Hotel & Tourism SMARTreport #35

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INNOVATIONS & TECHNOLOGIES<br />

APAC CONTINUES TO LEAD<br />

THE PUSH TOWARDS<br />

A COMPLETELY MOBILE<br />

TRAVELLER LIFE CYCLE<br />

It’s no surprise that global travel companies<br />

continue to focus on mobile growth in<br />

Asia Pacific (APAC). With high Internet<br />

and mobile penetration, travelers in<br />

APAC expect faster and easier access to<br />

travel, without being bogged down by<br />

traditional payment methods. Unique<br />

market dynamics force travel companies<br />

to adopt local strategies that don’t work<br />

anywhere else. Let’s take a look at why<br />

APAC continues to lead the push towards<br />

a completely mobile traveller life cycle.<br />

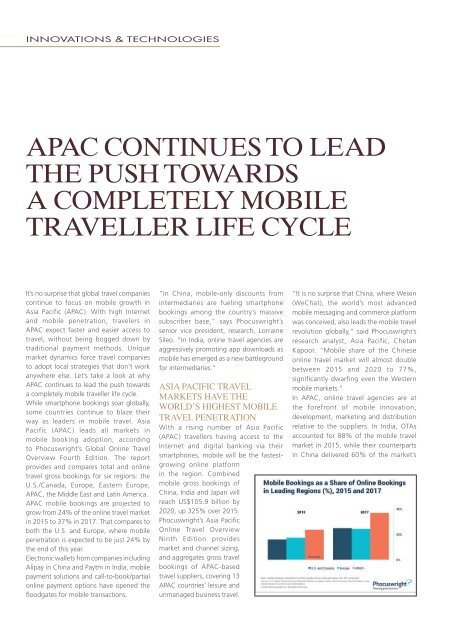

While smartphone bookings soar globally,<br />

some countries continue to blaze their<br />

way as leaders in mobile travel. Asia<br />

Pacific (APAC) leads all markets in<br />

mobile booking adoption, according<br />

to Phocuswright’s Global Online Travel<br />

Overview Fourth Edition. The report<br />

provides and compares total and online<br />

travel gross bookings for six regions: the<br />

U.S./Canada, Europe, Eastern Europe,<br />

APAC, the Middle East and Latin America.<br />

APAC mobile bookings are projected to<br />

grow from 24% of the online travel market<br />

in 2015 to 37% in 2017. That compares to<br />

both the U.S. and Europe, where mobile<br />

penetration is expected to be just 24% by<br />

the end of this year.<br />

Electronic wallets from companies including<br />

Alipay in China and Paytm in India, mobile<br />

payment solutions and call-to-book/partial<br />

online payment options have opened the<br />

floodgates for mobile transactions.<br />

“In China, mobile-only discounts from<br />

intermediaries are fueling smartphone<br />

bookings among the country’s massive<br />

subscriber base,” says Phocuswright’s<br />

senior vice president, research, Lorraine<br />

Sileo. “In India, online travel agencies are<br />

aggressively promoting app downloads as<br />

mobile has emerged as a new battleground<br />

for intermediaries.”<br />

ASIA PACIFIC TRAVEL<br />

MARKETS HAVE THE<br />

WORLD’S HIGHEST MOBILE<br />

TRAVEL PENETRATION<br />

With a rising number of Asia Pacific<br />

(APAC) travellers having access to the<br />

Internet and digital banking via their<br />

smartphones, mobile will be the fastestgrowing<br />

online platform<br />

in the region. Combined<br />

mobile gross bookings of<br />

China, India and Japan will<br />

reach US$105.9 billion by<br />

2020, up 325% over 2015.<br />

Phocuswright’s Asia Pacific<br />

Online Travel Overview<br />

Ninth Edition provides<br />

market and channel sizing,<br />

and aggregates gross travel<br />

bookings of APAC-based<br />

travel suppliers, covering 13<br />

APAC countries’ leisure and<br />

unmanaged business travel.<br />

“It is no surprise that China, where Weixin<br />

(WeChat), the world’s most advanced<br />

mobile messaging and commerce platform<br />

was conceived, also leads the mobile travel<br />

revolution globally,” said Phocuswright’s<br />

research analyst, Asia Pacific, Chetan<br />

Kapoor. “Mobile share of the Chinese<br />

online travel market will almost double<br />

between 2015 and 2020 to 77%,<br />

significantly dwarfing even the Western<br />

mobile markets.”<br />

In APAC, online travel agencies are at<br />

the forefront of mobile innovation,<br />

development, marketing and distribution<br />

relative to the suppliers. In India, OTAs<br />

accounted for 88% of the mobile travel<br />

market in 2015, while their counterparts<br />

in China delivered 60% of the market’s