2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

The stock grants are given in lieu of cash incentives and bonuses. The grant of shares under the<br />

ESGP does not require an exercise price to be paid by the awardees. The granted shares will vest<br />

over a three-year period as follows: 20% after the first anniversary of the grant date; 30% after the<br />

second anniversary of the grant date; and the remaining 50% after the third anniversary of the<br />

grant date. Awardees that resign or are terminated will lose any right to unvested shares. There<br />

are no cash settlement alternatives.<br />

The ESGP covers officers and employees of the Parent Company or other individuals whom the<br />

Committee may decide to include. The Committee shall maintain the sole discretion over the<br />

selection of individuals to whom awards may be granted for any given calendar year.<br />

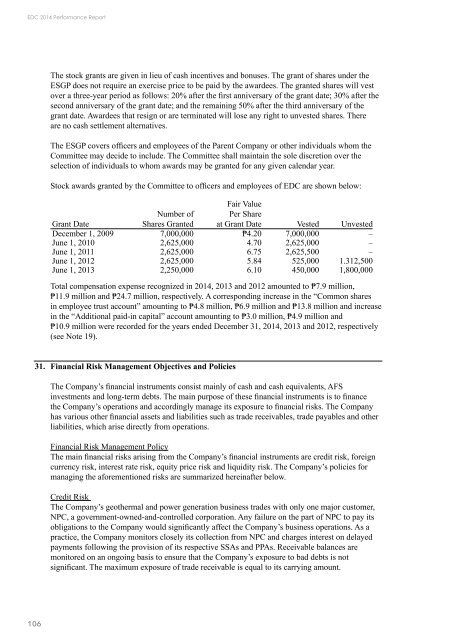

Stock awards granted by the Committee to officers and employees of EDC are shown below:<br />

Fair Value<br />

Grant Date<br />

Number of<br />

Shares Granted<br />

Per Share<br />

at Grant Date Vested Unvested<br />

December 1, 2009 7,000,000 ₱4.20 7,000,000 –<br />

June 1, 2010 2,625,000 4.70 2,625,000 –<br />

June 1, 2011 2,625,000 6.75 2,625,500 –<br />

June 1, 2012 2,625,000 5.84 525,000 1.312,500<br />

June 1, 2013 2,250,000 6.10 450,000 1,800,000<br />

Total compensation expense recognized in <strong>2014</strong>, 2013 and 2012 amounted to ₱7.9 million,<br />

₱11.9 million and ₱24.7 million, respectively. A corresponding increase in the “Common shares<br />

in employee trust account” amounting to ₱4.8 million, ₱6.9 million and ₱13.8 million and increase<br />

in the “Additional paid-in capital” account amounting to ₱3.0 million, ₱4.9 million and<br />

₱10.9 million were recorded for the years ended December 31, <strong>2014</strong>, 2013 and 2012, respectively<br />

(see Note 19).<br />

31.<br />

<strong>Financial</strong> Risk Management Objectives and Policies<br />

The Company’s financial instruments consist mainly of cash and cash equivalents, AFS<br />

investments and long-term debts. The main purpose of these financial instruments is to finance<br />

the Company’s operations and accordingly manage its exposure to financial risks. The Company<br />

has various other financial assets and liabilities such as trade receivables, trade payables and other<br />

liabilities, which arise directly from operations.<br />

<strong>Financial</strong> Risk Management Policy<br />

The main financial risks arising from the Company’s financial instruments are credit risk, foreign<br />

currency risk, interest rate risk, equity price risk and liquidity risk. The Company’s policies for<br />

managing the aforementioned risks are summarized hereinafter below.<br />

Credit Risk<br />

The Company’s geothermal and power generation business trades with only one major customer,<br />

NPC, a government-owned-and-controlled corporation. Any failure on the part of NPC to pay its<br />

obligations to the Company would significantly affect the Company’s business operations. As a<br />

practice, the Company monitors closely its collection from NPC and charges interest on delayed<br />

payments following the provision of its respective SSAs and PPAs. Receivable balances are<br />

monitored on an ongoing basis to ensure that the Company’s exposure to bad debts is not<br />

significant. The maximum exposure of trade receivable is equal to its carrying amount.<br />

106