Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Application <strong>and</strong> Common Errors <strong>in</strong> <strong>Fibonacci</strong> Fanl<strong>in</strong>es 99<br />

Figure 6.28<br />

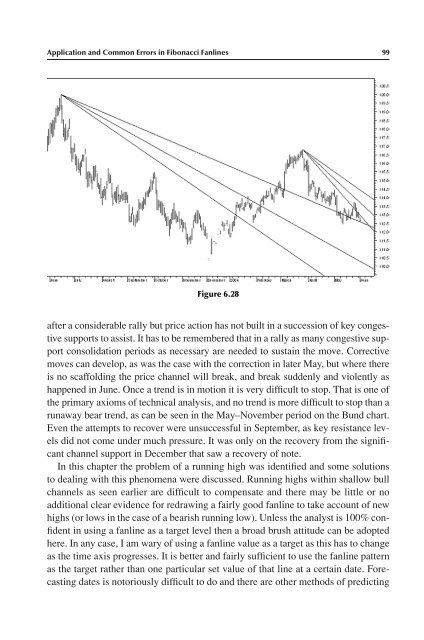

after a considerable rally but price action has not built <strong>in</strong> a succession of key congestive<br />

supports to assist. It has to be remembered that <strong>in</strong> a rally as many congestive support<br />

consolidation periods as necessary are needed to susta<strong>in</strong> the move. Corrective<br />

moves can develop, as was the case with the correction <strong>in</strong> later May, but where there<br />

is no scaffold<strong>in</strong>g the price channel will break, <strong>and</strong> break suddenly <strong>and</strong> violently as<br />

happened <strong>in</strong> June. Once a trend is <strong>in</strong> motion it is very difficult to stop. That is one of<br />

the primary axioms of technical analysis, <strong>and</strong> no trend is more difficult to stop than a<br />

runaway bear trend, as can be seen <strong>in</strong> the May–November period on the Bund chart.<br />

Even the attempts to recover were unsuccessful <strong>in</strong> September, as key resistance levels<br />

did not come under much pressure. It was only on the recovery from the significant<br />

channel support <strong>in</strong> December that saw a recovery of note.<br />

In this chapter the problem of a runn<strong>in</strong>g high was identified <strong>and</strong> some solutions<br />

to deal<strong>in</strong>g with this phenomena were discussed. Runn<strong>in</strong>g highs with<strong>in</strong> shallow bull<br />

channels as seen earlier are difficult to compensate <strong>and</strong> there may be little or no<br />

additional clear evidence for redraw<strong>in</strong>g a fairly good fanl<strong>in</strong>e to take account of new<br />

highs (or lows <strong>in</strong> the case of a bearish runn<strong>in</strong>g low). Unless the analyst is 100% confident<br />

<strong>in</strong> us<strong>in</strong>g a fanl<strong>in</strong>e as a target level then a broad brush attitude can be adopted<br />

here. In any case, I am wary of us<strong>in</strong>g a fanl<strong>in</strong>e value as a target as this has to change<br />

as the time axis progresses. It is better <strong>and</strong> fairly sufficient to use the fanl<strong>in</strong>e pattern<br />

as the target rather than one particular set value of that l<strong>in</strong>e at a certa<strong>in</strong> date. Forecast<strong>in</strong>g<br />

dates is notoriously difficult to do <strong>and</strong> there are other methods of predict<strong>in</strong>g