IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

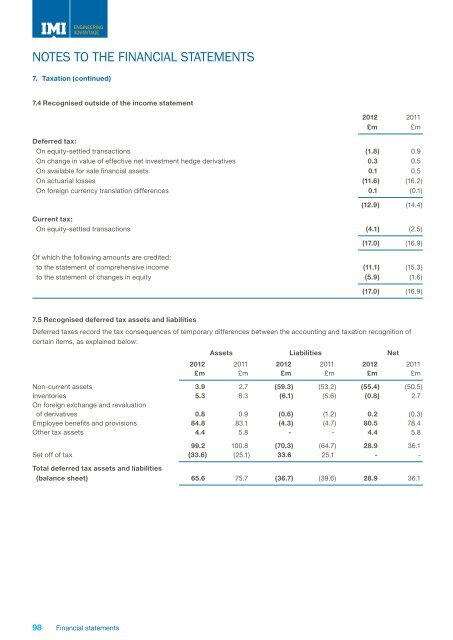

ENGINEERINGADVANTAGENotes to the Financial Statements7. Taxation (continued)7.4 Recognised outside of the income statement<strong>2012</strong> 2011£m £mDeferred tax:On equity-settled transactions (1.8) 0.9On change in value of effective net investment hedge derivatives 0.3 0.5On available for sale financial assets 0.1 0.5On actuarial losses (11.6) (16.2)On foreign currency translation differences 0.1 (0.1)(12.9) (14.4)Current tax:On equity-settled transactions (4.1) (2.5)(17.0) (16.9)Of which the following amounts are credited:to the statement of comprehensive income (11.1) (15.3)to the statement of changes in equity (5.9) (1.6)(17.0) (16.9)7.5 Recognised deferred tax assets and liabilitiesDeferred taxes record the tax consequences of temporary differences between the accounting and taxation recognition ofcertain items, as explained below:Assets Liabilities Net<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011£m £m £m £m £m £mNon-current assets 3.9 2.7 (59.3) (53.2) (55.4) (50.5)Inventories 5.3 8.3 (6.1) (5.6) (0.8) 2.7On foreign exchange and revaluationof derivatives 0.8 0.9 (0.6) (1.2) 0.2 (0.3)Employee benefits and provisions 84.8 83.1 (4.3) (4.7) 80.5 78.4Other tax assets 4.4 5.8 - - 4.4 5.899.2 100.8 (70.3) (64.7) 28.9 36.1Set off of tax (33.6) (25.1) 33.6 25.1 - -Total deferred tax assets and liabilities(balance sheet) 65.6 75.7 (36.7) (39.6) 28.9 36.198 Financial statements