2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

26.<br />

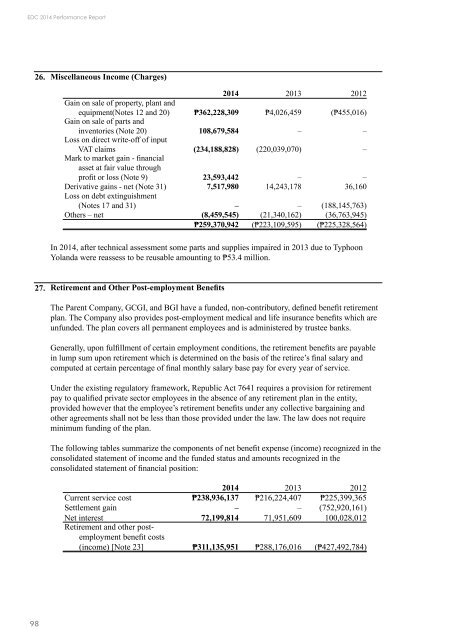

Miscellaneous Income (Charges)<br />

<strong>2014</strong> 2013 2012<br />

Gain on sale of property, plant and<br />

equipment(Notes 12 and 20) ₱362,228,309 ₱4,026,459 (₱455,016)<br />

Gain on sale of parts and<br />

inventories (Note 20) 108,679,584 – –<br />

Loss on direct write-off of input<br />

VAT claims (234,188,828) (220,039,070) –<br />

Mark to market gain - financial<br />

asset at fair value through<br />

profit or loss (Note 9) 23,593,442 – –<br />

Derivative gains - net (Note 31) 7,517,980 14,243,178 36,160<br />

Loss on debt extinguishment<br />

(Notes 17 and 31) – – (188,145,763)<br />

Others – net (8,459,545) (21,340,162) (36,763,945)<br />

₱259,370,942 (₱223,109,595) (₱225,328,564)<br />

In <strong>2014</strong>, after technical assessment some parts and supplies impaired in 2013 due to Typhoon<br />

Yolanda were reassess to be reusable amounting to ₱53.4 million.<br />

27.<br />

Retirement and Other Post-employment Benefits<br />

The Parent Company, GCGI, and BGI have a funded, non-contributory, defined benefit retirement<br />

plan. The Company also provides post-employment medical and life insurance benefits which are<br />

unfunded. The plan covers all permanent employees and is administered by trustee banks.<br />

Generally, upon fulfillment of certain employment conditions, the retirement benefits are payable<br />

in lump sum upon retirement which is determined on the basis of the retiree’s final salary and<br />

computed at certain percentage of final monthly salary base pay for every year of service.<br />

Under the existing regulatory framework, Republic Act 7641 requires a provision for retirement<br />

pay to qualified private sector employees in the absence of any retirement plan in the entity,<br />

provided however that the employee’s retirement benefits under any collective bargaining and<br />

other agreements shall not be less than those provided under the law. The law does not require<br />

minimum funding of the plan.<br />

The following tables summarize the components of net benefit expense (income) recognized in the<br />

consolidated statement of income and the funded status and amounts recognized in the<br />

consolidated statement of financial position:<br />

<strong>2014</strong> 2013 2012<br />

Current service cost ₱238,936,137 ₱216,224,407 ₱225,399,365<br />

Settlement gain – – (752,920,161)<br />

Net interest 72,199,814 71,951,609 100,028,012<br />

Retirement and other postemployment<br />

benefit costs<br />

(income) [Note 23] ₱311,135,951 ₱288,176,016 (₱427,492,784)<br />

98