- Page 3 and 4: Economic Reportof the PresidentTRAN

- Page 5 and 6: LETTER OF TRANSMITTALTHE WHITE HOUS

- Page 8 and 9: commercial demands and reduce the f

- Page 10: APPENDIXESPageA. Summary of Recomme

- Page 13 and 14: present consumption standards. Even

- Page 15 and 16: favored by temporary conditions or

- Page 17 and 18: Federal fiscal policies were also d

- Page 19 and 20: growth with reasonable stability of

- Page 21 and 22: The decline which became apparent i

- Page 23 and 24: CHART 2Shifts in Major Components o

- Page 25 and 26: 1957 than in 1956, but in the secon

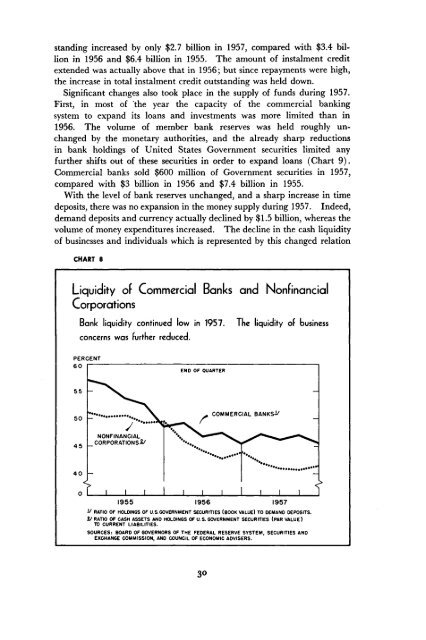

- Page 27 and 28: though there was no significant inc

- Page 29 and 30: CHART 4—ContinuedEmployment and I

- Page 31 and 32: week was 39.3 hours and average ove

- Page 33 and 34: CHART 5Price ChangesWholesale price

- Page 35 and 36: CHART 6Consumer PricesAfter declini

- Page 37 and 38: few decades and the still higher av

- Page 39: CHART 7The Pattern of Credit Expans

- Page 43 and 44: CHART 10Interest Rates and Bond Yie

- Page 45 and 46: CHART 11Indicators of Agricultural

- Page 47 and 48: various forms. On dollar sales of w

- Page 49 and 50: Because of the high level of privat

- Page 51 and 52: TABLE 7.—World industrial product

- Page 53 and 54: CHART 13World and U. S. Foreign Tra

- Page 55 and 56: CHART 14U. S. Balance of PaymentsTh

- Page 57 and 58: a still larger outflow of capital.

- Page 59 and 60: Chapter 4Economic Opportunities and

- Page 61 and 62: of the sources of strength for the

- Page 63 and 64: The strength of our financial insti

- Page 65 and 66: Chapter 5A Legislative Program To H

- Page 67 and 68: growth and stability. Although Fede

- Page 69 and 70: housing loans insured by the Federa

- Page 71 and 72: directions, without sacrificing eit

- Page 73 and 74: medical and dental teaching facilit

- Page 75 and 76: standards and help maintain the inc

- Page 77 and 78: funds, on financial dealings betwee

- Page 79 and 80: on basic crops and dairy products.

- Page 81 and 82: partners, and particularly on the s

- Page 83: FEDERAL ECONOMIC STATISTICSA well-c

- Page 87 and 88: Summary of Recommendations in the E

- Page 89 and 90: e) Authorize the Secretary of Labor

- Page 91:

Appendix BREPORT TO THE PRESIDENT O

- Page 95 and 96:

Report to the President on the Acti

- Page 97:

Advisory Board on Economic Growth a

- Page 101 and 102:

Program for Improving Federal Stati

- Page 103 and 104:

various divisions. Improvements in

- Page 105 and 106:

InventoriesSeparate stage-of-fabric

- Page 107:

Appendix DTHE CONSUMER PRICE INDEX9

- Page 110 and 111:

total market basket since the base

- Page 112 and 113:

described are applied whenever poss

- Page 114 and 115:

were employed under contracts conta

- Page 117 and 118:

Productivity StatisticsThe terms "p

- Page 119 and 120:

5 percent. Some improvement over th

- Page 121:

Appendix FSTATISTICAL TABLES RELATI

- Page 124 and 125:

Prices:PageF-36. Wholesale price in

- Page 127 and 128:

NATIONAL INCOME OR EXPENDITURETABLE

- Page 129 and 130:

TABLE F-2.—Gross national product

- Page 131 and 132:

TABLE F—4.—Gross national produ

- Page 133 and 134:

TABLE F—6.—The Nation's income,

- Page 135 and 136:

TABLE F-8.—Gross private domestic

- Page 137 and 138:

TABLE F-10.—Relation of gross nat

- Page 139 and 140:

TABLE F-12.—Sources of personal i

- Page 141 and 142:

TABLE F-14.—Total and per capita

- Page 143 and 144:

TABLE F—16.—Sources and uses of

- Page 145 and 146:

TABLE F-17.—Noninstitutional popu

- Page 147 and 148:

TABLE F—19.—Employed persons no

- Page 149 and 150:

TABLE F-21.—Unemployment insuranc

- Page 151 and 152:

TABLE F-22.—Number of wage and sa

- Page 153 and 154:

1929.193019311932193319341935193619

- Page 155 and 156:

TABLE F-26.—Average weekly hours

- Page 157 and 158:

TABLE F-28.—Labor turnover rates

- Page 159 and 160:

TABLE F-29.—Industrial production

- Page 161 and 162:

TABLE F-31.—New construction acti

- Page 163 and 164:

TABLE F-33.—Housing starts and ap

- Page 165 and 166:

TABLE F-35.—Manufacturers* sales,

- Page 167 and 168:

TABLE F-36.—Wholesale price index

- Page 169 and 170:

TABLE F-37.— Wholesale price inde

- Page 171 and 172:

TABLE F—39.—Consumer price inde

- Page 173 and 174:

TABLE F—41.—Loans and investmen

- Page 175 and 176:

TABLE F-43.—Bond yields and inter

- Page 177 and 178:

TABLE F—44.—Short- and intermed

- Page 179 and 180:

TABLE F-46.—Mortgage debt outstan

- Page 181 and 182:

GOVERNMENT FINANCETABLE F—48.—U

- Page 183 and 184:

TABLE F-50.—Federal budget receip

- Page 185 and 186:

TABLE F-52.—Government cash recei

- Page 187 and 188:

TABLE F—54.—Reconciliation of F

- Page 189 and 190:

CORPORATE PROFITS AND FINANCETABLE

- Page 191 and 192:

TABLE F-58.—Relation of profits a

- Page 193 and 194:

TABLE F-59.—Sources and uses of c

- Page 195 and 196:

TABLE F-61.—State and municipal a

- Page 197 and 198:

Period19291930193119321933193419351

- Page 199 and 200:

TABLE F-65.—Farm population, empl

- Page 201 and 202:

TABLE F—67.—Indexes of prices r

- Page 203 and 204:

TABLE F—70.—Selected indicators

- Page 205 and 206:

TABLE F—72.—United States balan

- Page 207 and 208:

TABLE F—73.—United States merch

- Page 209:

TABLE F—75.—U. S. Government gr