Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4. Financial assets by category<br />

All financial assets have been classified as loans and receivables.<br />

5. Financial liabilities by category<br />

All financial liabilities, apart from derivatives used for hedging, have been classified as financial liabilities measured at amortised<br />

costs.<br />

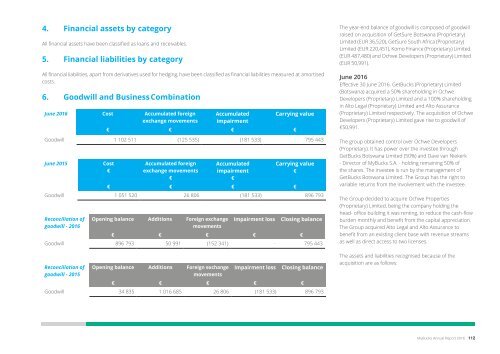

6. Goodwill and Business Combination<br />

June 2016 Cost Accumulated foreign<br />

exchange movements<br />

Accumulated<br />

impairment<br />

Carrying value<br />

€ € € €<br />

Goodwill 1 102 511 (125 535) (181 533) 795 443<br />

June 2015<br />

Cost<br />

€<br />

Accumulated foreign<br />

exchange movements<br />

€<br />

Accumulated<br />

impairment<br />

€<br />

Carrying value<br />

€<br />

€ € € €<br />

Goodwill 1 051 520 26 806 (181 533) 896 793<br />

Reconciliation <strong>of</strong><br />

goodwill - 2016<br />

Opening balance Additions Foreign exchange Impairment loss Closing balance<br />

movements<br />

€ € € € €<br />

Goodwill 896 793 50 991 (152 341) - 795 443<br />

Reconciliation <strong>of</strong><br />

goodwill - 2015<br />

Opening balance Additions Foreign exchange Impairment loss Closing balance<br />

movements<br />

€ € € € €<br />

Goodwill 34 835 1 016 685 26 806 (181 533) 896 793<br />

The year-end balance <strong>of</strong> goodwill is composed <strong>of</strong> goodwill<br />

raised on acquisition <strong>of</strong> GetSure Botswana (Proprietary)<br />

Limited (EUR 36,520), GetSure South Africa (Proprietary)<br />

Limited (EUR 220,451), Komo Finance (Proprietary) Limited<br />

(EUR 487,480) and Ochwe Developers (Proprietary) Limited<br />

(EUR 50,991).<br />

June 2016<br />

Effective 30 June 2016. GetBucks (Proprietary) Limited<br />

(Botswana) acquired a 50% shareholding in Ochwe<br />

Developers (Proprietary) Limited and a 100% shareholding<br />

in Alto Legal (Proprietary) Limited and Alto Assurance<br />

(Proprietary) Limited respectively. The acquisition <strong>of</strong> Ochwe<br />

Developers (Proprietary) Limited gave rise to goodwill <strong>of</strong><br />

€50,991.<br />

The group obtained control over Ochwe Developers<br />

(Proprietary). It has power over the investee through<br />

GetBucks Botswana Limited (50%) and Dave van Niekerk<br />

- Director <strong>of</strong> MyBucks S.A. - holding remaining 50% <strong>of</strong><br />

the shares. The investee is run by the management <strong>of</strong><br />

GetBucks Botswana Limited. The Group has the right to<br />

variable returns from the involvement with the investee.<br />

The Group decided to acquire Ochwe Properties<br />

(Proprietary) Limited, being the company holding the<br />

head- <strong>of</strong>fice building it was renting, to reduce the cash-flow<br />

burden monthly and benefit from the capital appreciation.<br />

The Group acquired Alto Legal and Alto Assurance to<br />

benefit from an existing client base with revenue streams<br />

as well as direct access to two licenses.<br />

The assets and liabilities recognised because <strong>of</strong> the<br />

acquisition are as follows:<br />

Ochwe<br />

Developers<br />

(Proprietary)<br />

Limited<br />

€<br />

Alto Legal<br />

(Proprietary)<br />

Limited<br />

€<br />

Alto<br />

Assurance<br />

(Proprietary)<br />

Limited<br />

€<br />

Total<br />

€<br />

Purchase<br />

0.08 258 212 73 984 332 196<br />

consideration<br />

Assets<br />

Property plant<br />

731 379 - - 731 379<br />

and equipment<br />

Loans recevable - 2 540 - 2 540<br />

Cash and cash<br />

equivalents<br />

1 633 298 3 719 5 650<br />

733 012 2 838 3 719 739 569<br />

Intangible<br />

asset acquired<br />

Intangible<br />

- 480 508 136 733 617 241<br />

assets<br />

Total assets 733 012 483 346 140 452 1 356 810<br />

Liabilities<br />

Loans payable (834 995) (198 217) (53 242) (1 086 454)<br />

Taxation - - (7 582) (7 582)<br />

Other liabilities - (26 916) (5 644) (32 560)<br />

Total<br />

liabilities<br />

Non-controlling<br />

interest<br />

(834 995) (225 133) (66 468) (1 126 596)<br />

(50 991) - - (50 991)<br />

Goodwill 50 991 (0) (0) 50 991<br />

The fair value <strong>of</strong> the acquisition has been determined by taking into consideration the<br />

building in Ochwe Developers (Proprietary) Limited, which is geared to generate rental<br />

income and potential capital appreciation, and Alto Legal (Proprietary) Limited and<br />

Alto Assurance (Proprietary) Limited, which is comprised <strong>of</strong> an existing client base and<br />

revenue streams as well as two licenses.<br />

The intangible assets in Alto Legal and Alto Assurance relate to customer relationships,<br />

licenses and agreements. Benefits are expected to be derived through the potential <strong>of</strong><br />

cross-selling opportunities to the existing customer base as well as to the new customer<br />

relationships. The operating licenses as well as the underwriting agreements will allow for a<br />

broader insurance product portfolio for the Group. This intangible assets will be allocated<br />

upon the finalisation <strong>of</strong> the purchase price allocation in accordance with IFRS 3 within a 12<br />

month period from the acquisition date <strong>of</strong> 30 June 2016.<br />

The acquired businesses were acquired on the last reporting day <strong>of</strong> the financial year<br />

(30 June 2016), and have contributed no revenues and pr<strong>of</strong>its for the year. If the acquisition<br />

had occurred on 1 July 2015, the impact on the consolidated revenue and pr<strong>of</strong>it for the year<br />

ended 30 June 2016 would have been as follows:<br />

Ochwe<br />

Developers<br />

(Proprietary)<br />

Limited<br />

€<br />

Alto Legal<br />

(Proprietary)<br />

Limited<br />

€<br />

Alto Assurance<br />

(Proprietary)<br />

Limited<br />

€<br />

Total<br />

€<br />

Revenue 25 334 4 773 8 120 38 227<br />

Loss (118 701) (127 430) (45 594) (291 725)<br />

The key assumptions applied in testing the goodwill for impairment are set out below:<br />

Ochwe Developers (Proprietary) Limited<br />

Rate per M² - Pula 90.34<br />

Rate per M² annual growth rate 5.0%<br />

Rental Income Growth 5.0%<br />

Operating Cost Growth 5.6%<br />

Discount Rate 9.0%<br />

Alto Legal (Proprietary) Limited and Alto Assurance<br />

(Proprietary) Limited<br />

Client Growth Rate - CAGR 77.2%<br />

Premium Revenue annual growth rate - CAGR 27.0%<br />

Operating Cost Growth 6.7%<br />

Discount Rate 9.0%<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

MyBucks Annual Report 2016 112<br />

113 MyBucks Annual Report 2016