Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

Fibonacci and Gann Applications in Financial Markets

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Other <strong>Applications</strong> of the <strong>Fibonacci</strong> Retracements <strong>and</strong> Extension 35<br />

Figure 3.6<br />

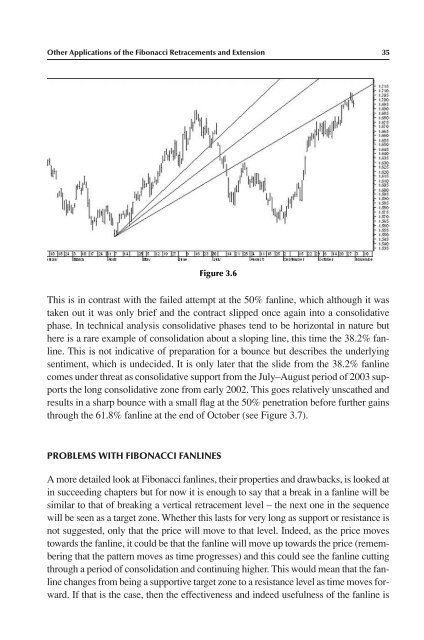

This is <strong>in</strong> contrast with the failed attempt at the 50% fanl<strong>in</strong>e, which although it was<br />

taken out it was only brief <strong>and</strong> the contract slipped once aga<strong>in</strong> <strong>in</strong>to a consolidative<br />

phase. In technical analysis consolidative phases tend to be horizontal <strong>in</strong> nature but<br />

here is a rare example of consolidation about a slop<strong>in</strong>g l<strong>in</strong>e, this time the 38.2% fanl<strong>in</strong>e.<br />

This is not <strong>in</strong>dicative of preparation for a bounce but describes the underly<strong>in</strong>g<br />

sentiment, which is undecided. It is only later that the slide from the 38.2% fanl<strong>in</strong>e<br />

comes under threat as consolidative support from the July–August period of 2003 supports<br />

the long consolidative zone from early 2002. This goes relatively unscathed <strong>and</strong><br />

results <strong>in</strong> a sharp bounce with a small flag at the 50% penetration before further ga<strong>in</strong>s<br />

through the 61.8% fanl<strong>in</strong>e at the end of October (see Figure 3.7).<br />

PROBLEMS WITH FIBONACCI FANLINES<br />

A more detailed look at <strong>Fibonacci</strong> fanl<strong>in</strong>es, their properties <strong>and</strong> drawbacks, is looked at<br />

<strong>in</strong> succeed<strong>in</strong>g chapters but for now it is enough to say that a break <strong>in</strong> a fanl<strong>in</strong>e will be<br />

similar to that of break<strong>in</strong>g a vertical retracement level – the next one <strong>in</strong> the sequence<br />

will be seen as a target zone. Whether this lasts for very long as support or resistance is<br />

not suggested, only that the price will move to that level. Indeed, as the price moves<br />

towards the fanl<strong>in</strong>e, it could be that the fanl<strong>in</strong>e will move up towards the price (remember<strong>in</strong>g<br />

that the pattern moves as time progresses) <strong>and</strong> this could see the fanl<strong>in</strong>e cutt<strong>in</strong>g<br />

through a period of consolidation <strong>and</strong> cont<strong>in</strong>u<strong>in</strong>g higher. This would mean that the fanl<strong>in</strong>e<br />

changes from be<strong>in</strong>g a supportive target zone to a resistance level as time moves forward.<br />

If that is the case, then the effectiveness <strong>and</strong> <strong>in</strong>deed usefulness of the fanl<strong>in</strong>e is