IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

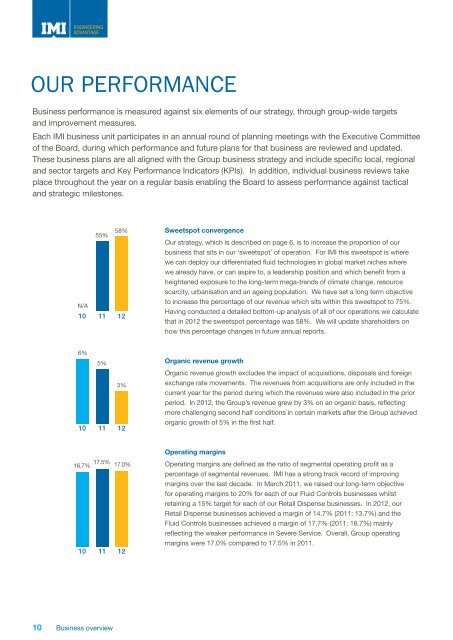

ENGINEERINGADVANTAGEOUR PERFORMANCEBusiness performance is measured against six elements of our strategy, through group-wide targetsand improvement measures.Each <strong>IMI</strong> business unit participates in an <strong>annual</strong> round of planning meetings with the Executive Committeeof the Board, during which performance and future plans for that business are reviewed and updated.These business plans are all aligned with the Group business strategy and include specific local, regionaland sector targets and Key Performance Indicators (KPIs). In addition, individual business reviews takeplace throughout the year on a regular basis enabling the Board to assess performance against tacticaland strategic milestones.N/A1055%1158%12Sweetspot convergenceOur strategy, which is described on page 6, is to increase the proportion of ourbusiness that sits in our ‘sweetspot’ of operation. For <strong>IMI</strong> this sweetspot is wherewe can deploy our differentiated fluid technologies in global market niches wherewe already have, or can aspire to, a leadership position and which benefit from aheightened exposure to the long-term mega-trends of climate change, resourcescarcity, urbanisation and an ageing population. We have set a long term objectiveto increase the percentage of our revenue which sits within this sweetspot to 75%.Having conducted a detailed bottom-up analysis of all of our operations we calculatethat in <strong>2012</strong> the sweetspot percentage was 58%. We will update shareholders onhow this percentage changes in future <strong>annual</strong> <strong>report</strong>s.6%105%113%12Organic revenue growthOrganic revenue growth excludes the impact of acquisitions, disposals and foreignexchange rate movements. The revenues from acquisitions are only included in thecurrent year for the period during which the revenues were also included in the priorperiod. In <strong>2012</strong>, the Group’s revenue grew by 3% on an organic basis, reflectingmore challenging second half conditions in certain markets after the Group achievedorganic growth of 5% in the first half.17.5%16.7%10 1117.0%12Operating marginsOperating margins are defined as the ratio of segmental operating profit as apercentage of segmental revenues. <strong>IMI</strong> has a strong track record of improvingmargins over the last decade. In March 2011, we raised our long-term objectivefor operating margins to 20% for each of our Fluid Controls businesses whilstretaining a 15% target for each of our Retail Dispense businesses. In <strong>2012</strong>, ourRetail Dispense businesses achieved a margin of 14.7% (2011: 13.7%) and theFluid Controls businesses achieved a margin of 17.7% (2011: 18.7%) mainlyreflecting the weaker performance in Severe Service. Overall, Group operatingmargins were 17.0% compared to 17.5% in 2011.10 Business overview