Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

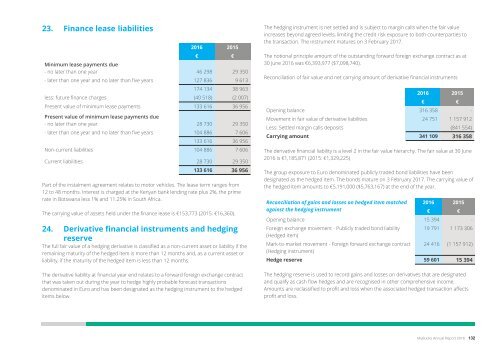

23. Finance lease liabilities<br />

2016 2015<br />

€ €<br />

Minimum lease payments due<br />

- no later than one year 46 298 29 350<br />

- later than one year and no later than five years 127 836 9 613<br />

174 134 38 963<br />

less: future finance charges (40 518) (2 007)<br />

Present value <strong>of</strong> minimum lease payments 133 616 36 956<br />

Present value <strong>of</strong> minimum lease payments due<br />

- no later than one year 28 730 29 350<br />

- later than one year and no later than five years 104 886 7 606<br />

133 616 36 956<br />

Non-current liabilities 104 886 7 606<br />

Current liabilities 28 730 29 350<br />

133 616 36 956<br />

Part <strong>of</strong> the instalment agreement relates to motor vehicles. The lease term ranges from<br />

12 to 48 months. Interest is charged at the Kenyan bank lending rate plus 2%, the prime<br />

rate in Botswana less 1% and 11.25% in South Africa.<br />

The carrying value <strong>of</strong> assets held under the finance lease is €153,773 (2015: €16,360).<br />

24. Derivative financial instruments and hedging<br />

reserve<br />

The full fair value <strong>of</strong> a hedging derivative is classified as a non-current asset or liability if the<br />

remaining maturity <strong>of</strong> the hedged item is more than 12 months and, as a current asset or<br />

liability, if the maturity <strong>of</strong> the hedged item is less than 12 months.<br />

The derivative liability at financial year end relates to a forward foreign exchange contract<br />

that was taken out during the year to hedge highly probable forecast transactions<br />

denominated in Euro and has been designated as the hedging instrument to the hedged<br />

items below.<br />

The hedging instrument is net settled and is subject to margin calls when the fair value<br />

increases beyond agreed levels, limiting the credit risk exposure to both counterparties to<br />

the transaction. The instrument matures on 3 February 2017.<br />

The notional principle amount <strong>of</strong> the outstanding forward foreign exchange contract as at<br />

30 June 2016 was €6,393,977 ($7,098,740).<br />

Reconciliation <strong>of</strong> fair value and net carrying amount <strong>of</strong> derivative financial instruments<br />

2016 2015<br />

€ €<br />

Opening balance 316 358 -<br />

Movement in fair value <strong>of</strong> derivative liabilities 24 751 1 157 912<br />

Less: Settled margin calls deposits (841 554)<br />

Carrying amount 341 109 316 358<br />

The derivative financial liability is a level 2 in the fair value hierarchy. The fair value at 30 June<br />

2016 is €1,185,871 (2015: €1,329,225)<br />

The group exposure to Euro denominated publicly traded bond liabilities have been<br />

designated as the hedged item. The bonds mature on 3 February 2017. The carrying value <strong>of</strong><br />

the hedged item amounts to €5,191,000 ($5,763,167) at the end <strong>of</strong> the year.<br />

Reconciliation <strong>of</strong> gains and losses on hedged item matched 2016 2015<br />

against the hedging instrument<br />

€ €<br />

Opening balance 15 394 -<br />

Foreign exchange movement - Publicly traded bond liability 19 791 1 173 306<br />

(Hedged item)<br />

Mark-to-market movement - Foreign forward exchange contract 24 416 (1 157 912)<br />

(Hedging instrument)<br />

Hedge reserve 59 601 15 394<br />

The hedging reserve is used to record gains and losses on derivatives that are designated<br />

and qualify as cash flow hedges and are recognised in other comprehensive income.<br />

Amounts are reclassified to pr<strong>of</strong>it and loss when the associated hedged transaction affects<br />

pr<strong>of</strong>it and loss.<br />

25. Offsetting <strong>of</strong> financial assets<br />

and financial liabilities<br />

The derivative financial instruments are the only financial<br />

instrument which are subject to <strong>of</strong>fsetting (refer to note<br />

24). The gross amount <strong>of</strong> the recognised derivative<br />

financial liability is €1,185,871 ($1,316,581) (June 2015:<br />

€1,157,912 ($1,290,440)) which is <strong>of</strong>fset against the margin<br />

call deposits <strong>of</strong> €844,761 ($937,873) and presented as a<br />

net derivative liability <strong>of</strong> €341,109 ($378,709) (June 2015:<br />

€316,358 ($352,567)). There are no other amounts set-<strong>of</strong>f<br />

in the consolidated combined financial statements.<br />

26. Trade and other payables<br />

2016 2015<br />

€ €<br />

Trade and other payables 2 415 666 1 055 724<br />

Sundry accruals 4 167 364 1 320 237<br />

VAT 407 892 137 073<br />

Provisions - 268 195<br />

Currencies<br />

6 990 922 2 781 229<br />

The carrying amounts <strong>of</strong> trade and other payables are<br />

denominated in the following currencies:<br />

Kenyan Shillings 99 347 208 680<br />

Malawi Kwacha 243 794 106 945<br />

Botswana Pula 597 080 369 953<br />

Euro 2 449 513 383 401<br />

US Dollar 1 040 112 222 478<br />

Zambian Kwacha 990 678 134 372<br />

South African Rand 1 307 431 1 241 241<br />

Other 262 967 114 159<br />

27. Deposits from customers<br />

Deposits from customers relate to GetBucks Zimbabwe.<br />

These deposits are primarily composed <strong>of</strong> amounts payable<br />

on demand<br />

Individual 2016 2015<br />

€ €<br />

Current accounts 17 159 -<br />

Term deposits - -<br />

17 159 -<br />

Small and medium<br />

enterprises<br />

Current accounts 212 878 -<br />

Term deposits 158 780 -<br />

371 658 -<br />

Total 388 817 -<br />

Current (no more than<br />

318 709 -<br />

12 months after reporting<br />

period)<br />

Non-current (more than<br />

70 108 -<br />

12 months after reporting<br />

period)<br />

Total 388 817 -<br />

Deposits due to customers only include financial<br />

instruments classified as liabilities at amortised cost. Fair<br />

value <strong>of</strong> deposits approximates its carrying amounts.<br />

28. Revenue<br />

2016 2015<br />

€ €<br />

Interest income 30 713 637 25 151 984<br />

Fee income 5 922 323 4 667 076<br />

Commission on insurance 2 269 792 1 471 787<br />

policies<br />

38 905 752 31 290 847<br />

29. Loan impairment<br />

Movement on impairment <strong>of</strong><br />

loan book<br />

2016 2015<br />

€ €<br />

9 107 634 6 813 975<br />

For detail reconciliation <strong>of</strong> impairment <strong>of</strong> loan book, refer to<br />

note 13.<br />

30. Other income<br />

Administration and<br />

management fees received<br />

2016 2015<br />

€ €<br />

193 194 281 739<br />

Credit subscription fees 47 424 86 225<br />

Bad debts recovered 190 064 14 995<br />

Liabilities written back 206 095 -<br />

Other income 20 260 23 528<br />

657 037 406 487<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

6 990 922 2 781 229<br />

MyBucks Annual Report 2016 132<br />

133 MyBucks Annual Report 2016