2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

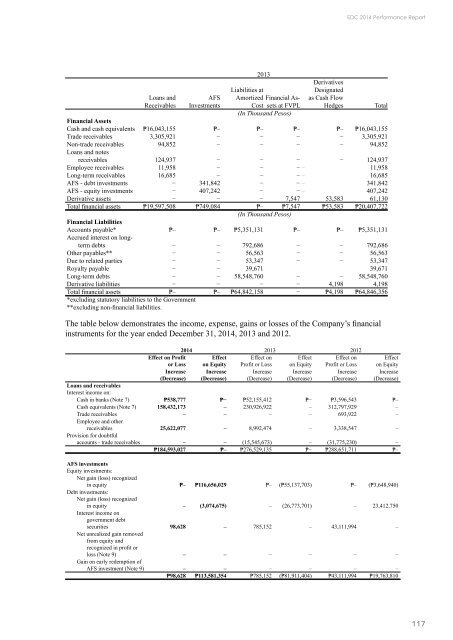

EDC <strong>2014</strong> Performance Report<br />

2013<br />

Derivatives<br />

Loans and<br />

AFS<br />

Liabilities at<br />

Amortized <strong>Financial</strong> Assets<br />

Designated<br />

as Cash Flow<br />

Receivables Investments Cost<br />

at FVPL Hedges Total<br />

(In Thousand Pesos)<br />

<strong>Financial</strong> Assets<br />

Cash and cash equivalents ₱16,043,155 ₱– ₱– ₱– ₱– ₱16,043,155<br />

Trade receivables 3,305,921 − − − − 3,305,921<br />

Non-trade receivables 94,852 − − − − 94,852<br />

Loans and notes<br />

receivables 124,937 − − − − 124,937<br />

Employee receivables 11,958 − − − − 11,958<br />

Long-term receivables 16,685 − − − − 16,685<br />

AFS - debt investments − 341,842 − − − 341,842<br />

AFS - equity investments − 407,242 − − − 407,242<br />

Derivative assets − − − 7,547 53,583 61,130<br />

Total financial assets ₱19,597,508 ₱749,084 ₱– ₱7,547 ₱53,583 ₱20,407,722<br />

(In Thousand Pesos)<br />

<strong>Financial</strong> Liabilities<br />

Accounts payable* ₱– ₱– ₱5,351,131 ₱– ₱– ₱5,351,131<br />

Accrued interest on longterm<br />

debts − − 792,686 − − 792,686<br />

Other payables** − − 56,563 − − 56,563<br />

Due to related parties − − 53,347 − − 53,347<br />

Royalty payable − − 39,671 39,671<br />

Long-term debts − − 58,548,760 − − 58,548,760<br />

Derivative liabilities − − − − 4,198 4,198<br />

Total financial assets ₱– ₱– ₱64,842,158 − ₱4,198 ₱64,846,356<br />

*excluding statutory liabilities to the Government<br />

**excluding non-financial liabilities.<br />

The table below demonstrates the income, expense, gains or losses of the Company’s financial<br />

instruments for the year ended December 31, <strong>2014</strong>, 2013 and 2012.<br />

<strong>2014</strong> 2013 2012<br />

Effect on Profit<br />

or Loss<br />

Effect<br />

on Equity<br />

Effect on<br />

Profit or Loss<br />

Effect<br />

on Equity<br />

Effect on<br />

Profit or Loss<br />

Effect<br />

on Equity<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Increase<br />

(Decrease)<br />

Loans and receivables<br />

Interest income on:<br />

Cash in banks (Note 7) ₱538,777 ₱− ₱52,155,412 ₱− ₱3,596,543 ₱–<br />

Cash equivalents (Note 7) 158,432,173 – 230,926,922 – 312,797,929 –<br />

Trade receivables – – – – 693,922 –<br />

Employee and other<br />

receivables 25,622,077 – 8,992,474 – 3,338,547 –<br />

Provision for doubtful<br />

accounts - trade receivables – – (15,545,673) – (31,775,230) –<br />

₱184,593,027 ₱– ₱276,529,135 ₱− ₱288,651,711 ₱–<br />

AFS investments<br />

Equity investments:<br />

Net gain (loss) recognized<br />

in equity ₱– ₱116,656,029 ₱– (₱55,137,703) ₱– (₱3,648,940)<br />

Debt investments:<br />

Net gain (loss) recognized<br />

in equity – (3,074,675) – (26,773,701) – 23,412,750<br />

Interest income on<br />

government debt<br />

securities 98,628 – 785,152 – 43,111,994 –<br />

Net unrealized gain removed<br />

from equity and<br />

recognized in profit or<br />

loss (Note 9) – – – – – –<br />

Gain on early redemption of<br />

AFS investment (Note 9) – – – – – –<br />

₱98,628 ₱113,581,354 ₱785,152 (₱81,911,404) ₱43,111,994 ₱19,763,810<br />

117