IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

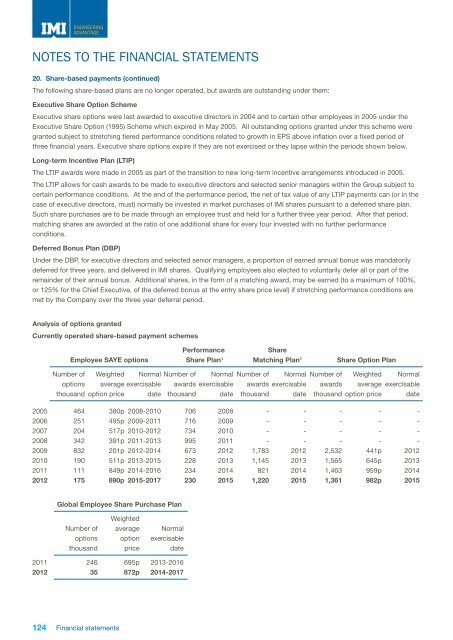

ENGINEERINGADVANTAGENOTES TO THE FINANCIAL STATEMENTS20. Share-based payments (continued)The following share-based plans are no longer operated, but awards are outstanding under them:Executive Share Option SchemeExecutive share options were last awarded to executive directors in 2004 and to certain other employees in 2005 under theExecutive Share Option (1995) Scheme which expired in May 2005. All outstanding options granted under this scheme weregranted subject to stretching tiered performance conditions related to growth in EPS above inflation over a fixed period ofthree financial years. Executive share options expire if they are not exercised or they lapse within the periods shown below.Long-term Incentive Plan (LTIP)The LTIP awards were made in 2005 as part of the transition to new long-term incentive arrangements introduced in 2005.The LTIP allows for cash awards to be made to executive directors and selected senior managers within the Group subject tocertain performance conditions. At the end of the performance period, the net of tax value of any LTIP payments can (or in thecase of executive directors, must) normally be invested in market purchases of <strong>IMI</strong> shares pursuant to a deferred share plan.Such share purchases are to be made through an employee trust and held for a further three year period. After that period,matching shares are awarded at the ratio of one additional share for every four invested with no further performanceconditions.Deferred Bonus Plan (DBP)Under the DBP, for executive directors and selected senior managers, a proportion of earned <strong>annual</strong> bonus was mandatorilydeferred for three years, and delivered in <strong>IMI</strong> shares. Qualifying employees also elected to voluntarily defer all or part of theremainder of their <strong>annual</strong> bonus. Additional shares, in the form of a matching award, may be earned (to a maximum of 100%,or 125% for the Chief Executive, of the deferred bonus at the entry share price level) if stretching performance conditions aremet by the Company over the three year deferral period.Analysis of options grantedCurrently operated share-based payment schemesPerformanceShareEmployee SAYE options Share Plan 1 Matching Plan 1 Share Option PlanNumber of Weighted Normal Number of Normal Number of Normal Number of Weighted Normaloptions average exercisable awards exercisable awards exercisable awards average exercisablethousand option price date thousand date thousand date thousand option price date2005 464 380p 2008-2010 706 2008 - - - - -2006 251 495p 2009-2011 716 2009 - - - - -2007 204 517p 2010-<strong>2012</strong> 734 2010 - - - - -2008 342 391p 2011-2013 995 2011 - - - - -2009 832 201p <strong>2012</strong>-2014 673 <strong>2012</strong> 1,783 <strong>2012</strong> 2,532 441p <strong>2012</strong>2010 190 511p 2013-2015 228 2013 1,145 2013 1,565 645p 20132011 111 849p 2014-2016 234 2014 821 2014 1,463 959p 2014<strong>2012</strong> 175 890p 2015-2017 230 2015 1,220 2015 1,361 982p 2015Global Employee Share Purchase PlanWeightedNumber of average Normaloptions option exercisablethousand price date2011 246 695p 2013-2016<strong>2012</strong> 35 872p 2014-2017124 Financial statements