2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDC <strong>2014</strong> Performance Report<br />

Interest on liability from litigation<br />

Interest on liability from litigation is related to land expropriation cases (see Note 3).<br />

Interest accretion of “Day 1” gain<br />

Interest accretion of “Day 1” gain arose from deferred royalty fee payable. Prior to the<br />

implementation of the RE Law, the Parent Company’s service contracts with the DOE under<br />

P.D. 1442 granted the Parent Company the right to explore, development, and utilize the country’s<br />

geothermal resources subject to sharing of net proceeds with the Government. The 60%<br />

government share is comprised of royalty fees and income taxes. The royalty fees are shared by<br />

the Government through DOE (60%) and the LGUs (40%).<br />

On July 8, 2009, the Parent Company negotiated with the DOE for the payment of deferred<br />

royalty due to DOE amounting to ₱1.4 billion covering the period from 1989 to 2008. As agreed<br />

with the DOE, the Parent Company will settle the deferred royalty fee for four years with a<br />

quarterly amortization of ₱87.5 million or an annual payment of ₱350.0 million. In accordance<br />

with PAS 39, “Day 1” gain amounting to ₱168.3 million was recognized for the difference<br />

between the nominal/maturity value and present value of the royalty fee payable. Subsequent to<br />

initial recognition, royalty fee payable is accreted to its maturity value based on the effective<br />

interest rate determined on Day 1.<br />

In 2012, the deferred royalty fee had been paid in full.<br />

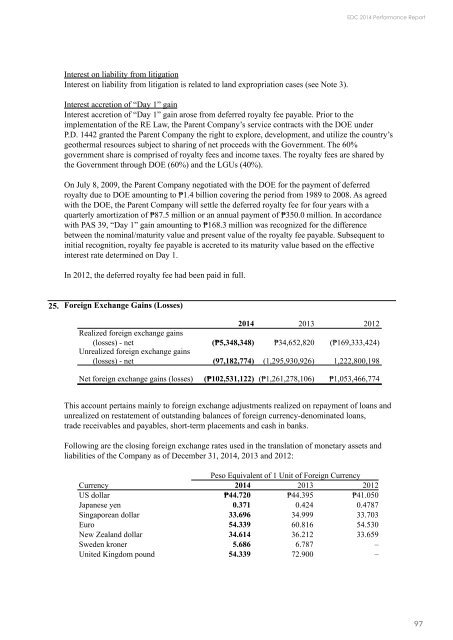

25.<br />

Foreign Exchange Gains (Losses)<br />

<strong>2014</strong> 2013 2012<br />

Realized foreign exchange gains<br />

(losses) - net (₱5,348,348) ₱34,652,820 (₱169,333,424)<br />

Unrealized foreign exchange gains<br />

(losses) - net (97,182,774) (1,295,930,926) 1,222,800,198<br />

Net foreign exchange gains (losses) (₱102,531,122) (₱1,261,278,106) ₱1,053,466,774<br />

This account pertains mainly to foreign exchange adjustments realized on repayment of loans and<br />

unrealized on restatement of outstanding balances of foreign currency-denominated loans,<br />

trade receivables and payables, short-term placements and cash in banks.<br />

Following are the closing foreign exchange rates used in the translation of monetary assets and<br />

liabilities of the Company as of December 31, <strong>2014</strong>, 2013 and 2012:<br />

Peso Equivalent of 1 Unit of Foreign Currency<br />

Currency <strong>2014</strong> 2013 2012<br />

US dollar ₱44.720 ₱44.395 ₱41.050<br />

Japanese yen 0.371 0.424 0.4787<br />

Singaporean dollar 33.696 34.999 33.703<br />

Euro 54.339 60.816 54.530<br />

New Zealand dollar 34.614 36.212 33.659<br />

Sweden kroner 5.686 6.787 –<br />

United Kingdom pound 54.339 72.900 –<br />

97