IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

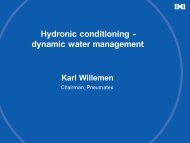

ENGINEERINGADVANTAGERemuneration Report10. Summary of directors’ pension arrangementsThis section of the Remuneration Report is required to be audited.Details of the pension benefits earned in the <strong>IMI</strong> Pension Fund or, in relation to I W Whiting, the Control Components Inc.Employees’ Pension Plan and the <strong>IMI</strong> Americas Supplemental Executive Retirement Plan are summarised in the following table:DirectorAge at31.12.12YearsPensionableservice to31.12.12 1YearsAccruedpension at31.12.12 2£000 paTransfervalue ofaccruedpensionat31.12.12£000Transfervalue ofaccruedpensionat31.12.11£000Differencebetweentransfervalues at31.12.11and31.12.12£000Increase inaccruedpensionover theyear 2£000 paIncrease inaccruedpensionover theyear (net ofinflation)£000 paValue ofincrease inaccruedpension at31.12.12(net ofinflation)£000M J Lamb 52 20 318 7,914 6,424 1,490 8 - -S Toomes 44 24 72 1,036 849 187 3 - -R M Twite 45 18 64 963 786 177 3 - -I W Whiting 3 48 5 6 43 187 (144) (32) - -1Pensionable service ceased with effect from 6 April 2006 for M J Lamb, 1 February 2007 for R M Twite, 31 August 2010 for S Toomesand 1 September 2010 for I W Whiting.2For M J Lamb, S Toomes and R M Twite the increase in the accrued pension during the year reflects the increase under the <strong>IMI</strong> PensionFund, which is generally in line with inflation. No allowance has been made for the value of benefits that may be derived by the paymentof additional voluntary contributions. For I W Whiting the reduction shown over <strong>2012</strong> relates to the <strong>IMI</strong> Americas Supplemental ExecutiveRetirement Plan (see note 3 below), in US dollar terms the benefit under the Control Components Inc. Employees’ Pension Plan does notchange from year to year.3Figures have been converted using exchange rates of £1:$1.62 as at 31 December <strong>2012</strong> (£1:$1.55 as at 31 December 2011). The transfervalue as at 31 December 2011 includes £153,000 in respect of the value of benefits accrued under the <strong>IMI</strong> Americas SupplementalExecutive Retirement Plan. On leaving the Group in August <strong>2012</strong> having completed fewer than 10 years’ service no benefits are dueunder this Plan. The transfer value as at 31 December <strong>2012</strong> relates solely to the benefits under the Control Components Inc. Employees’Pension Plan.The transfer values that would be payable from the <strong>IMI</strong> Pension Fund at the relevant date are also shown in the table,together with the transfer value (at the end of the year) of the increase in the accrued pension over the year (net of inflation).The transfer value shown is the estimated capital value of the future pension payments in retirement, determined by theFund’s Trustee in accordance with the appropriate statutory requirements. During <strong>2012</strong> the actuarial assumptions werereviewed and amended, resulting in increases in transfer values of around 15% for categories of membership including theabove individuals.In respect of I W Whiting’s benefits under US pension arrangements, the transfer value quoted is based on the method andassumptions used by the Company to account for the costs associated with US defined benefit pension schemes (see note19 to the financial statements on pages 116 to 122).Under the method and assumptions used by the Company to account for the costs associated with its defined benefitpension schemes, the aggregate value of the accrued benefits as at 31 December <strong>2012</strong> for the executive directors was£12.5m (2011: £11.8m).68 Board <strong>report</strong>s