2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

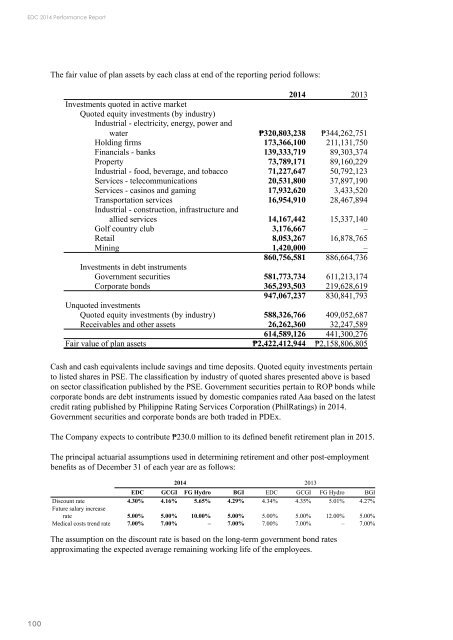

The fair value of plan assets by each class at end of the reporting period follows:<br />

<strong>2014</strong> 2013<br />

Investments quoted in active market<br />

Quoted equity investments (by industry)<br />

Industrial - electricity, energy, power and<br />

water ₱320,803,238 ₱344,262,751<br />

Holding firms 173,366,100 211,131,750<br />

<strong>Financial</strong>s - banks 139,333,719 89,303,374<br />

Property 73,789,171 89,160,229<br />

Industrial - food, beverage, and tobacco 71,227,647 50,792,123<br />

Services - telecommunications 20,531,800 37,897,190<br />

Services - casinos and gaming 17,932,620 3,433,520<br />

Transportation services 16,954,910 28,467,894<br />

Industrial - construction, infrastructure and<br />

allied services 14,167,442 15,337,140<br />

Golf country club 3,176,667 –<br />

Retail 8,053,267 16,878,765<br />

Mining 1,420,000 –<br />

860,756,581 886,664,736<br />

Investments in debt instruments<br />

Government securities 581,773,734 611,213,174<br />

Corporate bonds 365,293,503 219,628,619<br />

947,067,237 830,841,793<br />

Unquoted investments<br />

Quoted equity investments (by industry) 588,326,766 409,052,687<br />

Receivables and other assets 26,262,360 32,247,589<br />

614,589,126 441,300,276<br />

Fair value of plan assets ₱2,422,412,944 ₱2,158,806,805<br />

Cash and cash equivalents include savings and time deposits. Quoted equity investments pertain<br />

to listed shares in PSE. The classification by industry of quoted shares presented above is based<br />

on sector classification published by the PSE. Government securities pertain to ROP bonds while<br />

corporate bonds are debt instruments issued by domestic companies rated Aaa based on the latest<br />

credit rating published by Philippine Rating Services Corporation (PhilRatings) in <strong>2014</strong>.<br />

Government securities and corporate bonds are both traded in PDEx.<br />

The Company expects to contribute ₱230.0 million to its defined benefit retirement plan in 2015.<br />

The principal actuarial assumptions used in determining retirement and other post-employment<br />

benefits as of December 31 of each year are as follows:<br />

<strong>2014</strong> 2013<br />

EDC GCGI FG Hydro BGI EDC GCGI FG Hydro BGI<br />

Discount rate 4.30% 4.16% 5.65% 4.29% 4.34% 4.35% 5.01% 4.27%<br />

Future salary increase<br />

rate 5.00% 5.00% 10.00% 5.00% 5.00% 5.00% 12.00% 5.00%<br />

Medical costs trend rate 7.00% 7.00% – 7.00% 7.00% 7.00% – 7.00%<br />

The assumption on the discount rate is based on the long-term government bond rates<br />

approximating the expected average remaining working life of the employees.<br />

100