IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

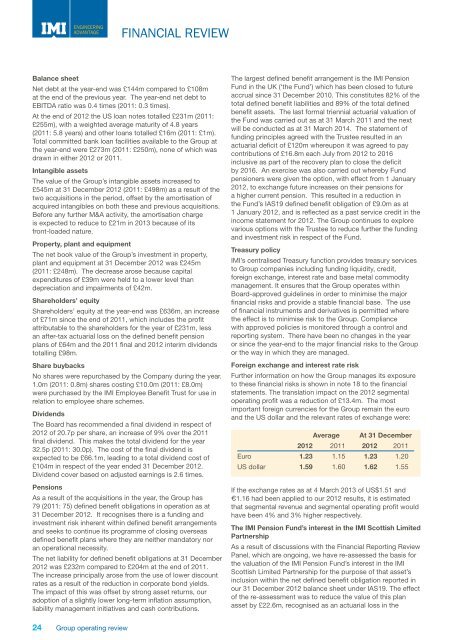

ENGINEERINGADVANTAGEFINANCIAL REVIEWBalance sheetNet debt at the year-end was £144m compared to £108mat the end of the previous year. The year-end net debt toEBITDA ratio was 0.4 times (2011: 0.3 times).At the end of <strong>2012</strong> the US loan notes totalled £231m (2011:£255m), with a weighted average maturity of 4.8 years(2011: 5.8 years) and other loans totalled £16m (2011: £1m).Total committed bank loan facilities available to the Group atthe year-end were £273m (2011: £250m), none of which wasdrawn in either <strong>2012</strong> or 2011.Intangible assetsThe value of the Group’s intangible assets increased to£545m at 31 December <strong>2012</strong> (2011: £498m) as a result of thetwo acquisitions in the period, offset by the amortisation ofacquired intangibles on both these and previous acquisitions.Before any further M&A activity, the amortisation chargeis expected to reduce to £21m in 2013 because of itsfront-loaded nature.Property, plant and equipmentThe net book value of the Group’s investment in property,plant and equipment at 31 December <strong>2012</strong> was £245m(2011: £248m). The decrease arose because capitalexpenditures of £39m were held to a lower level thandepreciation and impairments of £42m.Shareholders’ equityShareholders’ equity at the year-end was £636m, an increaseof £71m since the end of 2011, which includes the profitattributable to the shareholders for the year of £231m, lessan after-tax actuarial loss on the defined benefit pensionplans of £64m and the 2011 final and <strong>2012</strong> interim dividendstotalling £98m.Share buybacksNo shares were repurchased by the Company during the year.1.0m (2011: 0.8m) shares costing £10.0m (2011: £8.0m)were purchased by the <strong>IMI</strong> Employee Benefit Trust for use inrelation to employee share schemes.DividendsThe Board has recommended a final dividend in respect of<strong>2012</strong> of 20.7p per share, an increase of 9% over the 2011final dividend. This makes the total dividend for the year32.5p (2011: 30.0p). The cost of the final dividend isexpected to be £66.1m, leading to a total dividend cost of£104m in respect of the year ended 31 December <strong>2012</strong>.Dividend cover based on adjusted earnings is 2.6 times.PensionsAs a result of the acquisitions in the year, the Group has79 (2011: 75) defined benefit obligations in operation as at31 December <strong>2012</strong>. It recognises there is a funding andinvestment risk inherent within defined benefit arrangementsand seeks to continue its programme of closing overseasdefined benefit plans where they are neither mandatory noran operational necessity.The net liability for defined benefit obligations at 31 December<strong>2012</strong> was £232m compared to £204m at the end of 2011.The increase principally arose from the use of lower discountrates as a result of the reduction in corporate bond yields.The impact of this was offset by strong asset returns, ouradoption of a slightly lower long-term inflation assumption,liability management initiatives and cash contributions.The largest defined benefit arrangement is the <strong>IMI</strong> PensionFund in the UK (‘the Fund’) which has been closed to futureaccrual since 31 December 2010. This constitutes 82% of thetotal defined benefit liabilities and 89% of the total definedbenefit assets. The last formal triennial actuarial valuation ofthe Fund was carried out as at 31 March 2011 and the nextwill be conducted as at 31 March 2014. The statement offunding principles agreed with the Trustee resulted in anactuarial deficit of £120m whereupon it was agreed to paycontributions of £16.8m each July from <strong>2012</strong> to 2016inclusive as part of the recovery plan to close the deficitby 2016. An exercise was also carried out whereby Fundpensioners were given the option, with effect from 1 January<strong>2012</strong>, to exchange future increases on their pensions fora higher current pension. This resulted in a reduction inthe Fund’s IAS19 defined benefit obligation of £9.0m as at1 January <strong>2012</strong>, and is reflected as a past service credit in theincome statement for <strong>2012</strong>. The Group continues to explorevarious options with the Trustee to reduce further the fundingand investment risk in respect of the Fund.Treasury policy<strong>IMI</strong>’s centralised Treasury function provides treasury servicesto Group companies including funding liquidity, credit,foreign exchange, interest rate and base metal commoditymanagement. It ensures that the Group operates withinBoard-approved guidelines in order to minimise the majorfinancial risks and provide a stable financial base. The useof financial instruments and derivatives is permitted wherethe effect is to minimise risk to the Group. Compliancewith approved policies is monitored through a control and<strong>report</strong>ing system. There have been no changes in the yearor since the year-end to the major financial risks to the Groupor the way in which they are managed.Foreign exchange and interest rate riskFurther information on how the Group manages its exposureto these financial risks is shown in note 18 to the financialstatements. The translation impact on the <strong>2012</strong> segmentaloperating profit was a reduction of £13.4m. The mostimportant foreign currencies for the Group remain the euroand the US dollar and the relevant rates of exchange were:Average At 31 December<strong>2012</strong> 2011 <strong>2012</strong> 2011Euro 1.23 1.15 1.23 1.20US dollar 1.59 1.60 1.62 1.55If the exchange rates as at 4 March 2013 of US$1.51 and€1.16 had been applied to our <strong>2012</strong> results, it is estimatedthat segmental revenue and segmental operating profit wouldhave been 4% and 3% higher respectively.The <strong>IMI</strong> Pension Fund’s interest in the <strong>IMI</strong> Scottish LimitedPartnershipAs a result of discussions with the Financial Reporting ReviewPanel, which are ongoing, we have re-assessed the basis forthe valuation of the <strong>IMI</strong> Pension Fund’s interest in the <strong>IMI</strong>Scottish Limited Partnership for the purpose of that asset’sinclusion within the net defined benefit obligation <strong>report</strong>ed inour 31 December <strong>2012</strong> balance sheet under IAS19. The effectof the re-assessment was to reduce the value of this planasset by £22.6m, recognised as an actuarial loss in the24 Group operating review