2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

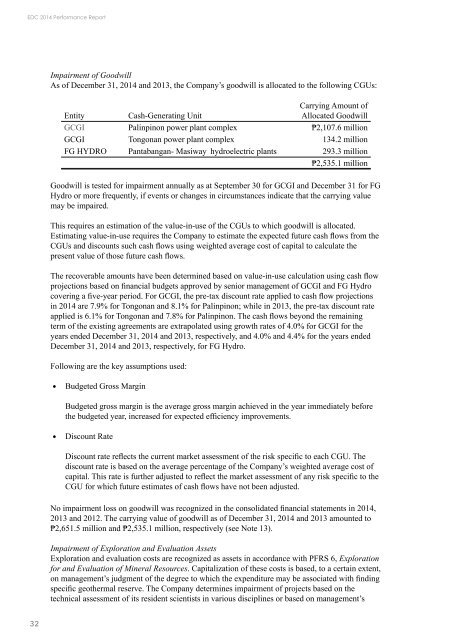

Impairment of Goodwill<br />

As of December 31, <strong>2014</strong> and 2013, the Company’s goodwill is allocated to the following CGUs:<br />

Entity<br />

Cash-Generating Unit<br />

Carrying Amount of<br />

Allocated Goodwill<br />

GCGI Palinpinon power plant complex ₱2,107.6 million<br />

GCGI Tongonan power plant complex 134.2 million<br />

FG Hydro Pantabangan- Masiway hydroelectric plants 293.3 million<br />

₱2,535.1 million<br />

Goodwill is tested for impairment annually as at September 30 for GCGI and December 31 for FG<br />

Hydro or more frequently, if events or changes in circumstances indicate that the carrying value<br />

may be impaired.<br />

This requires an estimation of the value-in-use of the CGUs to which goodwill is allocated.<br />

Estimating value-in-use requires the Company to estimate the expected future cash flows from the<br />

CGUs and discounts such cash flows using weighted average cost of capital to calculate the<br />

present value of those future cash flows.<br />

The recoverable amounts have been determined based on value-in-use calculation using cash flow<br />

projections based on financial budgets approved by senior management of GCGI and FG Hydro<br />

covering a five-year period. For GCGI, the pre-tax discount rate applied to cash flow projections<br />

in <strong>2014</strong> are 7.9% for Tongonan and 8.1% for Palinpinon; while in 2013, the pre-tax discount rate<br />

applied is 6.1% for Tongonan and 7.8% for Palinpinon. The cash flows beyond the remaining<br />

term of the existing agreements are extrapolated using growth rates of 4.0% for GCGI for the<br />

years ended December 31, <strong>2014</strong> and 2013, respectively, and 4.0% and 4.4% for the years ended<br />

December 31, <strong>2014</strong> and 2013, respectively, for FG Hydro.<br />

Following are the key assumptions used:<br />

Budgeted Gross Margin<br />

Budgeted gross margin is the average gross margin achieved in the year immediately before<br />

the budgeted year, increased for expected efficiency improvements.<br />

Discount Rate<br />

Discount rate reflects the current market assessment of the risk specific to each CGU. The<br />

discount rate is based on the average percentage of the Company’s weighted average cost of<br />

capital. This rate is further adjusted to reflect the market assessment of any risk specific to the<br />

CGU for which future estimates of cash flows have not been adjusted.<br />

No impairment loss on goodwill was recognized in the consolidated financial statements in <strong>2014</strong>,<br />

2013 and 2012. The carrying value of goodwill as of December 31, <strong>2014</strong> and 2013 amounted to<br />

₱2,651.5 million and ₱2,535.1 million, respectively (see Note 13).<br />

Impairment of Exploration and Evaluation Assets<br />

Exploration and evaluation costs are recognized as assets in accordance with PFRS 6, Exploration<br />

for and Evaluation of Mineral Resources. Capitalization of these costs is based, to a certain extent,<br />

on management’s judgment of the degree to which the expenditure may be associated with finding<br />

specific geothermal reserve. The Company determines impairment of projects based on the<br />

technical assessment of its resident scientists in various disciplines or based on management’s<br />

32