HOCHBAHN Annual Report 2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2015</strong><br />

The increase in other operating expenses by € 2.2 million in <strong>2015</strong> is mainly due to<br />

consultation services in connection with the planned construction of the new U-Bahn<br />

line U5, the study on the processes in the U- Bahn repair and maintenance shop and the<br />

upgrading of DT3 rolling stock.<br />

In the financial year <strong>2015</strong> there were write-downs of € 13.3 million on financial investments.<br />

The exposures of BeNEX GmbH on the local public rail transport market include<br />

a number of transport contracts which are unsatisfactory in terms of profitability. In the<br />

agilis companies, in particular, revenues and passenger numbers failed to meet expectations.<br />

The reasons for this lie in the continuing low fuel prices, which encourage people<br />

to use their private cars to travel, as well as the increasing popularity of intercity coach<br />

services. <strong>HOCHBAHN</strong> therefore wrote down its participation in BeNEX GmbH by an<br />

amount of € 12.0 million. As part of the restructuring of HanseCom GmbH, further value<br />

adjustment in the amount of € 1.3 million proved necessary.<br />

Due to the changes in presentation required by the German Accounting Law Modernisation<br />

Act (BilMoG), the corresponding differential amounts for long-term provisions are<br />

to be reported under Extraordinary Expenditures as from 1 January 2010. The extraordinary<br />

expenditures of financial year <strong>2015</strong> were, as in the previous year, due to the company’s<br />

exercise of the option to spread the differential amounts of pension provisions<br />

over 15 years.<br />

Despite the considerable rise in overall transport revenues by € 17.8 million in financial<br />

year <strong>2015</strong>, the deficit increased year-on-year by € 4.8 million to € 60.2 million (+8.6 %).<br />

This is primarily due to the required write-downs on financial investments. Operational<br />

profitability, in contrast, came in much stronger: EBITDA (annual earnings before loss<br />

absorption, interest, taxes, depreciation and amortisation) was up over the previous year<br />

by € 15,553,000 at € 44,635,000.<br />

The cost coverage ratio of the company in <strong>2015</strong>, at 89.6 %, was slightly (0.4 percentage<br />

points) below the comparable figure for the previous year (90.0 %). This nevertheless still<br />

represents one of the highest levels achieved in Germany and internationally.<br />

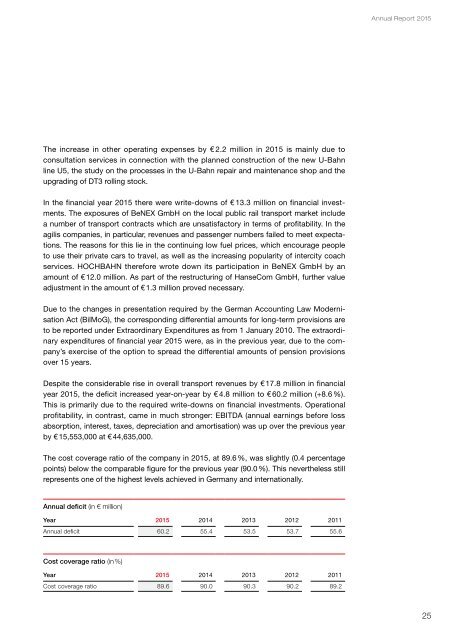

<strong>Annual</strong> deficit (in € million)<br />

Year <strong>2015</strong> 2014 2013 2012 2011<br />

<strong>Annual</strong> deficit 60.2 55.4 53.5 53.7 55.6<br />

Cost coverage ratio (in %)<br />

Year <strong>2015</strong> 2014 2013 2012 2011<br />

Cost coverage ratio 89.6 90.0 90.3 90.2 89.2<br />

25