2014 Financial Statement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EDC <strong>2014</strong> Performance Report<br />

Liquidity Risk<br />

The Company’s objective is to maintain a balance between continuity of funding and sourcing<br />

flexibility through the use of available financial instruments. The Company manages its liquidity<br />

profile to meet its working and capital expenditure requirements and service debt obligations. As<br />

part of the liquidity risk management program, the Company regularly evaluates and considers the<br />

maturity of both its financial investments and financial assets (e.g. trade receivables, other<br />

financial assets) and resorts to short-term borrowings whenever its available cash or matured<br />

placements is not enough to meet its daily working capital requirements. To ensure immediate<br />

availability of short-term borrowings, the Company maintains credit lines with banks on a<br />

continuing basis.<br />

Liquidity risk arises primarily when the Company has difficulty collecting its receivables from its<br />

major customer, NPC. Other instances that contribute to its exposure to liquidity risk are when the<br />

Company finances long-term projects with internal cash generation and when there is credit<br />

crunch especially at times when the company has temporary funding gaps.<br />

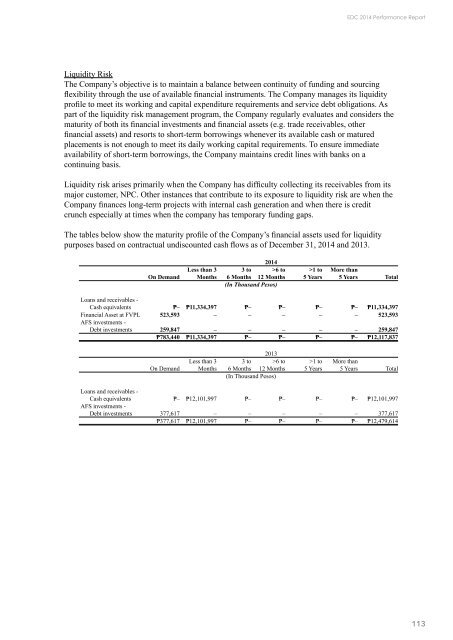

The tables below show the maturity profile of the Company’s financial assets used for liquidity<br />

purposes based on contractual undiscounted cash flows as of December 31, <strong>2014</strong> and 2013.<br />

On Demand<br />

Less than 3<br />

Months<br />

<strong>2014</strong><br />

3 to >6 to<br />

6 Months 12 Months<br />

(In Thousand Pesos)<br />

>1 to<br />

5 Years<br />

More than<br />

5 Years Total<br />

Loans and receivables -<br />

Cash equivalents ₱– ₱11,334,397 ₱– ₱– ₱– ₱– ₱11,334,397<br />

<strong>Financial</strong> Asset at FVPL 523,593 – – – – – 523,593<br />

AFS investments -<br />

Debt investments 259,847 – – – – – 259,847<br />

₱783,440 ₱11,334,397 ₱– ₱– ₱– ₱– ₱12,117,837<br />

On Demand<br />

Less than 3<br />

Months<br />

2013<br />

3 to >6 to<br />

6 Months 12 Months<br />

(In Thousand Pesos)<br />

>1 to<br />

5 Years<br />

More than<br />

5 Years Total<br />

Loans and receivables -<br />

Cash equivalents ₱– ₱12,101,997 ₱– ₱– ₱– ₱– ₱12,101,997<br />

AFS investments -<br />

Debt investments 377,617 – – – – – 377,617<br />

₱377,617 ₱12,101,997 ₱– ₱– ₱– ₱– ₱12,479,614<br />

113