2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EDC <strong>2014</strong> Performance Report<br />

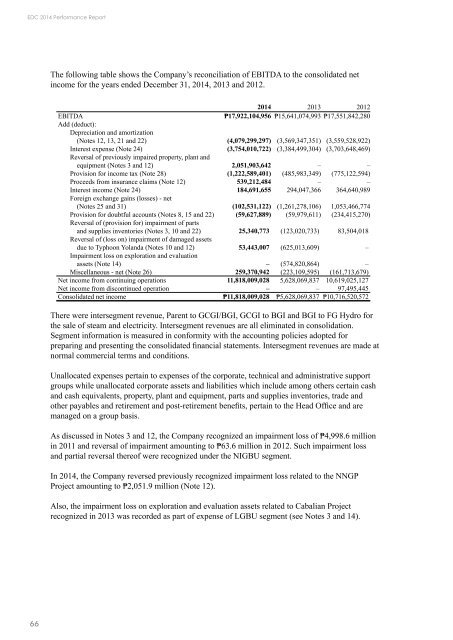

The following table shows the Company’s reconciliation of EBITDA to the consolidated net<br />

income for the years ended December 31, <strong>2014</strong>, 2013 and 2012.<br />

<strong>2014</strong> 2013 2012<br />

EBITDA ₱17,922,104,956 ₱15,641,074,993 ₱17,551,842,280<br />

Add (deduct):<br />

Depreciation and amortization<br />

(Notes 12, 13, 21 and 22) (4,079,299,297) (3,569,347,351) (3,559,528,922)<br />

Interest expense (Note 24) (3,754,010,722) (3,384,499,304) (3,703,648,469)<br />

Reversal of previously impaired property, plant and<br />

equipment (Notes 3 and 12) 2,051,903,642 – –<br />

Provision for income tax (Note 28) (1,222,589,401) (485,983,349) (775,122,594)<br />

Proceeds from insurance claims (Note 12) 539,212,484 – –<br />

Interest income (Note 24) 184,691,655 294,047,366 364,640,989<br />

Foreign exchange gains (losses) - net<br />

(Notes 25 and 31) (102,531,122) (1,261,278,106) 1,053,466,774<br />

Provision for doubtful accounts (Notes 8, 15 and 22) (59,627,889) (59,979,611) (234,415,270)<br />

Reversal of (provision for) impairment of parts<br />

and supplies inventories (Notes 3, 10 and 22) 25,340,773 (123,020,733) 83,504,018<br />

Reversal of (loss on) impairment of damaged assets<br />

due to Typhoon Yolanda (Notes 10 and 12) 53,443,007 (625,013,609) –<br />

Impairment loss on exploration and evaluation<br />

assets (Note 14) – (574,820,864) –<br />

Miscellaneous - net (Note 26) 259,370,942 (223,109,595) (161,713,679)<br />

Net income from continuing operations 11,818,009,028 5,628,069,837 10,619,025,127<br />

Net income from discontinued operation – – 97,495,445<br />

Consolidated net income ₱11,818,009,028 ₱5,628,069,837 ₱10,716,520,572<br />

There were intersegment revenue, Parent to GCGI/BGI, GCGI to BGI and BGI to FG Hydro for<br />

the sale of steam and electricity. Intersegment revenues are all eliminated in consolidation.<br />

Segment information is measured in conformity with the accounting policies adopted for<br />

preparing and presenting the consolidated financial statements. Intersegment revenues are made at<br />

normal commercial terms and conditions.<br />

Unallocated expenses pertain to expenses of the corporate, technical and administrative support<br />

groups while unallocated corporate assets and liabilities which include among others certain cash<br />

and cash equivalents, property, plant and equipment, parts and supplies inventories, trade and<br />

other payables and retirement and post-retirement benefits, pertain to the Head Office and are<br />

managed on a group basis.<br />

As discussed in Notes 3 and 12, the Company recognized an impairment loss of ₱4,998.6 million<br />

in 2011 and reversal of impairment amounting to ₱63.6 million in 2012. Such impairment loss<br />

and partial reversal thereof were recognized under the NIGBU segment.<br />

In <strong>2014</strong>, the Company reversed previously recognized impairment loss related to the NNGP<br />

Project amounting to ₱2,051.9 million (Note 12).<br />

Also, the impairment loss on exploration and evaluation assets related to Cabalian Project<br />

recognized in 2013 was recorded as part of expense of LGBU segment (see Notes 3 and 14).<br />

66