2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

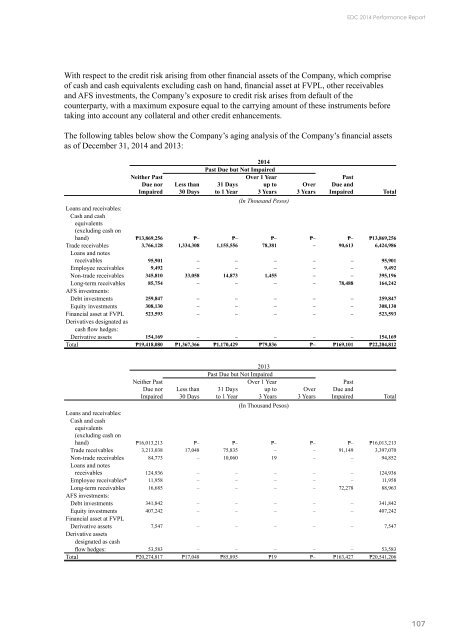

EDC <strong>2014</strong> Performance Report<br />

With respect to the credit risk arising from other financial assets of the Company, which comprise<br />

of cash and cash equivalents excluding cash on hand, financial asset at FVPL, other receivables<br />

and AFS investments, the Company’s exposure to credit risk arises from default of the<br />

counterparty, with a maximum exposure equal to the carrying amount of these instruments before<br />

taking into account any collateral and other credit enhancements.<br />

The following tables below show the Company’s aging analysis of the Company’s financial assets<br />

as of December 31, <strong>2014</strong> and 2013:<br />

Neither Past<br />

Due nor<br />

Impaired<br />

Less than<br />

30 Days<br />

<strong>2014</strong><br />

Past Due but Not Impaired<br />

Over 1 Year<br />

31 Days up to<br />

to 1 Year 3 Years<br />

(In Thousand Pesos)<br />

Over<br />

3 Years<br />

Past<br />

Due and<br />

Impaired<br />

Loans and receivables:<br />

Cash and cash<br />

equivalents<br />

(excluding cash on<br />

hand) ₱13,869,256 ₱– ₱– ₱– ₱– ₱– ₱13,869,256<br />

Trade receivables 3,766,128 1,334,308 1,155,556 78,381 – 90,613 6,424,986<br />

Loans and notes<br />

receivables 95,901 – – – – – 95,901<br />

Employee receivables 9,492 – – – – – 9,492<br />

Non-trade receivables 345,810 33,058 14,873 1,455 – – 395,196<br />

Long-term receivables 85,754 – – – – 78,488 164,242<br />

AFS investments:<br />

Debt investments 259,847 – – – – – 259,847<br />

Equity investments 308,130 – – – – – 308,130<br />

<strong>Financial</strong> asset at FVPL 523,593 – – – – – 523,593<br />

Derivatives designated as<br />

cash flow hedges:<br />

Derivative assets 154,169 – – – – – 154,169<br />

Total ₱19,418,080 ₱1,367,366 ₱1,170,429 ₱79,836 ₱– ₱169,101 ₱22,204,812<br />

Total<br />

Neither Past<br />

Due nor<br />

Impaired<br />

Less than<br />

30 Days<br />

2013<br />

Past Due but Not Impaired<br />

Over 1 Year<br />

31 Days up to<br />

to 1 Year 3 Years<br />

(In Thousand Pesos)<br />

Over<br />

3 Years<br />

Past<br />

Due and<br />

Impaired<br />

Loans and receivables:<br />

Cash and cash<br />

equivalents<br />

(excluding cash on<br />

hand) ₱16,013,213 ₱– ₱– ₱– ₱– ₱– ₱16,013,213<br />

Trade receivables 3,213,038 17,048 75,835 – – 91,149 3,397,070<br />

Non-trade receivables 84,773 – 10,060 19 – – 94,852<br />

Loans and notes<br />

receivables 124,936 – – – – – 124,936<br />

Employee receivables* 11,958 – – – – – 11,958<br />

Long-term receivables 16,685 – – – – 72,278 88,963<br />

AFS investments:<br />

Debt investments 341,842 – – – – – 341,842<br />

Equity investments 407,242 – – – – – 407,242<br />

<strong>Financial</strong> asset at FVPL<br />

Derivative assets 7,547 – – – – – 7,547<br />

Derivative assets<br />

designated as cash<br />

flow hedges: 53,583 – – – – – 53,583<br />

Total ₱20,274,817 ₱17,048 ₱85,895 ₱19 ₱– ₱163,427 ₱20,541,206<br />

Total<br />

107