IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

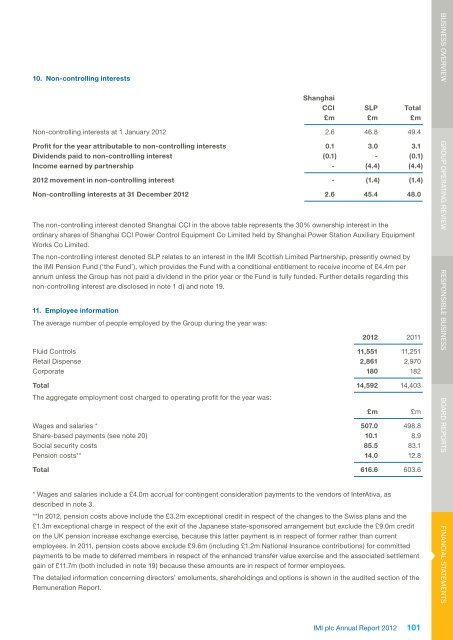

10. Non-controlling interestsShanghaiCCI SLP Total£m £m £mNon-controlling interests at 1 January <strong>2012</strong> 2.6 46.8 49.4Profit for the year attributable to non-controlling interests 0.1 3.0 3.1Dividends paid to non-controlling interest (0.1) - (0.1)Income earned by partnership - (4.4) (4.4)<strong>2012</strong> movement in non-controlling interest - (1.4) (1.4)Non-controlling interests at 31 December <strong>2012</strong> 2.6 45.4 48.0The non-controlling interest denoted Shanghai CCI in the above table represents the 30% ownership interest in theordinary shares of Shanghai CCI Power Control Equipment Co Limited held by Shanghai Power Station Auxiliary EquipmentWorks Co Limited.The non-controlling interest denoted SLP relates to an interest in the <strong>IMI</strong> Scottish Limited Partnership, presently owned bythe <strong>IMI</strong> Pension Fund (‘the Fund’), which provides the Fund with a conditional entitlement to receive income of £4.4m perannum unless the Group has not paid a dividend in the prior year or the Fund is fully funded. Further details regarding thisnon-controlling interest are disclosed in note 1 d) and note 19.11. Employee informationThe average number of people employed by the Group during the year was:<strong>2012</strong> 2011Fluid Controls 11,551 11,251Retail Dispense 2,861 2,970Corporate 180 182Total 14,592 14,403The aggregate employment cost charged to operating profit for the year was:£m £mWages and salaries * 507.0 498.8Share-based payments (see note 20) 10.1 8.9Social security costs 85.5 83.1Pension costs** 14.0 12.8Total 616.6 603.6* Wages and salaries include a £4.0m accrual for contingent consideration payments to the vendors of InterAtiva, asdescribed in note 3.**In <strong>2012</strong>, pension costs above include the £3.2m exceptional credit in respect of the changes to the Swiss plans and the£1.3m exceptional charge in respect of the exit of the Japanese state-sponsored arrangement but exclude the £9.0m crediton the UK pension increase exchange exercise, because this latter payment is in respect of former rather than currentemployees. In 2011, pension costs above exclude £9.6m (including £1.2m National Insurance contributions) for committedpayments to be made to deferred members in respect of the enhanced transfer value exercise and the associated settlementgain of £11.7m (both included in note 19) because these amounts are in respect of former employees.The detailed information concerning directors’ emoluments, shareholdings and options is shown in the audited section of theRemuneration Report.BUSINESS OVERVIEW GROUP OPERATING REVIEW RESPONSIBLE BUSINESS BOARD REPORTSFINANCIAL STATEMENTS<strong>IMI</strong> <strong>plc</strong> Annual Report <strong>2012</strong>101