Right time. - Regional Airline Association

Right time. - Regional Airline Association

Right time. - Regional Airline Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

although more point-to-point flying will be<br />

apparent over the forecast period.<br />

The delivery pattern for aircraft will be<br />

dominated by regional jet aircraft in the<br />

70- to 90-seat category which, because of<br />

relaxation of pilot scope, will enable<br />

regional airlines to provide seamless<br />

passenger service from their major airline<br />

partners at low seat mile unit costs. It is<br />

expected that the US will take a large<br />

proportion of deliveries of regional aircraft<br />

worldwide, likely taking more than 50<br />

percent of total world demand for 30- to<br />

90-seat regional aircraft.<br />

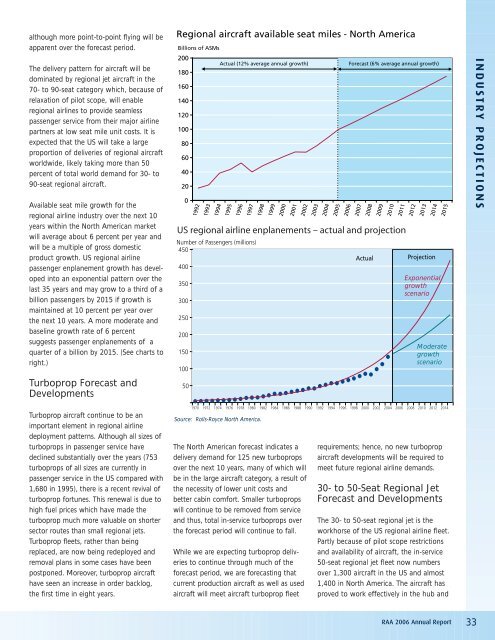

Available seat mile growth for the<br />

regional airline industry over the next 10<br />

years within the North American market<br />

will average about 6 percent per year and<br />

will be a multiple of gross domestic<br />

product growth. US regional airline<br />

passenger enplanement growth has developed<br />

into an exponential pattern over the<br />

last 35 years and may grow to a third of a<br />

billion passengers by 2015 if growth is<br />

maintained at 10 percent per year over<br />

the next 10 years. A more moderate and<br />

baseline growth rate of 6 percent<br />

suggests passenger enplanements of a<br />

quarter of a billion by 2015. (See charts to<br />

right.)<br />

Turboprop Forecast and<br />

Developments<br />

Turboprop aircraft continue to be an<br />

important element in regional airline<br />

deployment patterns. Although all sizes of<br />

turboprops in passenger service have<br />

declined substantially over the years (753<br />

turboprops of all sizes are currently in<br />

passenger service in the US compared with<br />

1,680 in 1995), there is a recent revival of<br />

turboprop fortunes. This renewal is due to<br />

high fuel prices which have made the<br />

turboprop much more valuable on shorter<br />

sector routes than small regional jets.<br />

Turboprop fleets, rather than being<br />

replaced, are now being redeployed and<br />

removal plans in some cases have been<br />

postponed. Moreover, turboprop aircraft<br />

have seen an increase in order backlog,<br />

the first <strong>time</strong> in eight years.<br />

<strong>Regional</strong> aircraft available seat miles - North America<br />

Billions of ASMs<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Actual (12% average annual growth) Forecast (6% average annual growth)<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

US regional airline enplanements – actual and projection<br />

Number of Passengers (millions)<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014<br />

Source: Rolls-Royce North America.<br />

The North American forecast indicates a<br />

delivery demand for 125 new turboprops<br />

over the next 10 years, many of which will<br />

be in the large aircraft category, a result of<br />

the necessity of lower unit costs and<br />

better cabin comfort. Smaller turboprops<br />

will continue to be removed from service<br />

and thus, total in-service turboprops over<br />

the forecast period will continue to fall.<br />

While we are expecting turboprop deliveries<br />

to continue through much of the<br />

forecast period, we are forecasting that<br />

current production aircraft as well as used<br />

aircraft will meet aircraft turboprop fleet<br />

Actual<br />

Projection<br />

Exponential<br />

growth<br />

scenario<br />

Moderate<br />

growth<br />

scenario<br />

requirements; hence, no new turboprop<br />

aircraft developments will be required to<br />

meet future regional airline demands.<br />

30- to 50-Seat <strong>Regional</strong> Jet<br />

Forecast and Developments<br />

The 30- to 50-seat regional jet is the<br />

workhorse of the US regional airline fleet.<br />

Partly because of pilot scope restrictions<br />

and availability of aircraft, the in-service<br />

50-seat regional jet fleet now numbers<br />

over 1,300 aircraft in the US and almost<br />

1,400 in North America. The aircraft has<br />

proved to work effectively in the hub and<br />

RAA 2006 Annual Report 33<br />

INDUSTRY PROJECTIONS