EDC <strong>2014</strong> Performance Report The fair value of plan assets by each class at end of the reporting period follows: <strong>2014</strong> 2013 Investments quoted in active market Quoted equity investments (by industry) Industrial - electricity, energy, power and water ₱320,803,238 ₱344,262,751 Holding firms 173,366,100 211,131,750 <strong>Financial</strong>s - banks 139,333,719 89,303,374 Property 73,789,171 89,160,229 Industrial - food, beverage, and tobacco 71,227,647 50,792,123 Services - telecommunications 20,531,800 37,897,190 Services - casinos and gaming 17,932,620 3,433,520 Transportation services 16,954,910 28,467,894 Industrial - construction, infrastructure and allied services 14,167,442 15,337,140 Golf country club 3,176,667 – Retail 8,053,267 16,878,765 Mining 1,420,000 – 860,756,581 886,664,736 Investments in debt instruments Government securities 581,773,734 611,213,174 Corporate bonds 365,293,503 219,628,619 947,067,237 830,841,793 Unquoted investments Quoted equity investments (by industry) 588,326,766 409,052,687 Receivables and other assets 26,262,360 32,247,589 614,589,126 441,300,276 Fair value of plan assets ₱2,422,412,944 ₱2,158,806,805 Cash and cash equivalents include savings and time deposits. Quoted equity investments pertain to listed shares in PSE. The classification by industry of quoted shares presented above is based on sector classification published by the PSE. Government securities pertain to ROP bonds while corporate bonds are debt instruments issued by domestic companies rated Aaa based on the latest credit rating published by Philippine Rating Services Corporation (PhilRatings) in <strong>2014</strong>. Government securities and corporate bonds are both traded in PDEx. The Company expects to contribute ₱230.0 million to its defined benefit retirement plan in 2015. The principal actuarial assumptions used in determining retirement and other post-employment benefits as of December 31 of each year are as follows: <strong>2014</strong> 2013 EDC GCGI FG Hydro BGI EDC GCGI FG Hydro BGI Discount rate 4.30% 4.16% 5.65% 4.29% 4.34% 4.35% 5.01% 4.27% Future salary increase rate 5.00% 5.00% 10.00% 5.00% 5.00% 5.00% 12.00% 5.00% Medical costs trend rate 7.00% 7.00% – 7.00% 7.00% 7.00% – 7.00% The assumption on the discount rate is based on the long-term government bond rates approximating the expected average remaining working life of the employees. 100

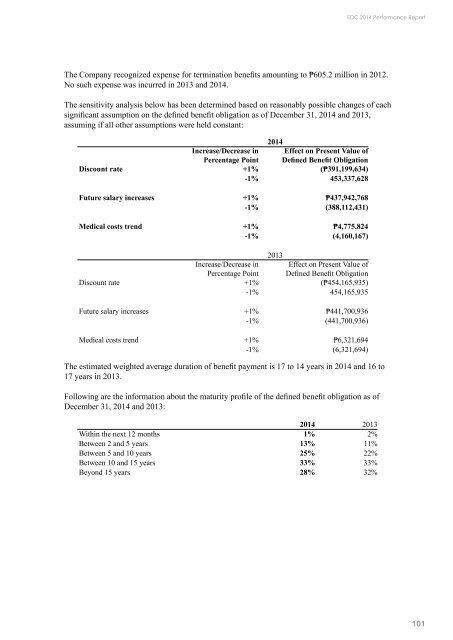

EDC <strong>2014</strong> Performance Report The Company recognized expense for termination benefits amounting to ₱605.2 million in 2012. No such expense was incurred in 2013 and <strong>2014</strong>. The sensitivity analysis below has been determined based on reasonably possible changes of each significant assumption on the defined benefit obligation as of December 31, <strong>2014</strong> and 2013, assuming if all other assumptions were held constant: <strong>2014</strong> Increase/Decrease in Percentage Point Effect on Present Value of Defined Benefit Obligation Discount rate +1% (₱391,199,634) -1% 453,337,628 Future salary increases +1% ₱437,942,768 -1% (388,112,431) Medical costs trend +1% ₱4,775,824 -1% (4,160,167) 2013 Increase/Decrease in Percentage Point Effect on Present Value of Defined Benefit Obligation Discount rate +1% (₱454,165,935) -1% 454,165,935 Future salary increases +1% ₱441,700,936 -1% (441,700,936) Medical costs trend +1% ₱6,321,694 -1% (6,321,694) The estimated weighted average duration of benefit payment is 17 to 14 years in <strong>2014</strong> and 16 to 17 years in 2013. Following are the information about the maturity profile of the defined benefit obligation as of December 31, <strong>2014</strong> and 2013: <strong>2014</strong> 2013 Within the next 12 months 1% 2% Between 2 and 5 years 13% 11% Between 5 and 10 years 25% 22% Between 10 and 15 years 33% 33% Beyond 15 years 28% 32% 101