Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

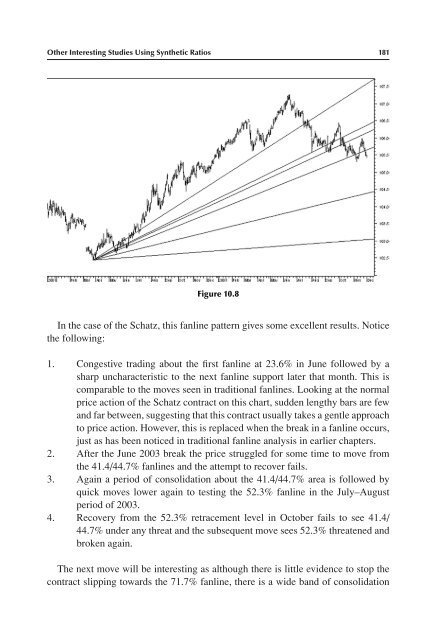

Other Interest<strong>in</strong>g Studies Us<strong>in</strong>g Synthetic Ratios 181<br />

Figure 10.8<br />

In the case of the Schatz, this fanl<strong>in</strong>e pattern gives some excellent results. Notice<br />

the follow<strong>in</strong>g:<br />

1. Congestive trad<strong>in</strong>g about the first fanl<strong>in</strong>e at 23.6% <strong>in</strong> June followed by a<br />

sharp uncharacteristic to the next fanl<strong>in</strong>e support later that month. This is<br />

comparable to the moves seen <strong>in</strong> traditional fanl<strong>in</strong>es. Look<strong>in</strong>g at the normal<br />

price action of the Schatz contract on this chart, sudden lengthy bars are few<br />

<strong>and</strong> far between, suggest<strong>in</strong>g that this contract usually takes a gentle approach<br />

to price action. However, this is replaced when the break <strong>in</strong> a fanl<strong>in</strong>e occurs,<br />

just as has been noticed <strong>in</strong> traditional fanl<strong>in</strong>e analysis <strong>in</strong> earlier chapters.<br />

2. After the June 2003 break the price struggled for some time to move from<br />

the 41.4/44.7% fanl<strong>in</strong>es <strong>and</strong> the attempt to recover fails.<br />

3. Aga<strong>in</strong> a period of consolidation about the 41.4/44.7% area is followed by<br />

quick moves lower aga<strong>in</strong> to test<strong>in</strong>g the 52.3% fanl<strong>in</strong>e <strong>in</strong> the July–August<br />

period of 2003.<br />

4. Recovery from the 52.3% retracement level <strong>in</strong> October fails to see 41.4/<br />

44.7% under any threat <strong>and</strong> the subsequent move sees 52.3% threatened <strong>and</strong><br />

broken aga<strong>in</strong>.<br />

The next move will be <strong>in</strong>terest<strong>in</strong>g as although there is little evidence to stop the<br />

contract slipp<strong>in</strong>g towards the 71.7% fanl<strong>in</strong>e, there is a wide b<strong>and</strong> of consolidation