PMR cover.psd - ppiaf

PMR cover.psd - ppiaf

PMR cover.psd - ppiaf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8. PPPs in Infrastructure Resource Center (PPIRC) website ($332,000) 2 : approved on June 24,<br />

2011, this activity will help the PPPs in Infrastructure Resource Center website to enhance its existing<br />

resources—particularly on up-to-date information related to the effects of the global financial crisis on the<br />

PPP contracts. The website, launched in 2009, makes practical PPP infrastructure related resources<br />

publicly available to governments, particularly in the developing world, to assist them with the legal and<br />

contractual issues arising from these complex projects. An assessment of reports, terms of references,<br />

and other relevant references for the website is expected to be completed by May 31, 2012.<br />

II. Country-specific Activities Funded through PPIAF Response to Financial Crisis Non-<br />

Core Trust Fund<br />

In addition to regional activities, PPIAF supported 22 country-specific activities:<br />

1. India: Preparation of a Business Plan for India Infrastructure Finance Company Limited<br />

($218,000): approved on December 1, 2009, this activity aims to help the Infrastructure Finance<br />

Company Limited (IIFCL) update its business plan in the context of market realities following the global<br />

financial and economic slowdown and the PPP financing needs in India. The government of India<br />

established the IIFCL in 2006 under a scheme for financing of infrastructure projects, with a focus on<br />

infrastructure projects domiciled as special purpose vehicles (SPV) and promoted by the private and<br />

public sectors. The IIFCL has been incorporated as a public financial institution designed to borrow in<br />

domestic markets as well as from multilateral financial institutions for on-lending to infrastructure SPV<br />

projects. However, the IIFCL was falling short on capacity in terms of people, processes, and systems for<br />

addressing this rapidly evolving role, which inter alia involves managing complex borrowings from<br />

domestic and international markets and multilateral institutions, and deployment through an increasing<br />

complex set of structures and products. The PPIAF activity aimed at helping the IIFCL to evolve from its<br />

present role, and introduce innovating financing instruments to address the challenge of infrastructure<br />

project financing in India. A market assessment report and business plan for IIFCL was developed in<br />

December 2011 under the PPIAF activity.<br />

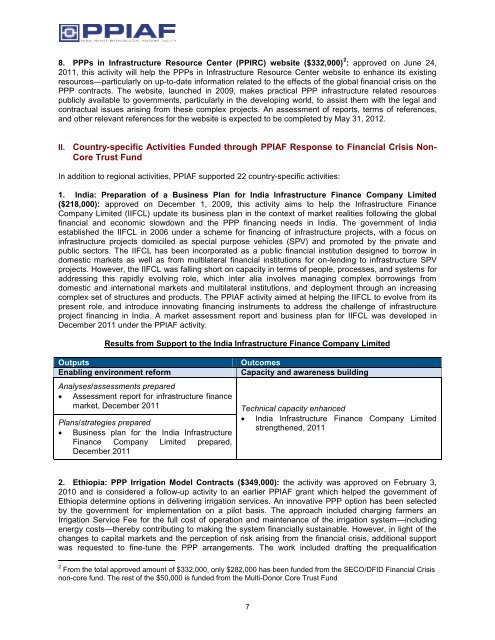

Results from Support to the India Infrastructure Finance Company Limited<br />

Outputs Outcomes<br />

Enabling environment reform Capacity and awareness building<br />

Analyses/assessments prepared<br />

� Assessment report for infrastructure finance<br />

market, December 2011 Technical capacity enhanced<br />

Plans/strategies prepared<br />

� Business plan for the India Infrastructure<br />

Finance Company Limited prepared,<br />

December 2011<br />

� India Infrastructure Finance Company Limited<br />

strengthened, 2011<br />

2. Ethiopia: PPP Irrigation Model Contracts ($349,000): the activity was approved on February 3,<br />

2010 and is considered a follow-up activity to an earlier PPIAF grant which helped the government of<br />

Ethiopia determine options in delivering irrigation services. An innovative PPP option has been selected<br />

by the government for implementation on a pilot basis. The approach included charging farmers an<br />

Irrigation Service Fee for the full cost of operation and maintenance of the irrigation system—including<br />

energy costs—thereby contributing to making the system financially sustainable. However, in light of the<br />

changes to capital markets and the perception of risk arising from the financial crisis, additional support<br />

was requested to fine-tune the PPP arrangements. The work included drafting the prequalification<br />

2 From the total approved amount of $332,000, only $282,000 has been funded from the SECO/DFID Financial Crisis<br />

non-core fund. The rest of the $50,000 is funded from the Multi-Donor Core Trust Fund<br />

7