January 2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

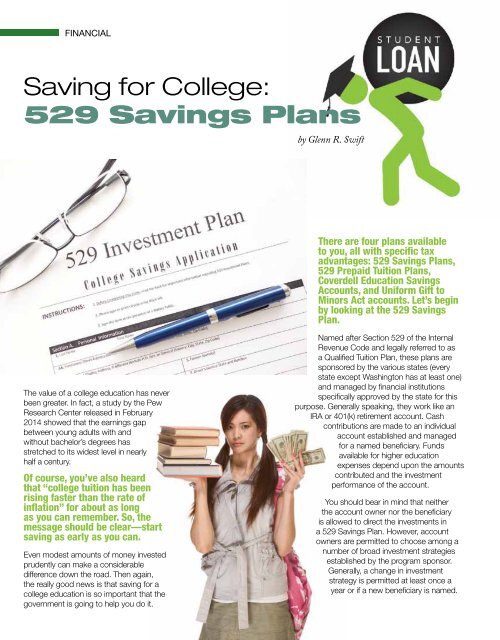

FINANCIAL<br />

Saving for College:<br />

529 Savings Plans<br />

by Glenn R. Swift<br />

There are four plans available<br />

to you, all with specific tax<br />

advantages: 529 Savings Plans,<br />

529 Prepaid Tuition Plans,<br />

Coverdell Education Savings<br />

Accounts, and Uniform Gift to<br />

Minors Act accounts. Let’s begin<br />

by looking at the 529 Savings<br />

Plan.<br />

The value of a college education has never<br />

been greater. In fact, a study by the Pew<br />

Research Center released in February<br />

2014 showed that the earnings gap<br />

between young adults with and<br />

without bachelor’s degrees has<br />

stretched to its widest level in nearly<br />

half a century.<br />

Of course, you’ve also heard<br />

that “college tuition has been<br />

rising faster than the rate of<br />

inflation” for about as long<br />

as you can remember. So, the<br />

message should be clear—start<br />

saving as early as you can.<br />

Even modest amounts of money invested<br />

prudently can make a considerable<br />

difference down the road. Then again,<br />

the really good news is that saving for a<br />

college education is so important that the<br />

government is going to help you do it.<br />

Named after Section 529 of the Internal<br />

Revenue Code and legally referred to as<br />

a Qualified Tuition Plan, these plans are<br />

sponsored by the various states (every<br />

state except Washington has at least one)<br />

and managed by financial institutions<br />

specifically approved by the state for this<br />

purpose. Generally speaking, they work like an<br />

IRA or 401(k) retirement account. Cash<br />

contributions are made to an individual<br />

account established and managed<br />

for a named beneficiary. Funds<br />

available for higher education<br />

expenses depend upon the amounts<br />

contributed and the investment<br />

performance of the account.<br />

You should bear in mind that neither<br />

the account owner nor the beneficiary<br />

is allowed to direct the investments in<br />

a 529 Savings Plan. However, account<br />

owners are permitted to choose among a<br />

number of broad investment strategies<br />

established by the program sponsor.<br />

Generally, a change in investment<br />

strategy is permitted at least once a<br />

year or if a new beneficiary is named.<br />

78<br />

JANUARY <strong>2017</strong>