Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

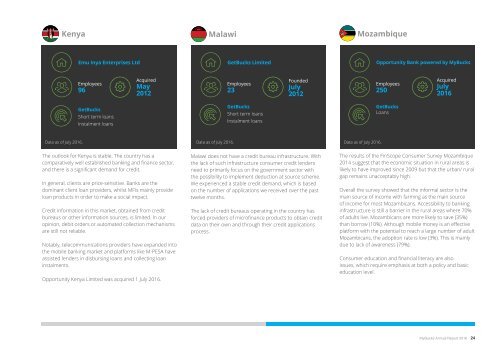

Kenya<br />

Emu Inya Enterprises Ltd<br />

Employees<br />

96<br />

GetBucks<br />

Short term loans<br />

Instalment loans<br />

Acquired<br />

May<br />

2012<br />

The outlook for Kenya is stable. The country has a<br />

comparatively well established banking and finance sector,<br />

and there is a significant demand for credit.<br />

In general, clients are price-sensitive. Banks are the<br />

dominant client loan providers, whilst MFIs mainly provide<br />

loan products in order to make a social impact.<br />

Credit information in this market, obtained from credit<br />

bureaus or other information sources, is limited. In our<br />

opinion, debit orders or automated collection mechanisms<br />

are still not reliable.<br />

Notably, telecommunications providers have expanded into<br />

the mobile banking market and platforms like M-PESA have<br />

assisted lenders in disbursing loans and collecting loan<br />

instalments.<br />

Opportunity Kenya Limited was acquired 1 July 2016.<br />

Malawi<br />

GetBucks Limited<br />

Employees<br />

23<br />

GetBucks<br />

Short term loans<br />

Instalment loans<br />

Founded<br />

July<br />

2012<br />

Malawi does not have a credit bureau infrastructure. With<br />

the lack <strong>of</strong> such infrastructure consumer credit lenders<br />

need to primarily focus on the government sector with<br />

the possibility to implement deduction at source scheme.<br />

We experienced a stable credit demand, which is based<br />

on the number <strong>of</strong> applications we received over the past<br />

twelve months.<br />

The lack <strong>of</strong> credit bureaus operating in the country has<br />

forced providers <strong>of</strong> micr<strong>of</strong>inance products to obtain credit<br />

data on their own and through their credit applications<br />

process.<br />

Mozambique<br />

Opportunity Bank powered by MyBucks<br />

Employees<br />

250<br />

GetBucks<br />

Loans<br />

Acquired<br />

July<br />

2016<br />

The results <strong>of</strong> the FinScope Consumer Survey Mozambique<br />

2014 suggest that the economic situation in rural areas is<br />

likely to have improved since 2009 but that the urban/ rural<br />

gap remains unacceptably high.<br />

Overall the survey showed that the informal sector is the<br />

main source <strong>of</strong> income with farming as the main source<br />

<strong>of</strong> income for most Mozambicans. Accessibility to banking<br />

infrastructure is still a barrier in the rural areas where 70%<br />

<strong>of</strong> adults live. Mozambicans are more likely to save (35%)<br />

than borrow (10%). Although mobile money is an effective<br />

platform with the potential to reach a large number <strong>of</strong> adult<br />

Mozambicans, the adoption rate is low (3%). This is mainly<br />

due to lack <strong>of</strong> awareness (79%).<br />

Consumer education and financial literacy are also<br />

issues, which require emphasis at both a policy and basic<br />

education level.<br />

Namibia<br />

GetBucks Namibia (Pty) Ltd<br />

Employees<br />

1<br />

GetBucks<br />

Short term loans<br />

Founded<br />

July<br />

2014<br />

According to the third quarter 2015 financial report <strong>of</strong><br />

the Namibian Financial Institutions Supervisory Authority<br />

(NAMFISA) the total amount <strong>of</strong> new loans disbursed by<br />

micro lenders country-wide rose from N$578 million<br />

(second quarter 2015) to N$709 million in third quarter<br />

2015. Similarly, year-on-year, the amount <strong>of</strong> new loans rose<br />

at a rate <strong>of</strong> 10.6% from N$641million to N$709 million.<br />

The increase both on a quarterly and annual basis is<br />

mainly attributed to the transactions <strong>of</strong> lenders granting a<br />

loan for a specific amount that has a specified repayment<br />

schedule and a floating interest rate. Over the same period,<br />

loan disbursements <strong>of</strong> smaller, so called payday lenders,<br />

who further, over the same period, loan disbursements <strong>of</strong><br />

‘Payday Lenders’ fell by 1.0 percent and rose albeit by a low<br />

rate <strong>of</strong> 8.4 percent, respectively to N$1841 million.<br />

Since 2016 we are among the few credit providers in the<br />

country <strong>of</strong>fering access to credit via online channels, such<br />

as the Internet and mobile.<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

MyBucks Annual Report 2016 24<br />

25 MyBucks Annual Report 2016