Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

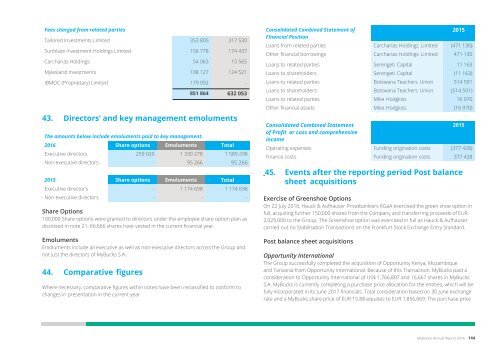

Fees charged from related parties<br />

Tailored Investments Limited 353 805 317 530<br />

Sunblaze Investment Holdings Limited 156 778 174 437<br />

Carcharias Holdings 54 063 15 565<br />

Mylesland Investments 108 127 124 521<br />

IBMOC (Proprietary) Limited 179 092 -<br />

851 864 632 053<br />

43. Directors’ and key management emoluments<br />

The amounts below include emoluments paid to key management.<br />

2016 Share options Emoluments Total<br />

Executive directors 259 020 1 330 278 1 589 298<br />

Non-executive directors - 95 266 95 266<br />

2015 Share options Emoluments Total<br />

Executive director’s - 1 174 698 1 174 698<br />

Non-executive directors - - -<br />

Share Options<br />

100,000 Share options were granted to directors under the employee share option plan as<br />

disclosed in note 21. 66,666 shares have vested in the current financial year.<br />

Emoluments<br />

Emoluments include all executive as well as non-executive directors across the Group and<br />

not just the directors <strong>of</strong> MyBucks S.A..<br />

44. Comparative figures<br />

Where necessary, comparative figures within notes have been reclassified to conform to<br />

changes in presentation in the current year.<br />

Consolidated Combined Statement <strong>of</strong><br />

2015<br />

Financial Position<br />

Loans from related parties Carcharias Holdings Limited (471 130)<br />

Other financial borrowings Carcharias Holdings Limited 471 130<br />

Loans to related parties Serengeti Capital 11 163<br />

Loans to shareholders Serengeti Capital (11 163)<br />

Loans to related parties Botswana Teachers Union 514 591<br />

Loans to shareholders Botswana Teachers Union (514 591)<br />

Loans to related parties Mike Hodgkiss 16 970<br />

Other financial assets Mike Hodgkiss (16 970)<br />

Consolidated Combined Statement<br />

2015<br />

<strong>of</strong> Pr<strong>of</strong>it or Loss and comprehensive<br />

income<br />

Operating expenses Funding origination costs (377 428)<br />

Finance costs Funding origination costs 377 428<br />

45. Events after the reporting period Post balance<br />

sheet acquisitions<br />

Exercise <strong>of</strong> Greenshoe Options<br />

On 22 July 2016, Hauck & Aufhauser Privatbankiers KGaA exercised the green shoe option in<br />

full, acquiring further 150,000 shares from the Company and transferring proceeds <strong>of</strong> EUR<br />

2,025,000 to the Group. The Greenshoe option was exercised in full as Hauck & Aufhauser<br />

carried out no Stabilisation Transactions on the Frankfurt Stock Exchange Entry Standard.<br />

Post balance sheet acquisitions<br />

Opportunity International<br />

The Group successfully completed the acquisition <strong>of</strong> Opportunity Kenya, Mozambique<br />

and Tanzania from Opportunity International. Because <strong>of</strong> this Transaction, MyBucks paid a<br />

consideration to Opportunity International <strong>of</strong> US$ 1,766,807 and 16,667 shares in MyBucks<br />

S.A. MyBucks is currently completing a purchase price allocation for the entities, which will be<br />

fully incorporated in its June 2017 financials. Total consideration based on 30 June exchange<br />

rate and a MyBucks share price <strong>of</strong> EUR 15.88 equates to EUR 1,856,069. The purchase price<br />

on these entities has been finalized based on closing accounts and does not include any<br />

contingent consideration.<br />

In September 2016, the Group received regulatory approval to take a 49% stake in<br />

Opportunity Bank <strong>of</strong> Uganda Limited and subsequently completed this acquisition on<br />

1 October 2016 against a consideration <strong>of</strong> US$ 1,684,654 in cash and 133,333 shares in<br />

MyBucks. Total consideration based on 30 June exchange rate and a MyBucks share price<br />

<strong>of</strong> EUR 18.80 equates to EUR 4,005,229. This purchase price is still subject to an adjustment<br />

based on the audited closing accounts for 30 September 2016. Management does not<br />

expect this adjustment to be material; no other contingent consideration exists.<br />

MyBucks will initiate the process <strong>of</strong> issuing the total <strong>of</strong> 150,000 shares as newly issued<br />

shares to Opportunity International upon the completion <strong>of</strong> the audited closing accounts<br />

<strong>of</strong> Opportunity Bank <strong>of</strong> Uganda Limited and expects this process to be completed by<br />

31 March 2017.<br />

'The acquisitions will give the group access to more affordable funding lines through local<br />

deposits and allow the group to control the bank accounts <strong>of</strong> all loan clients and thus<br />

improve collections processes. It will also <strong>of</strong>fer the group various new revenue streams.<br />

As a result, based on the current estimates, a bargain purchase existed on the acquisitions<br />

<strong>of</strong> Opportunity Kenya, Mozambique and Tanzania which could result in a gain <strong>of</strong> EUR<br />

2,914,481.<br />

Fair Go Finance (Pty) Ltd<br />

The Group entered into agreements on 18 October 2016 to acquire a 75% stake in Fair Go<br />

Finance (Pty) Ltd and subsequently completed this acquisition on 12 January 2017 against a<br />

consideration <strong>of</strong> 117,613 shares in MyBucks. Total consideration based on exchange rate <strong>of</strong><br />

(AUD/EUR) 1.44 and a MyBucks share price <strong>of</strong> EUR 17.70 equates to EUR 2,081,751.<br />

MyBucks will initiate the process <strong>of</strong> issuing the total <strong>of</strong> 117,613 shares as newly issued<br />

shares to the shareholders <strong>of</strong> Fair Go Finance (Pty) Ltd upon the completion <strong>of</strong> all conditions<br />

precedent and expects this process to be completed by 31 January 2017.<br />

The acquisition will give the group access to the Australasian market through an already<br />

established Australian business, a dedicated client base and operational know how <strong>of</strong> the<br />

market. Fair Go Finance is well respected with access to affordable hard currency funding<br />

lines through local fund management partnerships and is well positioned to spring board<br />

MyBucks into the rest <strong>of</strong> Australasia. It will also <strong>of</strong>fer the group various new revenue streams<br />

denominated in hard currency and thus reducing potential foreign exchange exposure.<br />

Summary <strong>of</strong> post balance sheet acquisitions<br />

€<br />

Acquisition<br />

date<br />

Purchase<br />

price<br />

Holding<br />

€ € %<br />

Banco Oportunidade de Mocambique. SA 01/07/2016 1 268 553 84.29%<br />

Opportunity Kenya Limited 01/07/2016 448 508 89.11%<br />

Opportunity Tanzania Limited 01/07/2016 139 008 100.00%<br />

Opportunity Bank <strong>of</strong> Uganda Limited 01/10/2016 4 005 229 49.00%<br />

Fair Go Finance (Pty) Ltd 12/01/2017 2 081 752 75.00%<br />

Note: Exchange rate applied <strong>of</strong> USD/EUR 1.11 as <strong>of</strong> 1 July 2016, USD/EUR 1.12 as <strong>of</strong> 1 October 2016 and<br />

AUD/EUR 1.44 as <strong>of</strong> 12 January 2017.<br />

Currently the accounts <strong>of</strong> all five entities are still being audited. MyBucks expects to complete<br />

the purchase price allocation for the above five acquisitions prior to 30 June 2017, being fully<br />

reflective in next year’s audited accounts.<br />

As per the requirements <strong>of</strong> IFRS 3 the fair values presented for these acquisitions are<br />

incomplete due to the following key factors:<br />

»»<br />

The valuation <strong>of</strong> certain loans and advances have not been completed. This is since<br />

management believes there may facts and circumstances that existed at the acquisition<br />

date that have not been factored into the impairment calculations <strong>of</strong> these loans.<br />

»»<br />

The identification <strong>of</strong> intangible assets and valuation <strong>of</strong> property, plant and equipment<br />

has not yet been completed as at the date <strong>of</strong> this report.<br />

»»<br />

Establishment <strong>of</strong> restructuring provisions and identification <strong>of</strong> contingent liabilities has<br />

not yet been completed as at the date <strong>of</strong> this report.<br />

The Group has measured the Non-controlling interest as a proportion <strong>of</strong> the fair value <strong>of</strong> the<br />

total net assets acquired.<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

MyBucks Annual Report 2016 144<br />

145 MyBucks Annual Report 2016