2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EDC <strong>2014</strong> Performance Report<br />

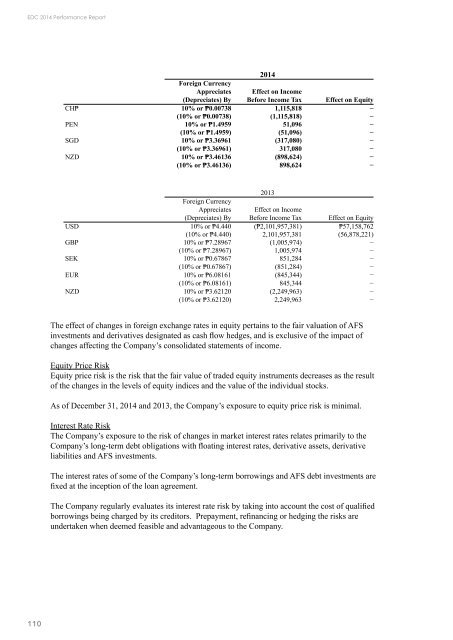

<strong>2014</strong><br />

Foreign Currency<br />

Appreciates<br />

(Depreciates) By<br />

Effect on Income<br />

Before Income Tax Effect on Equity<br />

CH₱ 10% or ₱0.00738 1,115,818 −<br />

(10% or ₱0.00738) (1,115,818) −<br />

PEN 10% or ₱1.4959 51,096 −<br />

(10% or ₱1.4959) (51,096) −<br />

SGD 10% or ₱3.36961 (317,080) −<br />

(10% or ₱3.36961) 317,080 −<br />

NZD 10% or ₱3.46136 (898,624) −<br />

(10% or ₱3.46136) 898,624 −<br />

2013<br />

Foreign Currency<br />

Appreciates<br />

(Depreciates) By<br />

Effect on Income<br />

Before Income Tax Effect on Equity<br />

USD 10% or ₱4.440 (₱2,101,957,381) ₱57,158,762<br />

(10% or ₱4.440) 2,101,957,381 (56,878,221)<br />

GBP 10% or ₱7.28967 (1,005,974) −<br />

(10% or ₱7.28967) 1,005,974 −<br />

SEK 10% or ₱0.67867 851,284 −<br />

(10% or ₱0.67867) (851,284) −<br />

EUR 10% or ₱6.08161 (845,344) −<br />

(10% or ₱6.08161) 845,344 −<br />

NZD 10% or ₱3.62120 (2,249,963) −<br />

(10% or ₱3.62120) 2,249,963 −<br />

The effect of changes in foreign exchange rates in equity pertains to the fair valuation of AFS<br />

investments and derivatives designated as cash flow hedges, and is exclusive of the impact of<br />

changes affecting the Company’s consolidated statements of income.<br />

Equity Price Risk<br />

Equity price risk is the risk that the fair value of traded equity instruments decreases as the result<br />

of the changes in the levels of equity indices and the value of the individual stocks.<br />

As of December 31, <strong>2014</strong> and 2013, the Company’s exposure to equity price risk is minimal.<br />

Interest Rate Risk<br />

The Company’s exposure to the risk of changes in market interest rates relates primarily to the<br />

Company’s long-term debt obligations with floating interest rates, derivative assets, derivative<br />

liabilities and AFS investments.<br />

The interest rates of some of the Company’s long-term borrowings and AFS debt investments are<br />

fixed at the inception of the loan agreement.<br />

The Company regularly evaluates its interest rate risk by taking into account the cost of qualified<br />

borrowings being charged by its creditors. Prepayment, refinancing or hedging the risks are<br />

undertaken when deemed feasible and advantageous to the Company.<br />

110