FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

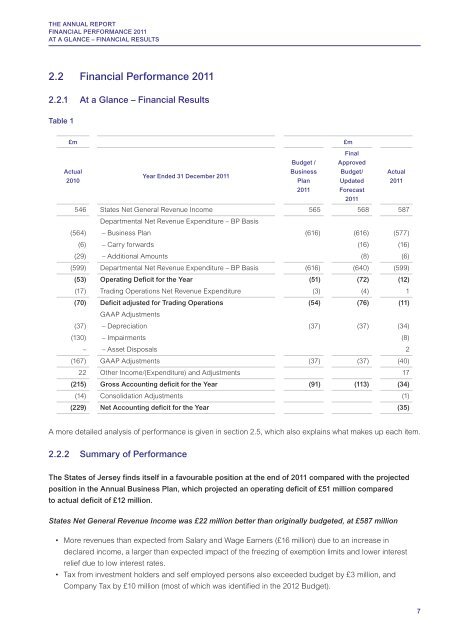

THE ANNUAL <strong>REPORT</strong><strong>FINANCIAL</strong> PERFORMANCE <strong>2011</strong>AT A GLANCE – <strong>FINANCIAL</strong> RESULTS2.2 Financial Performance <strong>2011</strong>2.2.1 At a Glance – Financial ResultsTable 1£m £mFinalBudget / ApprovedActualBusiness Budget/ ActualYear Ended 31 December <strong>2011</strong>2010Plan Updated <strong>2011</strong><strong>2011</strong> Forecast<strong>2011</strong>546 <strong>States</strong> Net General Revenue Income 565 568 587Departmental Net Revenue Expenditure – BP Basis(564) – Business Plan (616) (616) (577)(6) – Carry forwards (16) (16)(29) – Additional Amounts (8) (6)(599) Departmental Net Revenue Expenditure – BP Basis (616) (640) (599)(53) Operating Deficit for the Year (51) (72) (12)(17) Trading Operations Net Revenue Expenditure (3) (4) 1(70) Deficit adjusted for Trading Operations (54) (76) (11)GAAP Adjustments(37) – Depreciation (37) (37) (34)(130) – Impairments (8)– – Asset Disposals 2(167) GAAP Adjustments (37) (37) (40)22 Other Income/(Expenditure) and Adjustments 17(215) Gross Accounting deficit for the Year (91) (113) (34)(14) Consolidation Adjustments (1)(229) Net Accounting deficit for the Year (35)A more detailed analysis of performance is given in section 2.5, which also explains what makes up each item.2.2.2 Summary of PerformanceThe <strong>States</strong> of Jersey finds itself in a favourable position at the end of <strong>2011</strong> compared with the projectedposition in the Annual Business Plan, which projected an operating deficit of £51 million comparedto actual deficit of £12 million.<strong>States</strong> Net General Revenue Income was £22 million better than originally budgeted, at £587 million• More revenues than expected from Salary and Wage Earners (£16 million) due to an increase indeclared income, a larger than expected impact of the freezing of exemption limits and lower interestrelief due to low interest rates.• Tax from investment holders and self employed persons also exceeded budget by £3 million, andCompany Tax by £10 million (most of which was identified in the 2012 Budget).7