IMI plc annual report 2012

IMI plc annual report 2012

IMI plc annual report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

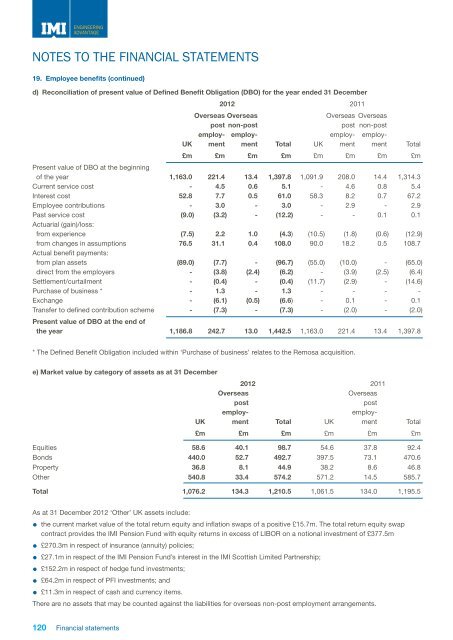

ENGINEERINGADVANTAGENOTES TO THE FINANCIAL STATEMENTS19. Employee benefits (continued)d) Reconciliation of present value of Defined Benefit Obligation (DBO) for the year ended 31 December<strong>2012</strong> 2011Overseas OverseasOverseas Overseaspost non-postpost non-postemploy- employ-employ- employ-UK ment ment Total UK ment ment Total£m £m £m £m £m £m £m £mPresent value of DBO at the beginningof the year 1,163.0 221.4 13.4 1,397.8 1,091.9 208.0 14.4 1,314.3Current service cost - 4.5 0.6 5.1 - 4.6 0.8 5.4Interest cost 52.8 7.7 0.5 61.0 58.3 8.2 0.7 67.2Employee contributions - 3.0 - 3.0 - 2.9 - 2.9Past service cost (9.0) (3.2) - (12.2) - - 0.1 0.1Actuarial (gain)/loss:from experience (7.5) 2.2 1.0 (4.3) (10.5) (1.8) (0.6) (12.9)from changes in assumptions 76.5 31.1 0.4 108.0 90.0 18.2 0.5 108.7Actual benefit payments:from plan assets (89.0) (7.7) - (96.7) (55.0) (10.0) - (65.0)direct from the employers - (3.8) (2.4) (6.2) - (3.9) (2.5) (6.4)Settlement/curtailment - (0.4) - (0.4) (11.7) (2.9) - (14.6)Purchase of business * - 1.3 - 1.3 - - - -Exchange - (6.1) (0.5) (6.6) - 0.1 - 0.1Transfer to defined contribution scheme - (7.3) - (7.3) - (2.0) - (2.0)Present value of DBO at the end ofthe year 1,186.8 242.7 13.0 1,442.5 1,163.0 221.4 13.4 1,397.8* The Defined Benefit Obligation included within ‘Purchase of business’ relates to the Remosa acquisition.e) Market value by category of assets as at 31 December<strong>2012</strong> 2011OverseasOverseaspostpostemploy-employ-UK ment Total UK ment Total£m £m £m £m £m £mEquities 58.6 40.1 98.7 54.6 37.8 92.4Bonds 440.0 52.7 492.7 397.5 73.1 470.6Property 36.8 8.1 44.9 38.2 8.6 46.8Other 540.8 33.4 574.2 571.2 14.5 585.7Total 1,076.2 134.3 1,210.5 1,061.5 134.0 1,195.5As at 31 December <strong>2012</strong> ‘Other’ UK assets include:• the current market value of the total return equity and inflation swaps of a positive £15.7m. The total return equity swapcontract provides the <strong>IMI</strong> Pension Fund with equity returns in excess of LIBOR on a notional investment of £377.5m• £270.3m in respect of insurance (annuity) policies;• £27.1m in respect of the <strong>IMI</strong> Pension Fund’s interest in the <strong>IMI</strong> Scottish Limited Partnership;• £152.2m in respect of hedge fund investments;• £64.2m in respect of PFI investments; and• £11.3m in respect of cash and currency items.There are no assets that may be counted against the liabilities for overseas non-post employment arrangements.120 Financial statements