Table of contents

MyBucks%20Annual%20Report%202016

MyBucks%20Annual%20Report%202016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

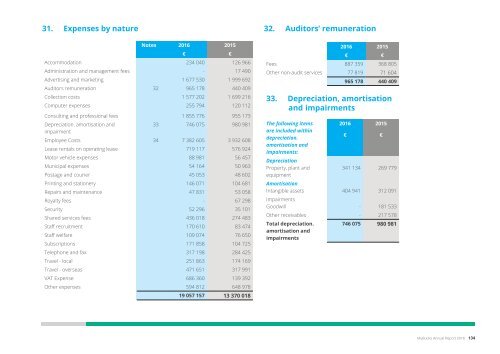

31. Expenses by nature<br />

Notes 2016 2015<br />

€ €<br />

Accommodation 234 040 126 966<br />

Administration and management fees - 17 490<br />

Advertising and marketing 1 677 530 1 999 692<br />

Auditors remuneration 32 965 178 440 409<br />

Collection costs 1 577 202 1 699 216<br />

Computer expenses 255 794 120 112<br />

Consulting and pr<strong>of</strong>essional fees 1 855 776 955 173<br />

Depreciation. amortisation and<br />

33 746 075 980 981<br />

impairment<br />

Employee Costs 34 7 382 605 3 932 608<br />

Lease rentals on operating lease 719 117 576 924<br />

Motor vehicle expenses 88 981 56 457<br />

Municipal expenses 54 164 50 963<br />

Postage and courier 45 053 48 602<br />

Printing and stationery 146 071 104 681<br />

Repairs and maintenance 47 831 53 058<br />

Royalty fees - 67 298<br />

Security 52 296 35 101<br />

Shared services fees 436 018 274 483<br />

Staff recruitment 170 610 83 474<br />

Staff welfare 109 074 76 650<br />

Subscriptions 171 858 104 725<br />

Telephone and fax 317 198 284 425<br />

Travel - local 251 863 174 169<br />

Travel - overseas 471 651 317 991<br />

VAT Expense 686 360 139 392<br />

Other expenses 594 812 648 978<br />

32. Auditors’ remuneration<br />

2016 2015<br />

€ € €<br />

Fees 887 359 368 805<br />

Other non-audit services 77 819 71 604<br />

965 178 440 409<br />

33. Depreciation, amortisation<br />

and impairments<br />

The following items<br />

2016 2015<br />

are included within<br />

depreciation.<br />

€ €<br />

amortisation and<br />

impairments:€<br />

Depreciation<br />

Property, plant and<br />

341 134 269 779<br />

equipment<br />

Amortisation<br />

Intangible assets 404 941 312 091<br />

Impairments<br />

Goodwill - 181 533<br />

Other receivables - 217 578<br />

Total depreciation.<br />

amortisation and<br />

impairments<br />

746 075 980 981<br />

34. Employee benefit expense<br />

Employee costs<br />

2016 2015<br />

€<br />

€ €<br />

Basic 6 825 770 3 725 385<br />

Commissions 556 835 207 223<br />

7 382 605 3 932 608<br />

The total average number <strong>of</strong> employees during the<br />

financial year was 328.<br />

35. Investment revenue<br />

2016 2015<br />

€ € €<br />

Bridging finance interest - 270 370<br />

Related party interest 1 499 750 601 661<br />

36. Finance costs<br />

1 499 750 872 031<br />

2016 2015<br />

€ € €<br />

Shareholders loans 710 165 2 497 178<br />

Other financial borrowings 9 637 249 2 838 546<br />

Loss on foreign exchange 467 958 985 382<br />

Funding origination costs 1 129 179 377 428<br />

Other interest 3 878 -<br />

11 948 429 6 698 534<br />

37. Income tax expense<br />

Major components <strong>of</strong> the 2016 2015<br />

Income tax expense<br />

€ €<br />

Current<br />

Local income tax - current 2 829 616 2 652 915<br />

period<br />

Excise duty 397 408<br />

Withholding tax - current 820 464 797 259<br />

period<br />

3 650 477 3 450 582<br />

Deferred<br />

Originating and reversing<br />

temporary differences<br />

(2 054 825) (1 099 060)<br />

Total income tax<br />

expense<br />

(2 054 825) (1 099 060)<br />

1 595 652 2 351 522<br />

Reconciliation <strong>of</strong> the Income tax expense<br />

Reconciliation between accounting pr<strong>of</strong>it and tax<br />

expense.<br />

Accounting pr<strong>of</strong>it/(loss) 949 319 5 686 838<br />

Tax at the domestic tax<br />

rates applicable to pr<strong>of</strong>its<br />

in the respective countries<br />

203 956 1 231 318<br />

Tax effect <strong>of</strong> adjustments<br />

on taxable income<br />

Nondeductible expenses 201 685 26 365<br />

Thin Capitalisation 120 899 -<br />

Amortisation <strong>of</strong> customer (19 465) 19 319<br />

base<br />

Unrecognised tax losses 420 586 372 977<br />

Utilisation <strong>of</strong> previously<br />

- (92 129)<br />

unrecognised tax losses<br />

Withholding tax credit 808 314 797 258<br />

Prior period adjustment (118 482) (3 994)<br />

Nondeductible income (22 238) -<br />

Excise duty 397 408<br />

1 595 652 2 351 522<br />

| Introduction | Business Overview | Corporate Governance | Financial Statements | Other |<br />

19 057 157 13 370 018<br />

MyBucks Annual Report 2016 134<br />

135 MyBucks Annual Report 2016