Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

fair value <strong>of</strong> the non-controlling interest in the acquiree<br />

over the consideration transferred. A bargain purchase<br />

represents a gain on the acquisition <strong>of</strong> the acquiree and<br />

this resulting gain is recognised in pr<strong>of</strong>it and loss.<br />

Goodwill is allocated to cash-generating units for the<br />

purpose <strong>of</strong> impairment testing. The allocation is made to<br />

those cash-generating units or group <strong>of</strong> cash-generating<br />

units that are expected to benefit from the business<br />

combination in which the goodwill arose identified<br />

according to operating segment. Goodwill impairment<br />

reviews are undertaken annually or more frequently if<br />

events or changes in circumstances indicate a potential<br />

impairment. The carrying value <strong>of</strong> goodwill is compared to<br />

the recoverable amount, which is the higher <strong>of</strong> value in use<br />

and the fair value less cost <strong>of</strong> disposal. Any impairment<br />

is recognised immediately in pr<strong>of</strong>it or loss and is not<br />

subsequently reversed.<br />

1.6 Other intangible assets<br />

An intangible asset is recognised when:<br />

»»<br />

it is probable that the expected future economic<br />

benefits that are attributable to the asset will flow to<br />

the entity; and<br />

»»<br />

the cost <strong>of</strong> the asset can be measured reliably.<br />

Other intangible assets are initially recognised at cost.<br />

Costs associated with maintaining computer s<strong>of</strong>tware<br />

programmes are recognised as an expense as incurred.<br />

Development costs that are directly attributable to the<br />

design and testing <strong>of</strong> identifiable and unique s<strong>of</strong>tware<br />

products controlled by the group are recognised as<br />

intangible assets when the following criteria are met:<br />

»»<br />

it is technically feasible to complete the s<strong>of</strong>tware<br />

product so that it will be available for use;<br />

»»<br />

management intends to complete the s<strong>of</strong>tware<br />

product and use or sell it;<br />

»»<br />

there is an ability to use or sell the s<strong>of</strong>tware product;<br />

»»<br />

it can be demonstrated how the s<strong>of</strong>tware product will<br />

generate probable future economic benefits;<br />

»»<br />

adequate technical, financial and other resources<br />

to complete the development s<strong>of</strong>tware product are<br />

available; and<br />

»»<br />

the expenditure attributable to the s<strong>of</strong>tware product<br />

during its development can be reliably measured.<br />

Directly attributable costs that are capitalised as part <strong>of</strong><br />

the s<strong>of</strong>tware product include the s<strong>of</strong>tware development<br />

employee costs and an appropriate portion <strong>of</strong> relevant<br />

overheads.<br />

Other development expenditures that do not meet<br />

these criteria are recognised as an expense as incurred.<br />

Development costs previously recognised as an expense<br />

are not recognised as an asset in a subsequent period.<br />

Computer s<strong>of</strong>tware development costs recognised as<br />

assets are amortised over their estimated useful lives,<br />

which does not exceed five years.<br />

The customer relationship relates to the fair value<br />

adjustment <strong>of</strong> the loan book on the acquisitions. They are<br />

amortised over their estimated useful lives (3-10 years).<br />

The customer relationship in South Africa relates to the fair<br />

value adjustments <strong>of</strong> the purchase <strong>of</strong> a deduction at source<br />

lending loan book. The group provides loans to gainfully<br />

employed individuals that are employed by employers<br />

that are vetted by the group and that have concluded<br />

an agreement with the company. In terms <strong>of</strong> these<br />

agreements the employer deducts the loan instalments<br />

from the customers salary and disburses these funds to the<br />

group.<br />

Other intangible assets are carried at cost less any<br />

accumulated amortisation and any impairment losses.<br />

Amortisation is provided to write down the other intangible<br />

assets, on a straight line basis, to their residual values<br />

as follows:<br />

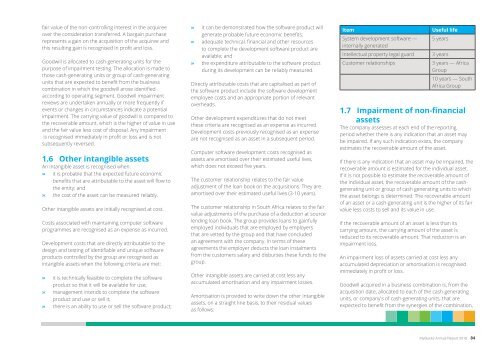

Item<br />

System development s<strong>of</strong>tware —<br />

internally generated<br />

Intellectual property legal guard<br />

Customer relationships<br />

Useful life<br />

5 years<br />

3 years<br />

3 years — Africa<br />

Group<br />

10 years — South<br />

Africa Group<br />

1.7 Impairment <strong>of</strong> non-financial<br />

assets<br />

The company assesses at each end <strong>of</strong> the reporting<br />

period whether there is any indication that an asset may<br />

be impaired. If any such indication exists, the company<br />

estimates the recoverable amount <strong>of</strong> the asset.<br />

If there is any indication that an asset may be impaired, the<br />

recoverable amount is estimated for the individual asset.<br />

If it is not possible to estimate the recoverable amount <strong>of</strong><br />

the individual asset, the recoverable amount <strong>of</strong> the cashgenerating<br />

unit or group <strong>of</strong> cash generating units to which<br />

the asset belongs is determined. The recoverable amount<br />

<strong>of</strong> an asset or a cash-generating unit is the higher <strong>of</strong> its fair<br />

value less costs to sell and its value in use.<br />

If the recoverable amount <strong>of</strong> an asset is less than its<br />

carrying amount, the carrying amount <strong>of</strong> the asset is<br />

reduced to its recoverable amount. That reduction is an<br />

impairment loss.<br />

An impairment loss <strong>of</strong> assets carried at cost less any<br />

accumulated depreciation or amortisation is recognised<br />

immediately in pr<strong>of</strong>it or loss.<br />

Goodwill acquired in a business combination is, from the<br />

acquisition date, allocated to each <strong>of</strong> the cash-generating<br />

units, or company's <strong>of</strong> cash-generating units, that are<br />

expected to benefit from the synergies <strong>of</strong> the combination,<br />

irrespective <strong>of</strong> whether other assets or liabilities <strong>of</strong> the<br />

acquiree are assigned to those units or company's <strong>of</strong> units.<br />

1.8 Financial instruments<br />

Classification<br />

The company classifies financial assets and financial<br />

liabilities into the following categories:<br />

»»<br />

Financial assets at fair value through pr<strong>of</strong>it or loss —<br />

held for trading<br />

»»<br />

Loans and receivables<br />

»»<br />

Available-for-sale financial assets<br />

»»<br />

Financial liabilities at fair value through pr<strong>of</strong>it or loss<br />

»»<br />

Financial liabilities measured at amortised cost<br />

Classification depends on the purpose for which the<br />

financial instruments were obtained/incurred and<br />

characteristics <strong>of</strong> those instruments. Management<br />

determines the classification <strong>of</strong> its financial assets/liabilities<br />

at initial recognition.<br />

(a) Financial assets/liabilities at fair value through pr<strong>of</strong>it or loss<br />

Financial assets/liabilities at fair value through pr<strong>of</strong>it<br />

or loss are financial assets/liabilities held for trading.<br />

A financial asset/liability is classified in this category if<br />

acquired principally for the purpose <strong>of</strong> selling in the short<br />

term. Derivatives are also categorised as held for trading<br />

unless they are designated as hedges. Assets/liabilities in<br />

this category are classified as current assets/liabilities if<br />

expected to be settled within 12 months, otherwise they<br />

are classified as non-current.<br />

(b) Loans and receivables/financial liabilities measured at<br />

amortised cost<br />

Loans and receivables/financial liabilities measured at<br />

amortised cost are non-derivative financial assets/liabilities<br />

with fixed or determinable payments that are not quoted<br />

in an active market. They are included in current assets/<br />

liabilities, except for maturities greater than 12 months<br />

after the end <strong>of</strong> the reporting period. These are classified<br />

as non-current assets/liabilities. The group’s loans and<br />

receivables/financial liabilities measured at amortised cost<br />

comprise 'loans to/(from) related parties', 'other financial<br />

assets', 'loans to/(from) shareholders', ‘loan book’, 'other<br />

receivables', 'cash and cash equivalents’, 'other financial<br />

borrowings', 'finance lease liabilities' and 'trade and other<br />

payables' in the Consolidated Combined Statement <strong>of</strong><br />

Financial Position.<br />

Initial recognition and measurement<br />

Financial instruments are recognised initially when the<br />

group becomes a party to the contractual provisions <strong>of</strong><br />

the instruments. The group classifies financial instruments,<br />

or their component parts, on initial recognition as a<br />

financial asset, a financial liability or an equity instrument<br />

in accordance with the substance <strong>of</strong> the contractual<br />

arrangement.<br />

Financial instruments are initially recognised at fair value<br />

plus transaction costs for all financial assets/liabilities not<br />

carried at fair value through pr<strong>of</strong>it or loss. Financial assets/<br />

liabilities carried at fair value through pr<strong>of</strong>it or loss are<br />

initially recognised at fair value, and transaction costs are<br />

expensed in the Consolidated Combined Statement <strong>of</strong><br />

Pr<strong>of</strong>it and Loss and Comprehensive Income. Available-forsale<br />

financial assets and financial assets/liabilities at fair<br />

value through pr<strong>of</strong>it or loss are subsequently carried at fair<br />

value. Loans and receivables/financial liabilities measured<br />

at amortised cost are subsequently carried at amortised<br />

cost using the effective interest method.<br />

Gains or losses arising from changes in the fair value <strong>of</strong><br />

the financial assets/liabilities at fair value through pr<strong>of</strong>it or<br />

loss category are presented in the Consolidated Combined<br />

Statement <strong>of</strong> Pr<strong>of</strong>it and Loss and Comprehensive Income<br />

within ‘Other income’ and 'Operating expenses' in the<br />

period in which they arise. Dividend income from financial<br />

assets at fair value through pr<strong>of</strong>it or loss is recognised in<br />

the Consolidated Combined Statement <strong>of</strong> Pr<strong>of</strong>it and Loss<br />

and Comprehensive Income as part <strong>of</strong> other income when<br />

the group’s right to receive payments is established.<br />

Derecognition<br />

Financial assets are derecognised when the rights to<br />

receive cash flows from the investments have expired<br />

or have been transferred and the group has transferred<br />

substantially all risks and rewards <strong>of</strong> ownership. Financial<br />

liabilities are derecognised when the obligation for cash<br />

outflows has been settled or has expired.<br />

Fair value determination<br />

The fair value is the price that would be received to sell an<br />

asset or paid to transfer a liability in an orderly transaction<br />

between market participants at the measurement date.<br />

IFRS 13 requires an entity to classify fair values measured<br />

and/or disclosed according to a hierarchy that reflects the<br />

significance <strong>of</strong> observable market inputs. The three levels <strong>of</strong><br />

the fair value hierarchy are defined as follows:<br />

Quoted market prices – Level 1:<br />

Quoted prices (unadjusted) in active markets for identical<br />

assets or liabilities<br />

Valuation technique using observable inputs – Level 2:<br />

Inputs other that quoted prices included in Level 1 that are<br />

observable for the asset or liability, either directly (that is, as<br />

prices) or indirectly (that is, derived from prices)<br />

Valuation technique using significant unobservable inputs –<br />

Level 3:<br />

Inputs for the asset or liability that are not based on<br />

observable market data (that is, unobservable inputs)<br />

Fair value measurement and<br />

valuation processes<br />

The MyBucks Group has applied valuation techniques<br />

in order to establish the fair value <strong>of</strong> its financial assets<br />

and financial liabilities. The valuation <strong>of</strong> a number <strong>of</strong> the<br />

instruments has required judgemental inputs. This is the<br />

case where no reference can be made to a quoted market<br />

price for a similar instrument, and where assumptions are<br />

made in respect <strong>of</strong> unobservable inputs.<br />

Offsetting financial assets and financial<br />

liabilities<br />

Financial assets/liabilities are <strong>of</strong>fset and the net amount<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

MyBucks Annual Report 2016 84<br />

85 MyBucks Annual Report 2016