- Page 1 and 2:

financial report and accounts 2011

- Page 4 and 5:

2

- Page 6 and 7:

MINISTER’S REPORTComprehens

- Page 8 and 9:

THE ANNUAL REPORTTREASURER’S INTR

- Page 10 and 11:

THE ANNUAL REPORTEXPLANATION OF THE

- Page 12 and 13:

THE ANNUAL REPORTEXPLANATION OF THE

- Page 14 and 15:

THE ANNUAL REPORTEXPLANATION OF THE

- Page 16 and 17:

THE ANNUAL REPORTTHE STATES OF JERS

- Page 18 and 19:

THE ANNUAL REPORTCOMPARISON OF RESU

- Page 20 and 21:

THE ANNUAL REPORTCOMPARISON OF RESU

- Page 22 and 23:

THE ANNUAL REPORTCOMPARISON OF RESU

- Page 24 and 25:

THE ANNUAL REPORTDETAILED FINANCIAL

- Page 26 and 27:

THE ANNUAL REPORTDETAILED FINANCIAL

- Page 28 and 29:

THE ANNUAL REPORTDETAILED FINANCIAL

- Page 30 and 31:

THE ANNUAL REPORTDETAILED FINANCIAL

- Page 32 and 33:

THE ANNUAL REPORTSUMMARY OF CURRENT

- Page 34 and 35:

THE ANNUAL REPORTSUMMARY OF CURRENT

- Page 36 and 37:

THE ANNUAL REPORTSUMMARY OF CURRENT

- Page 38 and 39:

THE ANNUAL REPORTGOVERNANCE STRUCTU

- Page 40 and 41:

THE ANNUAL REPORTGOVERNANCE STRUCTU

- Page 42 and 43:

THE ANNUAL REPORTGOVERNANCE STRUCTU

- Page 44 and 45:

THE ANNUAL REPORTCORPORATE SOCIAL R

- Page 46 and 47:

STATEMENT OF RESPONSIBILITIES FOR T

- Page 48 and 49:

REMUNERATION REPORTACCOUNTING OFFIC

- Page 50 and 51:

REMUNERATION REPORTACCOUNTING OFFIC

- Page 52 and 53:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 55 and 56:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 57 and 58:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 59 and 60:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 61 and 62:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 63 and 64:

STATEMENT ON INTERNAL CONTROL FOR T

- Page 65 and 66:

INTRODUCTION TO THE ACCOUNTSCHANGES

- Page 67 and 68:

INTRODUCTION TO THE ACCOUNTSEXPLANA

- Page 69 and 70:

PRIMARY STATEMENTSCONSOLIDATED OPER

- Page 71 and 72: PRIMARY STATEMENTSCONSOLIDATED BALA

- Page 73 and 74: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 75 and 76: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 77 and 78: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 79 and 80: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 81 and 82: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 83 and 84: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 85 and 86: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 87 and 88: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 89 and 90: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 91 and 92: NOTES TO THE ACCOUNTSNOTE 1: STATEM

- Page 93 and 94: NOTES TO THE ACCOUNTSNOTE 2: SEGMEN

- Page 95 and 96: NOTES TO THE ACCOUNTSNOTE 4: EXPEND

- Page 97 and 98: NOTES TO THE ACCOUNTSNOTE 6: NON-CA

- Page 99 and 100: NOTES TO THE ACCOUNTSNOTE 8: OTHER

- Page 101 and 102: NOTES TO THE ACCOUNTSNOTE 9: TANGIB

- Page 103 and 104: NOTES TO THE ACCOUNTSNOTE 11: AVAIL

- Page 105 and 106: NOTES TO THE ACCOUNTSNOTE 11: AVAIL

- Page 107 and 108: NOTES TO THE ACCOUNTSNOTE 12: INVES

- Page 109 and 110: NOTES TO THE ACCOUNTSNOTE 14: DEBTO

- Page 111 and 112: NOTES TO THE ACCOUNTSNOTE 16: CREDI

- Page 113 and 114: NOTES TO THE ACCOUNTSNOTE 18: FINAN

- Page 115 and 116: NOTES TO THE ACCOUNTSNOTE 20: DERIV

- Page 117 and 118: NOTES TO THE ACCOUNTSNOTE 21: OTHER

- Page 119 and 120: NOTES TO THE ACCOUNTSNOTE 22: PENSI

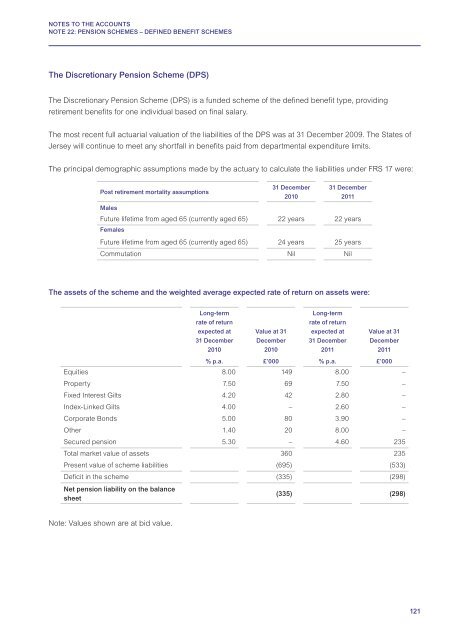

- Page 121: NOTES TO THE ACCOUNTSNOTE 22: PENSI

- Page 125 and 126: NOTES TO THE ACCOUNTSNOTE 22: PENSI

- Page 127 and 128: NOTES TO THE ACCOUNTSNOTE 22: PENSI

- Page 129 and 130: NOTES TO THE ACCOUNTSNOTE 22: PENSI

- Page 131 and 132: NOTES TO THE ACCOUNTSNOTE 24: RESER

- Page 133 and 134: NOTES TO THE ACCOUNTSNOTE 25: NOTES

- Page 135 and 136: NOTES TO THE ACCOUNTSNOTE 27: THIRD

- Page 137 and 138: NOTES TO THE ACCOUNTSNOTE 29: RISK

- Page 139 and 140: NOTES TO THE ACCOUNTSNOTE 29: RISK

- Page 141 and 142: NOTES TO THE ACCOUNTSNOTE 29: RISK

- Page 143 and 144: NOTES TO THE ACCOUNTSNOTE 30: SOJ C

- Page 145 and 146: NOTES TO THE ACCOUNTSNOTE 30: SOJ C

- Page 147 and 148: NOTES TO THE ACCOUNTSNOTE 30: SOJ C

- Page 149 and 150: NOTES TO THE ACCOUNTSNOTE 30: SOJ C

- Page 151 and 152: NOTES TO THE ACCOUNTSNOTE 32: PENSI

- Page 153 and 154: NOTES TO THE ACCOUNTSNOTE 32: PENSI

- Page 155 and 156: NOTES TO THE ACCOUNTSNOTE 32: PENSI

- Page 157 and 158: NOTES TO THE ACCOUNTSNOTE 32: PENSI

- Page 159 and 160: NOTES TO THE ACCOUNTSNOTE 34: GIFTS

- Page 161 and 162: NOTES TO THE ACCOUNTSNOTE 35: GRANT

- Page 163 and 164: NOTES TO THE ACCOUNTSNOTE 36: RELAT

- Page 165 and 166: NOTES TO THE ACCOUNTSNOTE 36: RELAT

- Page 167 and 168: NOTES TO THE ACCOUNTSNOTE 37: ENTIT

- Page 169 and 170: NOTES TO THE ACCOUNTSNOTE 37: ENTIT

- Page 171: States of Jersey TreasuryCyril Le M