2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

In 2009, 93,000,000 common shares held in treasury that were acquired in 2008 at the cost of<br />

₱404.2 million have been issued irrevocably by the Parent Company to BDO Trust for the benefit<br />

of the executive/employee grantees under the Parent Company’s Employee Stock Grant Plan<br />

(ESGP). The BDO Trust is an independent and separate legal entity. EDC has neither control nor<br />

discretion over the administration and investment activity on the common shares in<br />

executive/employee benefit trust held by BDO Trust. These shares are part of the issued and<br />

outstanding common shares and are entitled to vote and receive dividend. These shares will not<br />

revert to EDC even if the planned stock grant plan or other such plan is terminated. Any fruits or<br />

interests of these shares shall be for the sole and exclusive benefit of the officers and employees of<br />

EDC who are identified grantees of such stock plans. Any capital appreciation or decline in value,<br />

dividends, or other benefits declared on these shares shall accrue to the trust account and EDC<br />

shall not have any claim thereon. The issuance of the common shares to BDO Trust was<br />

recognized under the “Common shares in employee trust account” account in the consolidated<br />

statement of financial position (see Note 30).<br />

Equity Reserve<br />

On October 16, 2008, EDC, First Gen and FG Hydro entered into a Share Purchase and<br />

Investment Agreement (SPIA), whereby EDC shall own 60% of the outstanding equity of FG<br />

Hydro, which was then a wholly owned subsidiary of First Gen prior to the SPIA. FG Hydro and<br />

EDC were subsidiaries of First Gen at that time and were, therefore, under common control of<br />

First Gen. The acquisition was accounted for similar to a pooling-of-interests method since First<br />

Gen controlled FG Hydro and EDC before and after the execution of the SPIA. EDC recognized<br />

equity reserve amounting to ₱3,706.4 million pertaining to the difference between the acquisition<br />

cost and EDC’s proportionate share in the paid-in capital of FG Hydro.<br />

Retained Earnings<br />

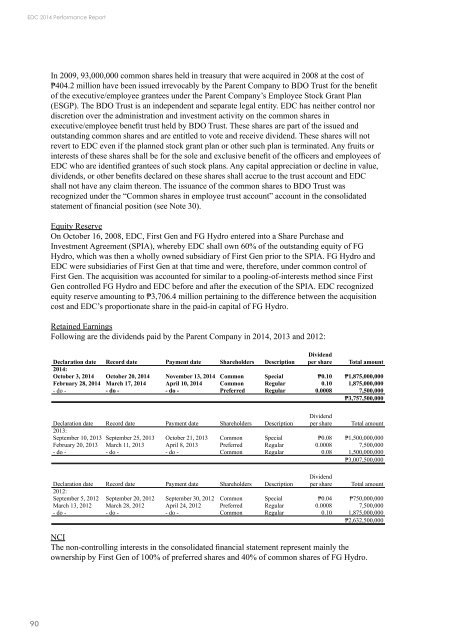

Following are the dividends paid by the Parent Company in <strong>2014</strong>, 2013 and 2012:<br />

Declaration date Record date Payment date Shareholders Description<br />

Dividend<br />

per share Total amount<br />

<strong>2014</strong>:<br />

October 3, <strong>2014</strong> October 20, <strong>2014</strong> November 13, <strong>2014</strong> Common Special ₱0.10 ₱1,875,000,000<br />

February 28, <strong>2014</strong> March 17, <strong>2014</strong> April 10, <strong>2014</strong> Common Regular 0.10 1,875,000,000<br />

- do - - do - - do - Preferred Regular 0.0008 7,500,000<br />

₱3,757,500,000<br />

Declaration date Record date Payment date Shareholders Description<br />

Dividend<br />

per share Total amount<br />

2013:<br />

September 10, 2013 September 25, 2013 October 21, 2013 Common Special ₱0.08 ₱1,500,000,000<br />

February 20, 2013 March 11, 2013 April 8, 2013 Preferred Regular 0.0008 7,500,000<br />

- do - - do - - do - Common Regular 0.08 1,500,000,000<br />

₱3,007,500,000<br />

Declaration date Record date Payment date Shareholders Description<br />

Dividend<br />

per share Total amount<br />

2012:<br />

September 5, 2012 September 20, 2012 September 30, 2012 Common Special ₱0.04 ₱750,000,000<br />

March 13, 2012 March 28, 2012 April 24, 2012 Preferred Regular 0.0008 7,500,000<br />

- do - - do - - do - Common Regular 0.10 1,875,000,000<br />

₱2,632,500,000<br />

NCI<br />

The non-controlling interests in the consolidated financial statement represent mainly the<br />

ownership by First Gen of 100% of preferred shares and 40% of common shares of FG Hydro.<br />

90