Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Gann</strong>, The Misunderstood Analysis 171<br />

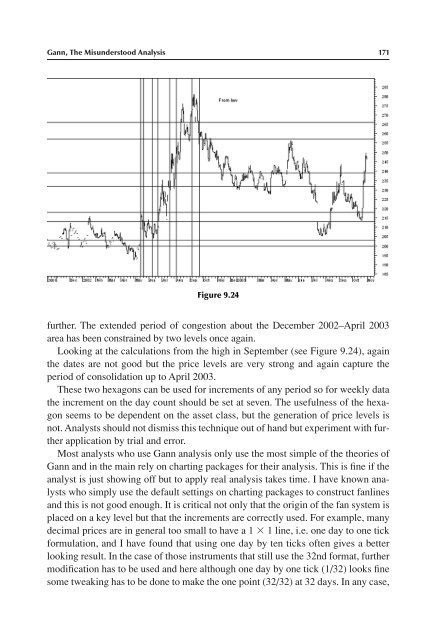

Figure 9.24<br />

further. The extended period of congestion about the December 2002–April 2003<br />

area has been constra<strong>in</strong>ed by two levels once aga<strong>in</strong>.<br />

Look<strong>in</strong>g at the calculations from the high <strong>in</strong> September (see Figure 9.24), aga<strong>in</strong><br />

the dates are not good but the price levels are very strong <strong>and</strong> aga<strong>in</strong> capture the<br />

period of consolidation up to April 2003.<br />

These two hexagons can be used for <strong>in</strong>crements of any period so for weekly data<br />

the <strong>in</strong>crement on the day count should be set at seven. The usefulness of the hexagon<br />

seems to be dependent on the asset class, but the generation of price levels is<br />

not. Analysts should not dismiss this technique out of h<strong>and</strong> but experiment with further<br />

application by trial <strong>and</strong> error.<br />

Most analysts who use <strong>Gann</strong> analysis only use the most simple of the theories of<br />

<strong>Gann</strong> <strong>and</strong> <strong>in</strong> the ma<strong>in</strong> rely on chart<strong>in</strong>g packages for their analysis. This is f<strong>in</strong>e if the<br />

analyst is just show<strong>in</strong>g off but to apply real analysis takes time. I have known analysts<br />

who simply use the default sett<strong>in</strong>gs on chart<strong>in</strong>g packages to construct fanl<strong>in</strong>es<br />

<strong>and</strong> this is not good enough. It is critical not only that the orig<strong>in</strong> of the fan system is<br />

placed on a key level but that the <strong>in</strong>crements are correctly used. For example, many<br />

decimal prices are <strong>in</strong> general too small to have a 1 � 1 l<strong>in</strong>e, i.e. one day to one tick<br />

formulation, <strong>and</strong> I have found that us<strong>in</strong>g one day by ten ticks often gives a better<br />

look<strong>in</strong>g result. In the case of those <strong>in</strong>struments that still use the 32nd format, further<br />

modification has to be used <strong>and</strong> here although one day by one tick (1/32) looks f<strong>in</strong>e<br />

some tweak<strong>in</strong>g has to be done to make the one po<strong>in</strong>t (32/32) at 32 days. In any case,