Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Common Errors <strong>in</strong> Application of <strong>Fibonacci</strong> Retracements <strong>and</strong> Extension 71<br />

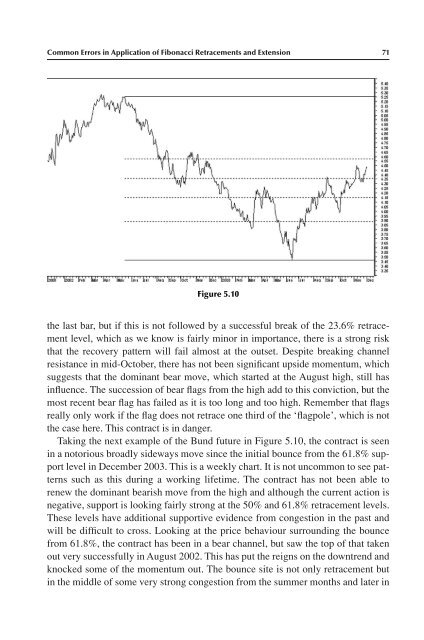

Figure 5.10<br />

the last bar, but if this is not followed by a successful break of the 23.6% retracement<br />

level, which as we know is fairly m<strong>in</strong>or <strong>in</strong> importance, there is a strong risk<br />

that the recovery pattern will fail almost at the outset. Despite break<strong>in</strong>g channel<br />

resistance <strong>in</strong> mid-October, there has not been significant upside momentum, which<br />

suggests that the dom<strong>in</strong>ant bear move, which started at the August high, still has<br />

<strong>in</strong>fluence. The succession of bear flags from the high add to this conviction, but the<br />

most recent bear flag has failed as it is too long <strong>and</strong> too high. Remember that flags<br />

really only work if the flag does not retrace one third of the ‘flagpole’, which is not<br />

the case here. This contract is <strong>in</strong> danger.<br />

Tak<strong>in</strong>g the next example of the Bund future <strong>in</strong> Figure 5.10, the contract is seen<br />

<strong>in</strong> a notorious broadly sideways move s<strong>in</strong>ce the <strong>in</strong>itial bounce from the 61.8% support<br />

level <strong>in</strong> December 2003. This is a weekly chart. It is not uncommon to see patterns<br />

such as this dur<strong>in</strong>g a work<strong>in</strong>g lifetime. The contract has not been able to<br />

renew the dom<strong>in</strong>ant bearish move from the high <strong>and</strong> although the current action is<br />

negative, support is look<strong>in</strong>g fairly strong at the 50% <strong>and</strong> 61.8% retracement levels.<br />

These levels have additional supportive evidence from congestion <strong>in</strong> the past <strong>and</strong><br />

will be difficult to cross. Look<strong>in</strong>g at the price behaviour surround<strong>in</strong>g the bounce<br />

from 61.8%, the contract has been <strong>in</strong> a bear channel, but saw the top of that taken<br />

out very successfully <strong>in</strong> August 2002. This has put the reigns on the downtrend <strong>and</strong><br />

knocked some of the momentum out. The bounce site is not only retracement but<br />

<strong>in</strong> the middle of some very strong congestion from the summer months <strong>and</strong> later <strong>in</strong>