ASQ7 EN (20170705)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INDUSTRY INSIGHTS<br />

FACTORS IMPACTING BUSINESS<br />

AVIATION AIRPORT INFRASTRUCTURE<br />

Contributed by Aviation Consultant, David Best<br />

According to the International Air Transport Association (IATA), “the complex problem of traffic peaking at<br />

airports has been the subject of increasing concern for airlines and airport operators around the world.”<br />

With passenger traffic expected to double over the next 20 years, the issue of aviation infrastructure<br />

has been forced into the spotlight. As aviation infrastructure already struggles to handle the increasing demand,<br />

the challenge now is to identify the weak points and move forward productively.<br />

Infrastructure in Asia Pacific<br />

Within the Asia-Pacific region we have some great facilities where<br />

investment has been made or is growing, but in many cases the<br />

infrastructure demands and expertise are focused around growing<br />

capacity for the needs of commercial aviation traffic growth. Dedicated<br />

facilities like Seletar in Singapore and Subang in Malaysia are seeing<br />

investment in MRO and FBO facilities in a hub-like basis, while others are<br />

focusing on commercial needs. The commercial aviation demand growth<br />

in Asia has been a huge challenge for airports and freeing up space for<br />

business aviation has mostly taken second place.<br />

The issue with infrastructure is that it is demand push and not pull. By<br />

building great hangars and facilities you will not necessarily get traffic to<br />

come. People own business jets because they want convenience, privacy<br />

and a business tool. That demand therefore usually migrates towards<br />

major cities.<br />

International airports with slot restrictions and high demand on airport<br />

capacity fill this space too, however both sides do not fit together. As you<br />

look across the world, many major international airports have capable<br />

business jet infrastructure but the beneficial investments in the industry<br />

have come at secondary airports located near business centers. A few<br />

examples are Teterboro in New Jersey, Farnborough in London and Le<br />

Bourget in Paris.<br />

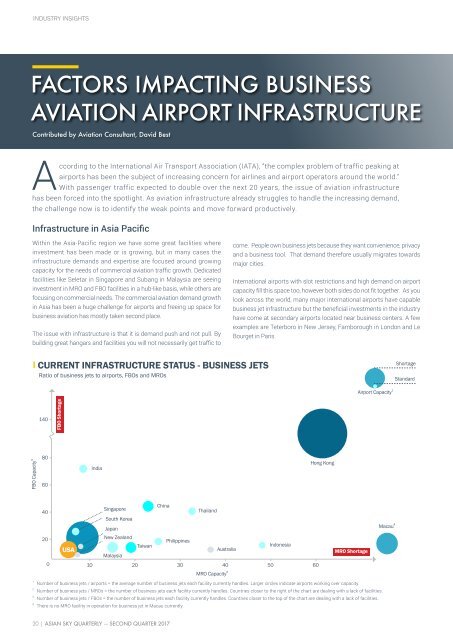

CURR<strong>EN</strong>T INFRASTRUCTURE STATUS - BUSINESS JETS<br />

Ratio of business jets to airports, FBOs and MROs<br />

Shortage<br />

Airport Capacity 1 Standard<br />

140<br />

FBO Shortage<br />

FBO Capacity 3<br />

80<br />

60<br />

India<br />

Hong Kong<br />

40<br />

Singapore<br />

South Korea<br />

Japan<br />

China<br />

Thailand<br />

Macau 4<br />

20<br />

USA<br />

New Zealand<br />

Malaysia<br />

Taiwan<br />

Philippines<br />

Australia<br />

Indonesia<br />

MRO Shortage<br />

0<br />

10 20 30 40 50 60<br />

MRO Capacity 2<br />

1<br />

Number of business jets / airports = the average number of business jets each facility currently handles. Larger circles indicate airports working over capacity.<br />

2<br />

Number of business jets / MROs = the number of business jets each facility currently handles. Countries closer to the right of the chart are dealing with a lack of facilities.<br />

3<br />

4<br />

Number of business jets / FBOs = the number of business jets each facility currently handles. Countries closer to the top of the chart are dealing with a lack of facilities.<br />

There is no MRO facility in operation for business jet in Macau currently.<br />

20 | ASIAN SKY QUARTERLY — SECOND QUARTER 2017