Right time. - Regional Airline Association

Right time. - Regional Airline Association

Right time. - Regional Airline Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL REVIEW<br />

26<br />

<strong>Regional</strong> <strong>Airline</strong>s — Where do we go from here?<br />

By Raymond E. Neidl<br />

Calyon Securities<br />

Consolidation May Be in the Works as the Strong Get Stronger<br />

Overview<br />

Some of the US based regional carriers<br />

with less financial resources are expected<br />

to face an uncertain future as their<br />

customers, the major legacy carriers,<br />

continue to cut costs. Some industry<br />

observers have expressed that margins<br />

may come down to as low as 5 or 6<br />

percent. While we believe there will be<br />

continuing pressures on margins, we do<br />

not expect that industry margins will be<br />

cut to those levels, but we believe that the<br />

regional partners will have to take on<br />

more risk such as aircraft ownership. The<br />

regional feeders are too important to the<br />

legacy carriers and despite sharp costcutting;<br />

the regional’s can still do the job<br />

more economically. The legacy carriers will<br />

not kill the “goose that lays the golden<br />

eggs for them.” If margins are reduced to<br />

mid-single digit, the regionals would not<br />

be able to raise capital.<br />

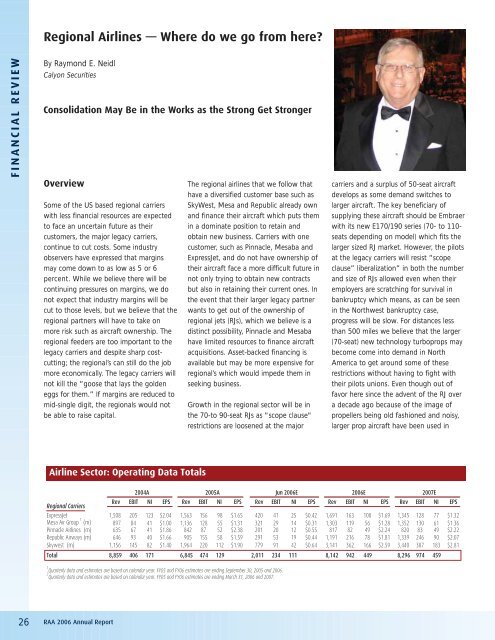

<strong>Airline</strong> Sector: Operating Data Totals<br />

RAA 2006 Annual Report<br />

The regional airlines that we follow that<br />

have a diversified customer base such as<br />

SkyWest, Mesa and Republic already own<br />

and finance their aircraft which puts them<br />

in a dominate position to retain and<br />

obtain new business. Carriers with one<br />

customer, such as Pinnacle, Mesaba and<br />

ExpressJet, and do not have ownership of<br />

their aircraft face a more difficult future in<br />

not only trying to obtain new contracts<br />

but also in retaining their current ones. In<br />

the event that their larger legacy partner<br />

wants to get out of the ownership of<br />

regional jets (RJs), which we believe is a<br />

distinct possibility, Pinnacle and Mesaba<br />

have limited resources to finance aircraft<br />

acquisitions. Asset-backed financing is<br />

available but may be more expensive for<br />

regional’s which would impede them in<br />

seeking business.<br />

Growth in the regional sector will be in<br />

the 70-to 90-seat RJs as "scope clause"<br />

restrictions are loosened at the major<br />

carriers and a surplus of 50-seat aircraft<br />

develops as some demand switches to<br />

larger aircraft. The key beneficiary of<br />

supplying these aircraft should be Embraer<br />

with its new E170/190 series (70- to 110seats<br />

depending on model) which fits the<br />

larger sized RJ market. However, the pilots<br />

at the legacy carriers will resist “scope<br />

clause” liberalization” in both the number<br />

and size of RJs allowed even when their<br />

employers are scratching for survival in<br />

bankruptcy which means, as can be seen<br />

in the Northwest bankruptcy case,<br />

progress will be slow. For distances less<br />

than 500 miles we believe that the larger<br />

(70-seat) new technology turboprops may<br />

become come into demand in North<br />

America to get around some of these<br />

restrictions without having to fight with<br />

their pilots unions. Even though out of<br />

favor here since the advent of the RJ over<br />

a decade ago because of the image of<br />

propellers being old fashioned and noisy,<br />

larger prop aircraft have been used in<br />

2004A 2005A 2006E 2007E<br />

<strong>Regional</strong> Carriers<br />

Rev EBIT NI EPS<br />

ExpressJet<br />

Mesa Air Group<br />

1,508 205 123 $2.04 1,563 156 98 $1.65 420 41 25 $0.42 1,691 163 100 $1.69 1,345 128 77 $1.32<br />

1 Jun 2006E<br />

Rev EBIT NI EPS Rev EBIT NI EPS Rev EBIT NI EPS Rev EBIT NI EPS<br />

(m) 897 84 41 $1.00 1,136 128 55 $1.31 321 29 14 $0.31 1,303 119 56 $1.28 1,352 130 61 $1.36<br />

Pinnacle <strong>Airline</strong>s (m) 635 67 41 $1.86 842 87 52 $2.38 201 20 12 $0.55 817 82 49 $2.24 820 83 49 $2.22<br />

Republic Airways (m) 646 93 40 $1.66 905 155 58 $1.59 291 53 19 $0.44 1,191 216 78 $1.81 1,339 246 90 $2.07<br />

Skywest (m) 1,156 145 82 $1.40 1,964 220 112 $1.90 779 91 42 $0.64 3,141 362 166 $2.59 3,440 387 183 $2.81<br />

Total 8,859 406 171 6,845 474 129 2,011 234 111 8,142 942 449 8,296 974 459<br />

1 Quarterly data and estimates are based on calendar year. FY05 and FY06 estimates are ending September 30, 2005 and 2006.<br />

2 Quarterly data and estimates are based on calendar year. FY05 and FY06 estimates are ending March 31, 2006 and 2007.