2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EDC <strong>2014</strong> Performance Report<br />

<strong>2014</strong> 2013 2012<br />

Effect on Profit<br />

or Loss<br />

Effect<br />

on Equity<br />

Effect on<br />

Profit or Loss<br />

Effect<br />

on Equity<br />

Effect on<br />

Profit or Loss<br />

Effect<br />

on Equity<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

<strong>Financial</strong> assets at FVPL<br />

Net fair value changes of<br />

forward contracts ₱7,517,980 ₱− ₱14,243,178 ₱− (₱4,131,240) ₱–<br />

Derivatives designated as cash<br />

flow hedges<br />

Cumulative translation<br />

adjustment ₱– (₱122,566,454) ₱– ₱88,810,758 ₱– (₱144,426,476)<br />

<strong>Financial</strong> liabilities at<br />

amortized cost<br />

Interest expense on (Note 24):<br />

Long-term debts, including<br />

amortization of<br />

transaction costs (₱3,713,109,302) ₱– (₱3,352,638,769) ₱– (₱3,656,390,728) ₱–<br />

Royalty fee payable – – – – (10,945,030) –<br />

Loan payable and others – – – – (59,822) –<br />

Loss on extinguishment of debt<br />

(Note 26) – – – – (188,145,763) –<br />

(₱3,713,109,302) ₱– (₱3,352,638,769) ₱– (₱3,855,541,343) ₱–<br />

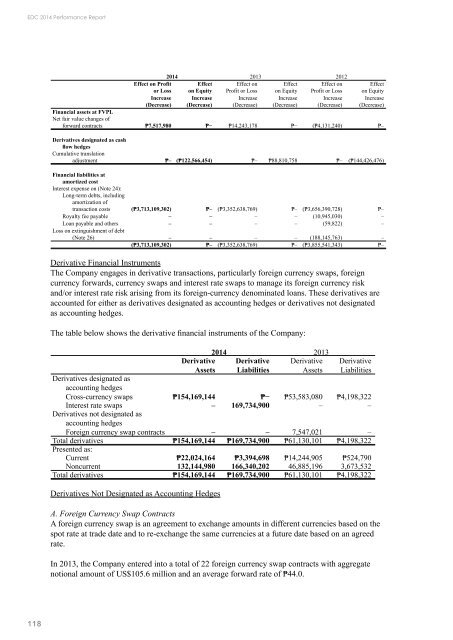

Derivative <strong>Financial</strong> Instruments<br />

The Company engages in derivative transactions, particularly foreign currency swaps, foreign<br />

currency forwards, currency swaps and interest rate swaps to manage its foreign currency risk<br />

and/or interest rate risk arising from its foreign-currency denominated loans. These derivatives are<br />

accounted for either as derivatives designated as accounting hedges or derivatives not designated<br />

as accounting hedges.<br />

The table below shows the derivative financial instruments of the Company:<br />

Derivative<br />

Assets<br />

Derivatives Not Designated as Accounting Hedges<br />

<strong>2014</strong> 2013<br />

Derivative Derivative<br />

Liabilities Assets<br />

Derivative<br />

Liabilities<br />

Derivatives designated as<br />

accounting hedges<br />

Cross-currency swaps ₱154,169,144 ₱− ₱53,583,080 ₱4,198,322<br />

Interest rate swaps – 169,734,900 – –<br />

Derivatives not designated as<br />

accounting hedges<br />

Foreign currency swap contracts – – 7,547,021 –<br />

Total derivatives ₱154,169,144 ₱169,734,900 ₱61,130,101 ₱4,198,322<br />

Presented as:<br />

Current ₱22,024,164 ₱3,394,698 ₱14,244,905 ₱524,790<br />

Noncurrent 132,144,980 166,340,202 46,885,196 3,673,532<br />

Total derivatives ₱154,169,144 ₱169,734,900 ₱61,130,101 ₱4,198,322<br />

A. Foreign Currency Swap Contracts<br />

A foreign currency swap is an agreement to exchange amounts in different currencies based on the<br />

spot rate at trade date and to re-exchange the same currencies at a future date based on an agreed<br />

rate.<br />

In 2013, the Company entered into a total of 22 foreign currency swap contracts with aggregate<br />

notional amount of US$105.6 million and an average forward rate of ₱44.0.<br />

118