HOCHBAHN Annual Report 2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2015</strong><br />

OTHER INFORMATION<br />

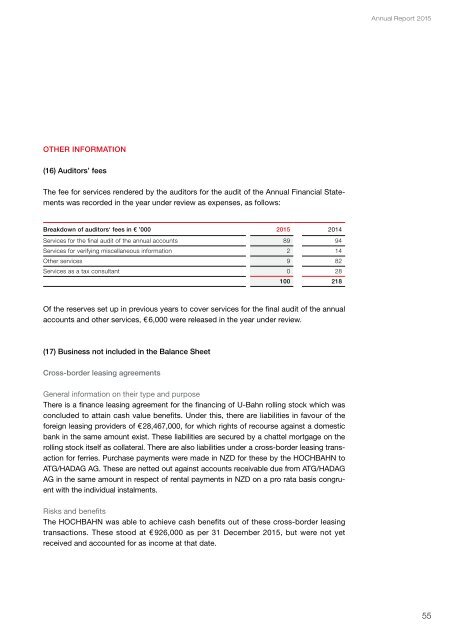

(16) Auditors’ fees<br />

The fee for services rendered by the auditors for the audit of the <strong>Annual</strong> Financial Statements<br />

was recorded in the year under review as expenses, as follows:<br />

Breakdown of auditors‘ fees in € ’000 <strong>2015</strong> 2014<br />

Services for the final audit of the annual accounts 89 94<br />

Services for verifying miscellaneous information 2 14<br />

Other services 9 82<br />

Services as a tax consultant 0 28<br />

100 218<br />

Of the reserves set up in previous years to cover services for the final audit of the annual<br />

accounts and other services, € 6,000 were released in the year under review.<br />

(17) Business not included in the Balance Sheet<br />

Cross-border leasing agreements<br />

General information on their type and purpose<br />

There is a finance leasing agreement for the financing of U-Bahn rolling stock which was<br />

concluded to attain cash value benefits. Under this, there are liabilities in favour of the<br />

foreign leasing providers of € 28,467,000, for which rights of recourse against a domestic<br />

bank in the same amount exist. These liabilities are secured by a chattel mortgage on the<br />

rolling stock itself as collateral. There are also liabilities under a cross-border leasing transaction<br />

for ferries. Purchase payments were made in NZD for these by the <strong>HOCHBAHN</strong> to<br />

ATG/HADAG AG. These are netted out against accounts receivable due from ATG/HADAG<br />

AG in the same amount in respect of rental payments in NZD on a pro rata basis congruent<br />

with the individual instalments.<br />

Risks and benefits<br />

The <strong>HOCHBAHN</strong> was able to achieve cash benefits out of these cross-border leasing<br />

transactions. These stood at € 926,000 as per 31 December <strong>2015</strong>, but were not yet<br />

received and accounted for as income at that date.<br />

55