Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Gann</strong>, The Misunderstood Analysis 157<br />

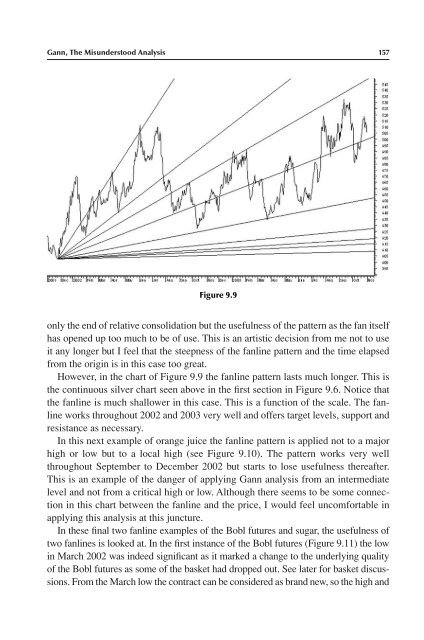

Figure 9.9<br />

only the end of relative consolidation but the usefulness of the pattern as the fan itself<br />

has opened up too much to be of use. This is an artistic decision from me not to use<br />

it any longer but I feel that the steepness of the fanl<strong>in</strong>e pattern <strong>and</strong> the time elapsed<br />

from the orig<strong>in</strong> is <strong>in</strong> this case too great.<br />

However, <strong>in</strong> the chart of Figure 9.9 the fanl<strong>in</strong>e pattern lasts much longer. This is<br />

the cont<strong>in</strong>uous silver chart seen above <strong>in</strong> the first section <strong>in</strong> Figure 9.6. Notice that<br />

the fanl<strong>in</strong>e is much shallower <strong>in</strong> this case. This is a function of the scale. The fanl<strong>in</strong>e<br />

works throughout 2002 <strong>and</strong> 2003 very well <strong>and</strong> offers target levels, support <strong>and</strong><br />

resistance as necessary.<br />

In this next example of orange juice the fanl<strong>in</strong>e pattern is applied not to a major<br />

high or low but to a local high (see Figure 9.10). The pattern works very well<br />

throughout September to December 2002 but starts to lose usefulness thereafter.<br />

This is an example of the danger of apply<strong>in</strong>g <strong>Gann</strong> analysis from an <strong>in</strong>termediate<br />

level <strong>and</strong> not from a critical high or low. Although there seems to be some connection<br />

<strong>in</strong> this chart between the fanl<strong>in</strong>e <strong>and</strong> the price, I would feel uncomfortable <strong>in</strong><br />

apply<strong>in</strong>g this analysis at this juncture.<br />

In these f<strong>in</strong>al two fanl<strong>in</strong>e examples of the Bobl futures <strong>and</strong> sugar, the usefulness of<br />

two fanl<strong>in</strong>es is looked at. In the first <strong>in</strong>stance of the Bobl futures (Figure 9.11) the low<br />

<strong>in</strong> March 2002 was <strong>in</strong>deed significant as it marked a change to the underly<strong>in</strong>g quality<br />

of the Bobl futures as some of the basket had dropped out. See later for basket discussions.<br />

From the March low the contract can be considered as br<strong>and</strong> new, so the high <strong>and</strong>