Business Removing

Doing Business in 2005 -- Removing Obstacles to Growth

Doing Business in 2005 -- Removing Obstacles to Growth

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GETTING CREDIT 43<br />

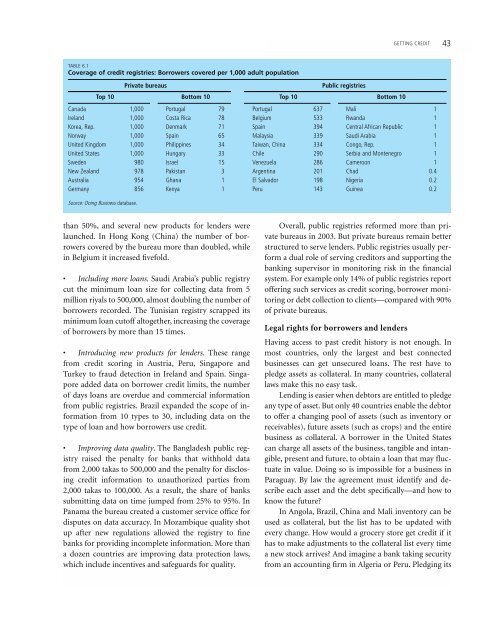

TABLE 6.1<br />

Coverage of credit registries: Borrowers covered per 1,000 adult population<br />

Private bureaus<br />

Public registries<br />

Top 10 Bottom 10 Top 10 Bottom 10<br />

Canada 1,000 Portugal 79 Portugal 637 Mali 1<br />

Ireland 1,000 Costa Rica 78 Belgium 533 Rwanda 1<br />

Korea, Rep. 1,000 Denmark 71 Spain 394 Central African Republic 1<br />

Norway 1,000 Spain 65 Malaysia 339 Saudi Arabia 1<br />

United Kingdom 1,000 Philippines 34 Taiwan, China 334 Congo, Rep. 1<br />

United States 1,000 Hungary 33 Chile 290 Serbia and Montenegro 1<br />

Sweden 980 Israel 15 Venezuela 286 Cameroon 1<br />

New Zealand 978 Pakistan 3 Argentina 201 Chad 0.4<br />

Australia 954 Ghana 1 El Salvador 198 Nigeria 0.2<br />

Germany 856 Kenya 1 Peru 143 Guinea 0.2<br />

Source: Doing <strong>Business</strong> database.<br />

than 50%, and several new products for lenders were<br />

launched. In Hong Kong (China) the number of borrowers<br />

covered by the bureau more than doubled, while<br />

in Belgium it increased fivefold.<br />

• Including more loans. Saudi Arabia’s public registry<br />

cut the minimum loan size for collecting data from 5<br />

million riyals to 500,000, almost doubling the number of<br />

borrowers recorded. The Tunisian registry scrapped its<br />

minimum loan cutoff altogether, increasing the coverage<br />

of borrowers by more than 15 times.<br />

• Introducing new products for lenders. These range<br />

from credit scoring in Austria, Peru, Singapore and<br />

Turkey to fraud detection in Ireland and Spain. Singapore<br />

added data on borrower credit limits, the number<br />

of days loans are overdue and commercial information<br />

from public registries. Brazil expanded the scope of information<br />

from 10 types to 30, including data on the<br />

type of loan and how borrowers use credit.<br />

• Improving data quality. The Bangladesh public registry<br />

raised the penalty for banks that withhold data<br />

from 2,000 takas to 500,000 and the penalty for disclosing<br />

credit information to unauthorized parties from<br />

2,000 takas to 100,000. As a result, the share of banks<br />

submitting data on time jumped from 25% to 95%. In<br />

Panama the bureau created a customer service office for<br />

disputes on data accuracy. In Mozambique quality shot<br />

up after new regulations allowed the registry to fine<br />

banks for providing incomplete information. More than<br />

a dozen countries are improving data protection laws,<br />

which include incentives and safeguards for quality.<br />

Overall, public registries reformed more than private<br />

bureaus in 2003. But private bureaus remain better<br />

structured to serve lenders. Public registries usually perform<br />

a dual role of serving creditors and supporting the<br />

banking supervisor in monitoring risk in the financial<br />

system. For example only 14% of public registries report<br />

offering such services as credit scoring, borrower monitoring<br />

or debt collection to clients—compared with 90%<br />

of private bureaus.<br />

Legal rights for borrowers and lenders<br />

Having access to past credit history is not enough. In<br />

most countries, only the largest and best connected<br />

businesses can get unsecured loans. The rest have to<br />

pledge assets as collateral. In many countries, collateral<br />

laws make this no easy task.<br />

Lending is easier when debtors are entitled to pledge<br />

any type of asset. But only 40 countries enable the debtor<br />

to offer a changing pool of assets (such as inventory or<br />

receivables), future assets (such as crops) and the entire<br />

business as collateral. A borrower in the United States<br />

can charge all assets of the business, tangible and intangible,<br />

present and future, to obtain a loan that may fluctuate<br />

in value. Doing so is impossible for a business in<br />

Paraguay. By law the agreement must identify and describe<br />

each asset and the debt specifically—and how to<br />

know the future?<br />

In Angola, Brazil, China and Mali inventory can be<br />

used as collateral, but the list has to be updated with<br />

every change. How would a grocery store get credit if it<br />

has to make adjustments to the collateral list every time<br />

a new stock arrives? And imagine a bank taking security<br />

from an accounting firm in Algeria or Peru. Pledging its