Destination Nevada County

Premium visitors magazine for Nevada County produced by the Grass Valley Chamber of Commerce

Premium visitors magazine for Nevada County produced by the Grass Valley Chamber of Commerce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

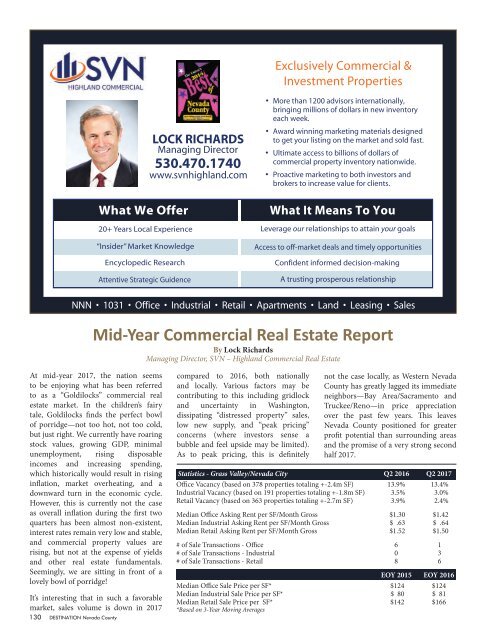

Exclusively Commercial &<br />

Investment Properties<br />

What We Offer<br />

20+ Years Local Experience<br />

“Insider” Market Knowledge<br />

Encyclopedic Research<br />

Attentive Strategic Guidence<br />

LOCK RICHARDS<br />

Managing Director<br />

530.470.1740<br />

www.svnhighland.com<br />

More than 1200 advisors internationally,<br />

bringing millions of dollars in new inventory<br />

each week.<br />

Award winning marketing materials designed<br />

to get your listing on the market and sold fast.<br />

Ultimate access to billions of dollars of<br />

commercial property inventory nationwide.<br />

Proactive marketing to both investors and<br />

brokers to increase value for clients.<br />

What It Means To You<br />

Leverage our relationships to attain your goals<br />

Access to off-market deals and timely opportunities<br />

Confident informed decision-making<br />

A trusting prosperous relationship<br />

NNN • 1031 • Office • Industrial • Retail • Apartments • Land • Leasing • Sales<br />

Mid-Year Commercial Real Estate Report<br />

By Lock Richards<br />

Managing Director, SVN – Highland Commercial Real Estate<br />

At mid-year 2017, the nation seems<br />

to be enjoying what has been referred<br />

to as a “Goldilocks” commercial real<br />

estate market. In the children’s fairy<br />

tale, Goldilocks finds the perfect bowl<br />

of porridge—not too hot, not too cold,<br />

but just right. We currently have roaring<br />

stock values, growing GDP, minimal<br />

unemployment, rising disposable<br />

incomes and increasing spending,<br />

which historically would result in rising<br />

inflation, market overheating, and a<br />

downward turn in the economic cycle.<br />

However, this is currently not the case<br />

as overall inflation during the first two<br />

quarters has been almost non-existent,<br />

interest rates remain very low and stable,<br />

and commercial property values are<br />

rising, but not at the expense of yields<br />

and other real estate fundamentals.<br />

Seemingly, we are sitting in front of a<br />

lovely bowl of porridge!<br />

It’s interesting that in such a favorable<br />

market, sales volume is down in 2017<br />

130 DESTINATION <strong>Nevada</strong> <strong>County</strong><br />

compared to 2016, both nationally<br />

and locally. Various factors may be<br />

contributing to this including gridlock<br />

and uncertainty in Washington,<br />

dissipating “distressed property” sales,<br />

low new supply, and “peak pricing”<br />

concerns (where investors sense a<br />

bubble and feel upside may be limited).<br />

As to peak pricing, this is definitely<br />

not the case locally, as Western <strong>Nevada</strong><br />

<strong>County</strong> has greatly lagged its immediate<br />

neighbors—Bay Area/Sacramento and<br />

Truckee/Reno—in price appreciation<br />

over the past few years. This leaves<br />

<strong>Nevada</strong> <strong>County</strong> positioned for greater<br />

profit potential than surrounding areas<br />

and the promise of a very strong second<br />

half 2017.<br />

Statistics - Grass Valley/<strong>Nevada</strong> City Q2 2016 Q2 2017<br />

Office Vacancy (based on 378 properties totaling +-2.4m SF) 13.9% 13.4%<br />

Industrial Vacancy (based on 191 properties totaling +-1.8m SF) 3.5% 3.0%<br />

Retail Vacancy (based on 363 properties totaling +-2.7m SF) 3.9% 2.4%<br />

Median Office Asking Rent per SF/Month Gross $1.30 $1.42<br />

Median Industrial Asking Rent per SF/Month Gross $ .63 $ .64<br />

Median Retail Asking Rent per SF/Month Gross $1.52 $1.50<br />

# of Sale Transactions - Office 6 1<br />

# of Sale Transactions - Industrial 0 3<br />

# of Sale Transactions - Retail 8 6<br />

EOY 2015 EOY 2016<br />

Median Office Sale Price per SF* $124 $124<br />

Median Industrial Sale Price per SF* $ 80 $ 81<br />

Median Retail Sale Price per SF* $142 $166<br />

*Based on 3-Year Moving Averages