <strong>States</strong> of Jersey employs a building block approach in determining the long-term rate of return onscheme assets. Historical markets are studied and assets with higher volatility are assumed to generatehigher returns consistent with widely accepted capital market principles. The assumed long-term rate ofreturn on assets is then derived by aggregating the expected return for each asset class over the actualasset allocation for the scheme.116