2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EDC <strong>2014</strong> Performance Report<br />

21.<br />

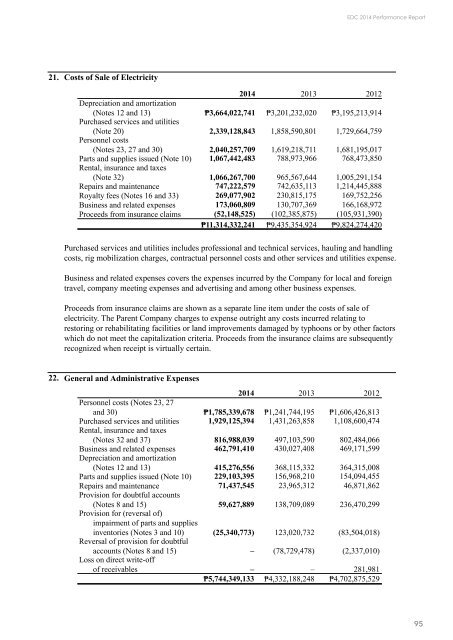

Costs of Sale of Electricity<br />

<strong>2014</strong> 2013 2012<br />

Depreciation and amortization<br />

(Notes 12 and 13) ₱3,664,022,741 ₱3,201,232,020 ₱3,195,213,914<br />

Purchased services and utilities<br />

(Note 20) 2,339,128,843 1,858,590,801 1,729,664,759<br />

Personnel costs<br />

(Notes 23, 27 and 30) 2,040,257,709 1,619,218,711 1,681,195,017<br />

Parts and supplies issued (Note 10) 1,067,442,483 788,973,966 768,473,850<br />

Rental, insurance and taxes<br />

(Note 32) 1,066,267,700 965,567,644 1,005,291,154<br />

Repairs and maintenance 747,222,579 742,635,113 1,214,445,888<br />

Royalty fees (Notes 16 and 33) 269,077,902 230,815,175 169,752,256<br />

Business and related expenses 173,060,809 130,707,369 166,168,972<br />

Proceeds from insurance claims (52,148,525) (102,385,875) (105,931,390)<br />

₱11,314,332,241 ₱9,435,354,924 ₱9,824,274,420<br />

Purchased services and utilities includes professional and technical services, hauling and handling<br />

costs, rig mobilization charges, contractual personnel costs and other services and utilities expense.<br />

Business and related expenses covers the expenses incurred by the Company for local and foreign<br />

travel, company meeting expenses and advertising and among other business expenses.<br />

Proceeds from insurance claims are shown as a separate line item under the costs of sale of<br />

electricity. The Parent Company charges to expense outright any costs incurred relating to<br />

restoring or rehabilitating facilities or land improvements damaged by typhoons or by other factors<br />

which do not meet the capitalization criteria. Proceeds from the insurance claims are subsequently<br />

recognized when receipt is virtually certain.<br />

22.<br />

General and Administrative Expenses<br />

<strong>2014</strong> 2013 2012<br />

Personnel costs (Notes 23, 27<br />

and 30) ₱1,785,339,678 ₱1,241,744,195 ₱1,606,426,813<br />

Purchased services and utilities 1,929,125,394 1,431,263,858 1,108,600,474<br />

Rental, insurance and taxes<br />

(Notes 32 and 37) 816,988,039 497,103,590 802,484,066<br />

Business and related expenses 462,791,410 430,027,408 469,171,599<br />

Depreciation and amortization<br />

(Notes 12 and 13) 415,276,556 368,115,332 364,315,008<br />

Parts and supplies issued (Note 10) 229,103,395 156,968,210 154,094,455<br />

Repairs and maintenance 71,437,545 23,965,312 46,871,862<br />

Provision for doubtful accounts<br />

(Notes 8 and 15) 59,627,889 138,709,089 236,470,299<br />

Provision for (reversal of)<br />

impairment of parts and supplies<br />

inventories (Notes 3 and 10) (25,340,773) 123,020,732 (83,504,018)<br />

Reversal of provision for doubtful<br />

accounts (Notes 8 and 15) – (78,729,478) (2,337,010)<br />

Loss on direct write-off<br />

of receivables – – 281,981<br />

₱5,744,349,133 ₱4,332,188,248 ₱4,702,875,529<br />

95